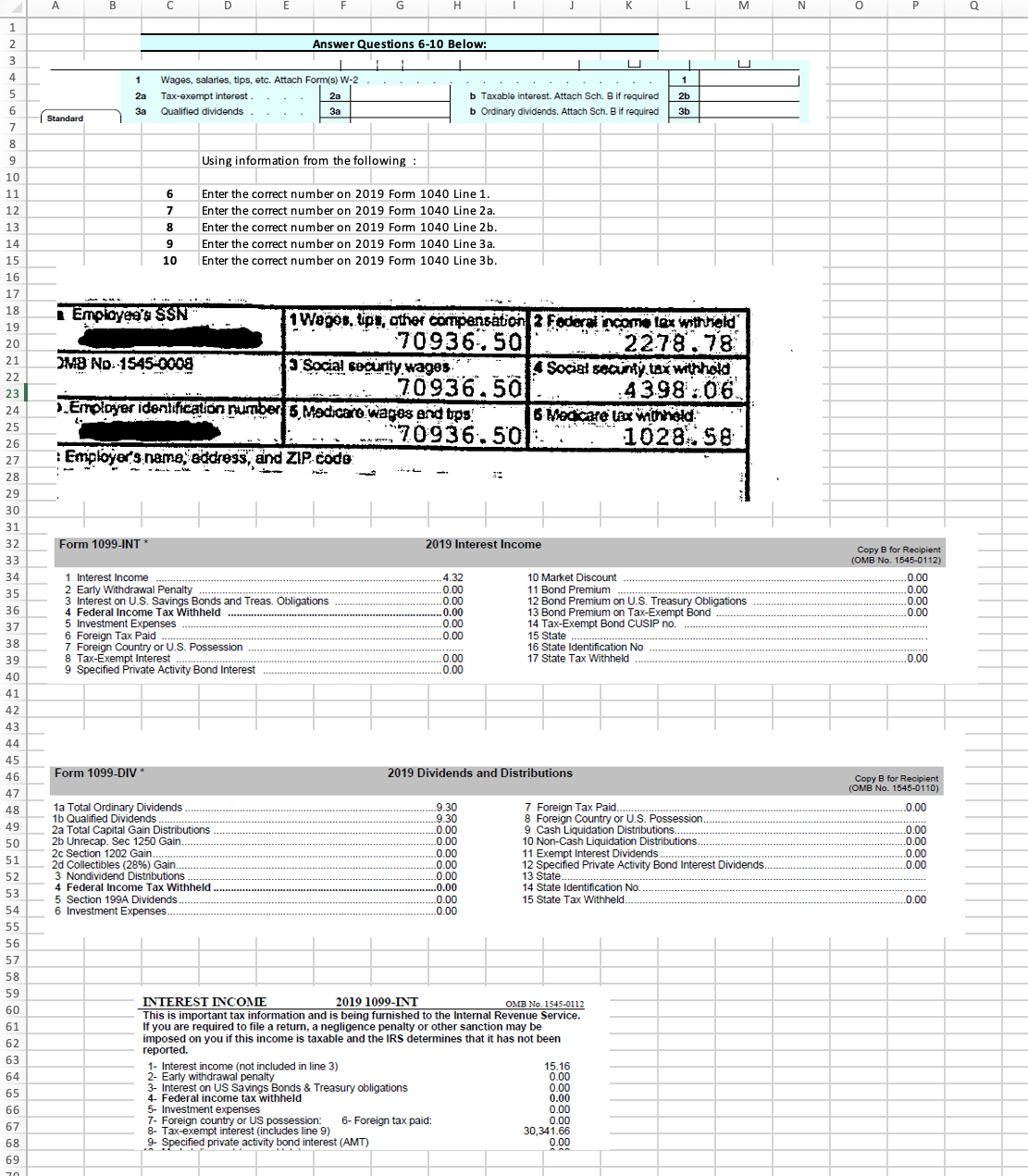

Question: Using the given information, I need help filling out the 1 0 4 0 tax form. 3a Answer salaries. tips, etc. Atth Form(s) W-2 interest

3a Answer salaries. tips, etc. Atth Form(s) W-2 interest (Nalitie divid.ds uestions 6-10 Below: b Taxable Attach Sch. if b Ordinaty dividerds. Attach Sch. g it required 2b 3b 6 8 10 No. 4545-0008 usin information from the followin Enter the correct number on 2019 Form 1040 Line 1. Enter the correct number on 2019 Form 1040 Line 2a. Enter thecorrect number on 2019 Form 1040 Line 2b. Enter the correct number on 2019 Form 1040 Line 3a. Enter the correct number on 2019 Form 1040 Line 3b. I W090B. Epp, 70936.50 70936.50 bps. "70936.50 2 tax 2278'.7'S 4398 ; 06 6 name;' ZIP. Codg 1099 Early Withdraaal Penalty 2 4 5 6 7 9 3 nterest on U.S. Savings Bonds and Treas. Obligatims Federal Income Tax Withheld nvestment Expenses Tax Paid Fweign Country or u. S. possessm Tax-exempt Interest Specified Private Activity Bond Interest 9 Interest I O Martet Discount 1 1 Bond 12 Bond Premium US. Treasury Obligations 13 Bond Premium cn Tax-exempt Bcnd 14 Tax-Exenwt BoM CUSIP no. 15 state _ 16 State Identifcatbn NO 17 State Tax Withheld 9Dividendsand Distri 1 a Total Ordinary Dividends 1b Oualfed Dividauls 2a Total Canal Gam Distributims 2b unrecap. Sec 1250 Gain 2c section 1202 Gain 2d colectibles (28%) Gain. 3 Nondivida% Distributions _ 4 FecEraI Income Tax Withheld 5 Sectn 199A OivfendS 6 Investment Expenses. INTEREST INCONIE ___o.oo ___o.oo ..o.oo ...0.00 ___o.oo m.o.oo ...0.00 7 Foreign Tax Paid.... 8 Foreign Country US. Possessico g Cash Lquidaton 10 N'-Cash Liquidatim 11 Exempt Interest Dividends 12 Specified Private Activfy Bond Interest Dividends.. 13 State__. 14 State Identification No. . 15 state Tax Withheld. Copy No. 1545-011 Copy 8 No. 1545-01 ..o.oo .o.oo 2019 This is important tax information and is being furnished to the Internal Revenue Service. If you are required to file a return, a negligence penalty or other sanction may be imposed you if this income is taxable and the IRS determines that it has not been 1- Interest (not in 3) 2- Earty withdrawal penalty Interest on US Sa vims Bonds & Treasury obligations 4- Federal income tax withheld Investment expenses 7- cou n try or us pcssessn: 6- Foreim tax paid: 8- Tax-exempt interest (includes line g) Sgeclfied pnvate activity interest (AMT) 15.16 30,341.66

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts