Question: Using the following please answer 1 and 2. Provide an opinion of the company's financial condition liquidity, solvency, and profitability . explain whether these ratios

Using the following please answer 1 and 2.

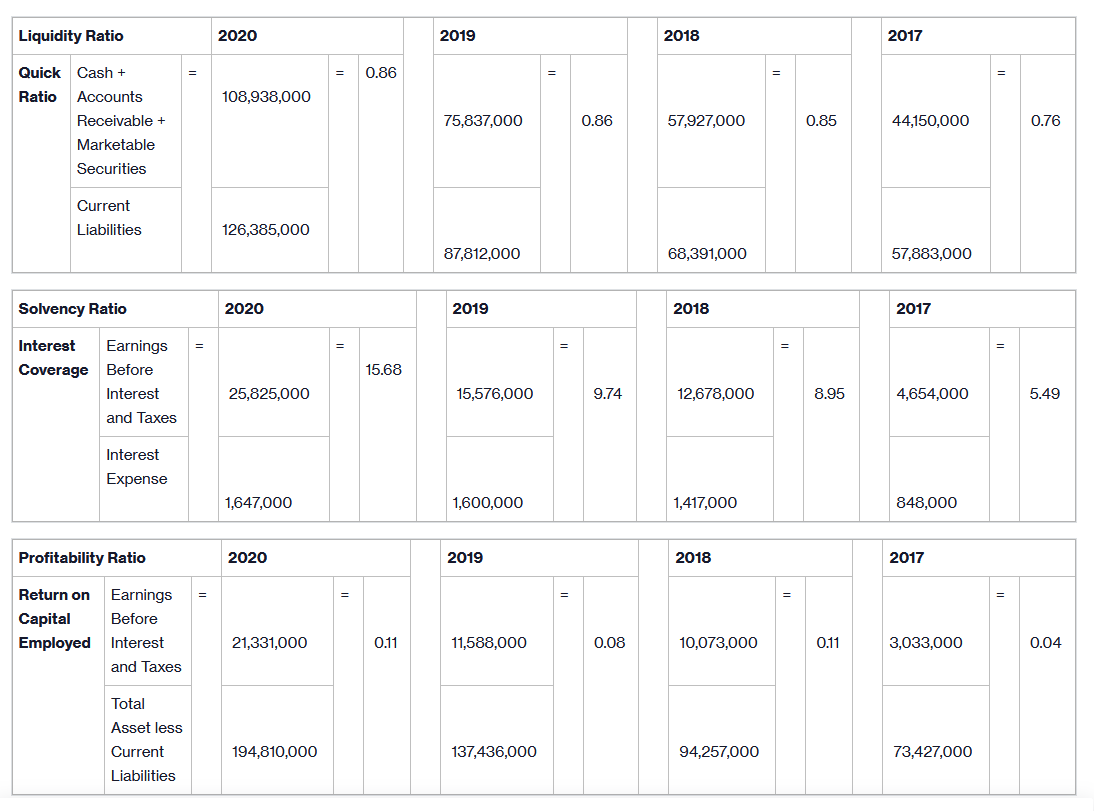

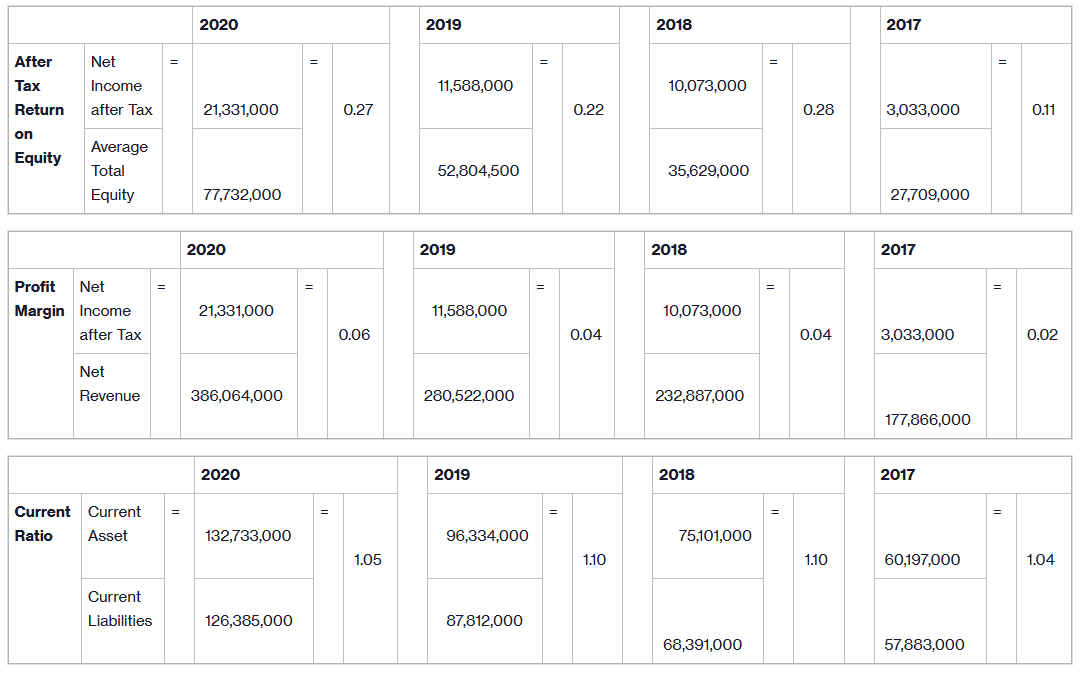

- Provide an opinion of the company's financial condition liquidity, solvency, and profitability.

- explain whether these ratios for current ratio, net profit margin, and after tax ROE are favorable or unfavorable.

Liquidity Ratio 2020 2019 2018 2017 0.86 108,938,000 Quick Cash + Ratio Accounts Receivable + Marketable Securities 75,837,000 0.86 57,927,000 0.85 44,150,000 0.76 Current Liabilities 126,385,000 87,812,000 68,391,000 57,883,000 Solvency Ratio 2020 2019 2018 2017 II II = Interest Earnings Coverage Before 15.68 Interest 25,825,000 15,576,000 9.74 9.74 12,678,000 8.95 4,654,000 5.49 and Taxes Interest Expense 1,647,000 1,600,000 1,417,000 848,000 Profitability Ratio 2020 2019 2018 2017 = = Return on Capital Employed Earnings Before Interest and Taxes 21,331,000 0.11 11,588,000 0.08 10,073,000 0.11 3,033,000 0.04 Total Asset less Current 194,810,000 137,436,000 94,257,000 73,427,000 Liabilities 2020 2019 2018 2017 After Tax Net Income after Tax 11,588,000 10,073,000 Return 21,331,000 0.27 0.22 0.28 3,033,000 0.11 on Equity Average Total Equity 52,804,500 35,629,000 77,732,000 27,709,000 2020 2019 2018 2017 = Profit Net Margin Income after Tax 21,331,000 11,588,000 10,073,000 0.06 0.04 0.04 3,033,000 0.02 Net Revenue 386,064,000 280,522,000 232,887,000 177,866,000 2020 2019 2018 2017 = Current Current Ratio Asset 132,733,000 96,334,000 75,101,000 1.05 1.10 1.10 60,197,000 1.04 Current Liabilities 126,385,000 87,812,000 68,391,000 57,883,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts