Question: Using the generic profit model developed in the section Logic and Business Principles in Chapter 9 , develop a financial simulation model for a new

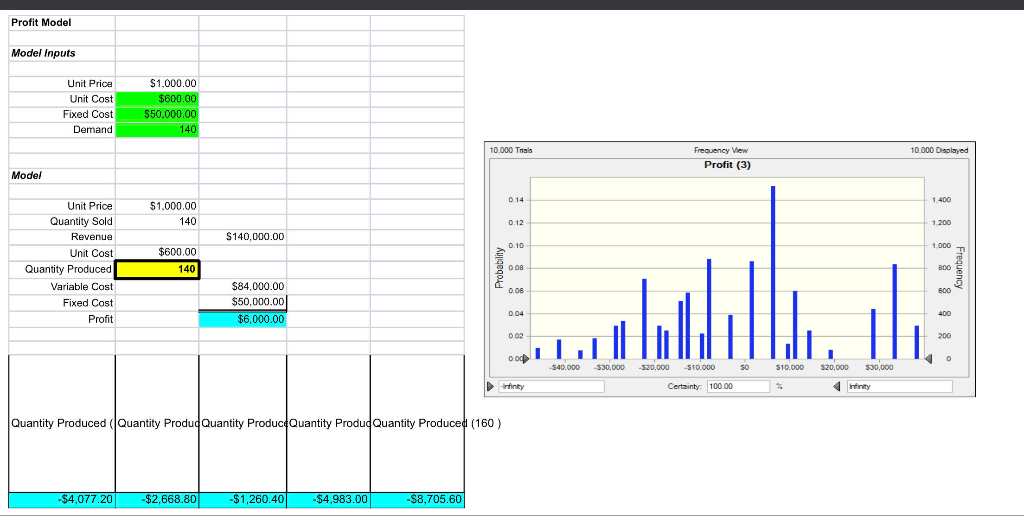

Using the generic profit model developed in the section Logic and Business Principles in Chapter 9 , develop a financial simulation model for a new product proposal and construct a distribution of profits under the following assumptions: Price is fixed at $1,000. Unit costs are unknown and follow the distribution. Unit Cost Probability $400 0.20 $600 0.40 $700 0.25 $800 0.15 Demand is also variable and follows the following distribution: Demand Probability 120 0.25 140 0.50 160 0.25 Fixed costs are estimated to follow the following distribution: Fixed Costs Probability $45,000 0.20 $50,000 0.50 $55,000 0.30

Read problem 6, Chapter 10, page 336. Based on the Profit Model, which you can find as an Excel file titled "Profit Model" in Week 6, answer the following questions:

- The assumption is that the best production quantity to maximize average profit is 140 units. Use your analysis skills by looking at the data to determine if you, as a business decision maker, would pursue this. Explain why or why not!

- What does the decision table suggest? Is this a good investment? Why or why not?

Profit Model Model Inputs Unit Price Unit Cost Fixed Cost Demand 51.000.00 $GTH0,000 550000, 14 Tna 000 10 57 500 10 Frequency View Profit (3) Model 1 0 51,000,00 140 0 13 1. $14.000.00 2 10 1.DOC Unit Price Quantity Sold Revenue Unit Cost Quantity Produced Variable Cost Fixed Cost Profit $600,00 140 Probability OOR Freuen BOO 2 = 584,000.00 550,000,00| 66.000.00 0 24 002 0.00 000 540 SO 510 000 520,000 Infinity Certainty 100.00 Infinity Quantity Produced (Quantity Produd Quantity Produc Quantity Produd Quantity Produced (160) 34,077 20 -$2,668.80 =$1,260.40 -54,983.00 -SE,705.60

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts