Question: Using the following information to answer the next three questions. Company Average Daily Return Standard Deviation of Daily Returns Correlation with the Market Walmart 0.057%

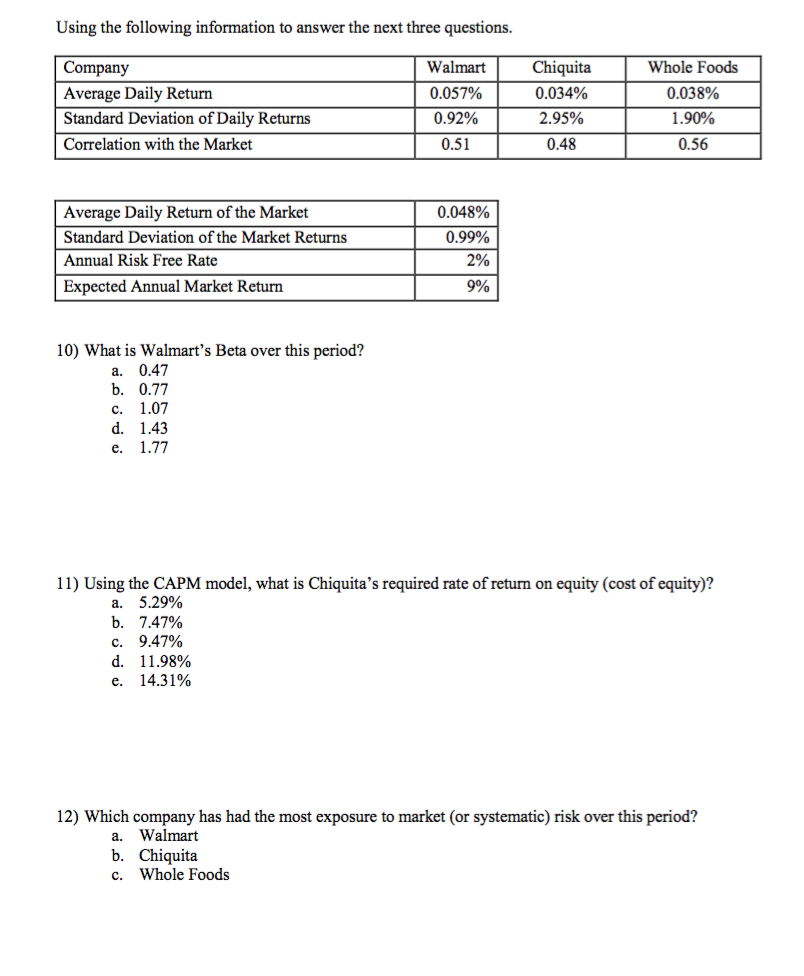

Using the following information to answer the next three questions. Company Average Daily Return Standard Deviation of Daily Returns Correlation with the Market Walmart 0.057% 0.92% 0.51 Chiquita 0.034% 2.95% 0.48 Whole Foods 0.038% 1.90% 0.56 Average Daily Return of the Market Standard Deviation of the Market Returns Annual Risk Free Rate Expected Annual Market Return 0.048% 0.99% 2% 9% 10) What is Walmart's Beta over this period? a. 0.47 c. 1.07 d. 1.43 11) Using the CAPM model, what is Chiquita's required rate of return on equity (cost of equity)? a. b. c. d. e. 5.29% 7.47% 9.47% 11.98% 14.31% 12) Which company has had the most exposure to market (or systematic) risk over this period? a. Walmart b. Chiquita c. Whole Foods

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts