Question: Using the given information, fill out the personal cashflow statement. Please use this information to fill out the balance sheet and cash flow statement Use

Using the given information, fill out the personal cashflow statement.

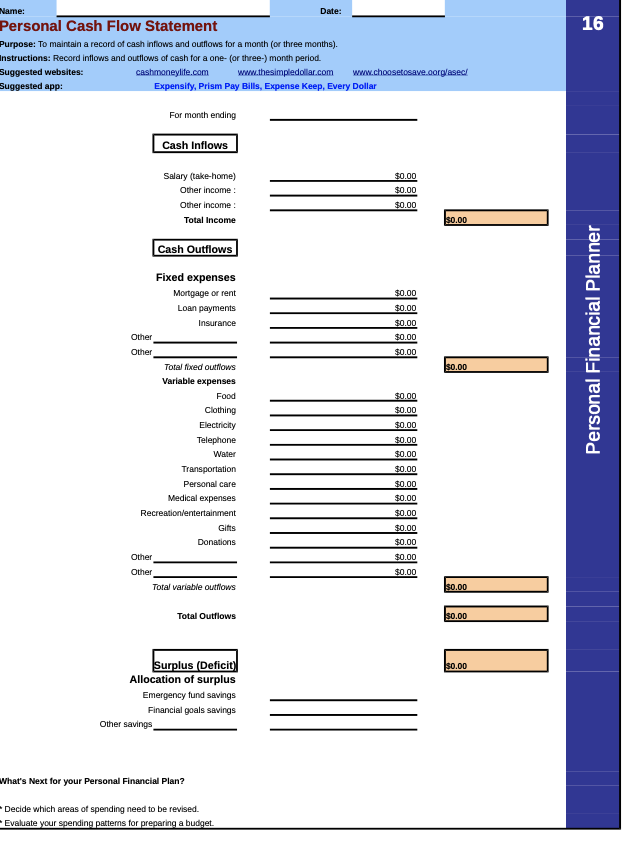

Please use this information to fill out the balance sheet and cash flow statement Use your own information to do the budget. If you do not have any information, you can use this. I graduated from college 3 years ago and just bought my first house. I make $42,000 a year for a salary. I get paid $1436.25 (which taxes and my 401K are taken out) on the 1st and 15th. My company pays also pays my health insurance premium. My company does a 100% match on my 401K up to 6% of my salary, so I have been doing that for the last 3 years and have that money and what they matched in my retirment account. I also have been saving $200 a month for the last 3 years that is in my savings account. If I have a surplus when I budget or do my cash flow, I save $200 and put the rest in mutual funds. I have invested $10,500 in mutual funds. I bought my house for $175,000, but it is already appraising for $180,000. My mortgage is for $150,000. I got a 3% interest rate over 30 years, so my monthly payment including taxes is $800 a month. Insurance is $900 a year, but I pay it monthly. Electric is about $75 a month and water is $25. Food generally is around $400 a month. My car payment is $250/month and car insurance of $50/month and gas of $200/month. My cell phone is $50/month, clothes average $50/month and fun money is about $100/month. I tithe 10% of my gross income every month. As far as what I own, my checking account is currently at $1,600. I have a life insurance plan that will pay out $100,000 if I die, but it has a cash value of $6,250. According to KBB, my car is worth $12,000. However, I still owe $4,000 on it. I have a credit card that I pay off every month, but the current balance is $545. I do not put the credit card payment in my cash flow or budget, as I use it to pay the items t that are already in my budget and cash flow like gas and food. I also own a laptop that I paid $2000 for, but it is probably worth $600 currently. I just paid $6,000 for furniture for my house. 16 Name: Date: Personal Cash Flow Statement Purpose: To maintain a record of cash inflows and outflows for a month (or three months). Instructions: Record intlows and outflows of cash for a one-(or three-) month period. Suggested websites: cashmoneylife.com www.thesimpledollar.com www.choosetosave.corglase! Suggested app: Expensity, Prism Pay Bills, Expense Keep, Every Dollar For month ending Cash Inflows $0.00 $0.00 Salary (take-home) Other Income Other income: Total Income $0.00 $0.00 Cash Outflows $0.00 $0.00 $0.00 $0.00 Personal Financial Planner $0.00 $0.00 $0.00 Fixed expenses Mortgage or rent Loan payments Insurance Other Other Total fixed outflows Variable expenses Food Clothing Electricity Telephone Water Transportation Personal care Medical expenses Recreation/entertainment Gifts Donations Other Other Total variable outflows $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 30.00 Total Outflows 30.00 30.00 Surplus (Deficit) Allocation of surplus Emergency fund savings Financial goals savings Other savings What's Next for your Personal Financial Plan? Decide which areas of spending need to be revised. Evaluate your spending patterns for preparing a budget. Please use this information to fill out the balance sheet and cash flow statement Use your own information to do the budget. If you do not have any information, you can use this. I graduated from college 3 years ago and just bought my first house. I make $42,000 a year for a salary. I get paid $1436.25 (which taxes and my 401K are taken out) on the 1st and 15th. My company pays also pays my health insurance premium. My company does a 100% match on my 401K up to 6% of my salary, so I have been doing that for the last 3 years and have that money and what they matched in my retirment account. I also have been saving $200 a month for the last 3 years that is in my savings account. If I have a surplus when I budget or do my cash flow, I save $200 and put the rest in mutual funds. I have invested $10,500 in mutual funds. I bought my house for $175,000, but it is already appraising for $180,000. My mortgage is for $150,000. I got a 3% interest rate over 30 years, so my monthly payment including taxes is $800 a month. Insurance is $900 a year, but I pay it monthly. Electric is about $75 a month and water is $25. Food generally is around $400 a month. My car payment is $250/month and car insurance of $50/month and gas of $200/month. My cell phone is $50/month, clothes average $50/month and fun money is about $100/month. I tithe 10% of my gross income every month. As far as what I own, my checking account is currently at $1,600. I have a life insurance plan that will pay out $100,000 if I die, but it has a cash value of $6,250. According to KBB, my car is worth $12,000. However, I still owe $4,000 on it. I have a credit card that I pay off every month, but the current balance is $545. I do not put the credit card payment in my cash flow or budget, as I use it to pay the items t that are already in my budget and cash flow like gas and food. I also own a laptop that I paid $2000 for, but it is probably worth $600 currently. I just paid $6,000 for furniture for my house. 16 Name: Date: Personal Cash Flow Statement Purpose: To maintain a record of cash inflows and outflows for a month (or three months). Instructions: Record intlows and outflows of cash for a one-(or three-) month period. Suggested websites: cashmoneylife.com www.thesimpledollar.com www.choosetosave.corglase! Suggested app: Expensity, Prism Pay Bills, Expense Keep, Every Dollar For month ending Cash Inflows $0.00 $0.00 Salary (take-home) Other Income Other income: Total Income $0.00 $0.00 Cash Outflows $0.00 $0.00 $0.00 $0.00 Personal Financial Planner $0.00 $0.00 $0.00 Fixed expenses Mortgage or rent Loan payments Insurance Other Other Total fixed outflows Variable expenses Food Clothing Electricity Telephone Water Transportation Personal care Medical expenses Recreation/entertainment Gifts Donations Other Other Total variable outflows $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 30.00 Total Outflows 30.00 30.00 Surplus (Deficit) Allocation of surplus Emergency fund savings Financial goals savings Other savings What's Next for your Personal Financial Plan? Decide which areas of spending need to be revised. Evaluate your spending patterns for preparing a budget

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts