Question: Using the given information, what is the loan-to-value (LTV) ratio required by the Third Universal Bank? 3. The benefits and costs of home ownership -

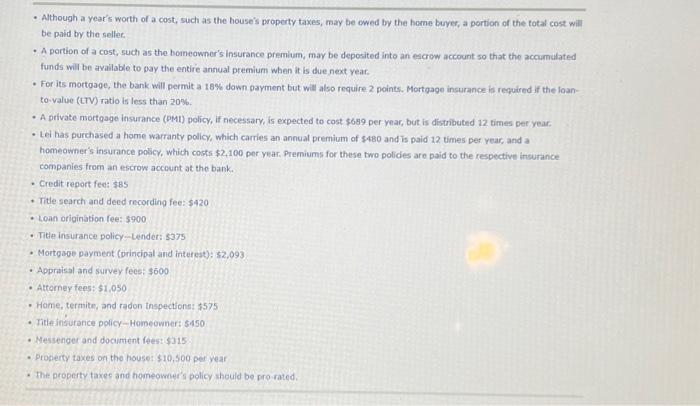

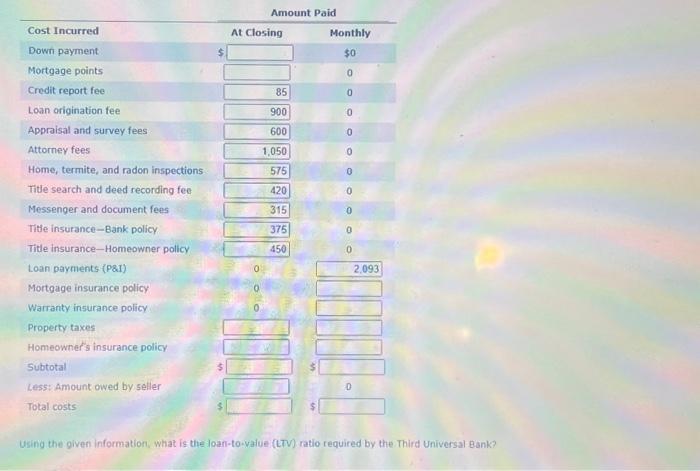

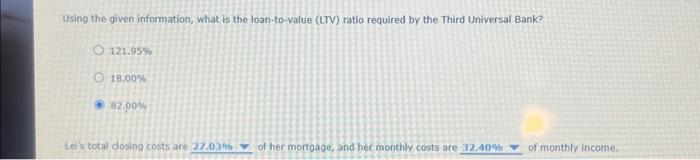

Using the given information, what is the loan-to-value (LTV) ratio required by the Third Universal Bank? 3. The benefits and costs of home ownership - Part 2 How Should the Costs of Purchasing and Owning a Home Be Categorized? You can categorize the costs assoclated with home ownership according to whether they are paid at closing, or monthly throughout: the life of the mortgage loan, or even after the horne is paid off. Consder the following situation, and then complefe the form that follows by entering the necessary data, dasafying the costs acconding to whethur they rupresent up front, monthly costs, or both. Finally, answer the associated questions that follow. Note: Round all dollar amounts to the nearest whole dollar, and if no payment is necessary, record a zero (0) in the In case of deduction, enter the dollar armount without minus sion. When Should tei Pay Housing Costs? On Aprili o next year, Lei is purchasing a \$210,000 bouse and has accepted the Third Univeral Aanks offer of a ten inar s172,200 ioan with an ioterest rate of 8 w. She has a gross annual income of $120,000 and is concemed about how much ber one time vp-front cesta and recurting monthly conts natitin. bepad by the seger. - Athough a year's worth of a cost, such as the house's property taxes, may be owed by the home buyer, a portion of the total cost will be paid by the sellar. - A pertion of a cost, such as the homeowner's insurance premium, may be deposited into an escrow account so that the accurnulated funds will be available to pay the entire annual premium when it is due next year. - For its mortoage, the bank will permit a 18% down pavment but will also require 2 peints, Mortgage insurance is required if the loanto-value (LTV) ratio is less than 20%. - A private mortgage insurance (PMI) policy, if necessary, is expected to cost $689 per year, but is distributed 12 times per year. - Lei has purchased a home warranty policy, which carries an annual premium of $480 and is paid 12 times per year, and a homeowner's insurance policy, which costs $2,100 per year. Premiums for these two policies are paid to the respective insurance companies from an escrow account at the bank. - Credit report fees \$8S - Title search and deed recording fee: $420 - Loan origination fee: $900 - Title insurance policy-Lender: $375 - Mortgage payment (principal and interest): \$2,093 - Appraisal and survey fees: $600 - Attorney fees: $1.050 - Home, termite, and radon thspections: $575 - nitie insurance policy-Homeowner: $450 - Messenger and document feestisis - Property taxes on the houses $10,500 per vear - the property takes and homeowner's policy should be pro rated. Using the given information, what is the loan-to-value (LTV) ratio required by the Third Universal Bank? 121.95% 18,00% 82.00% Lei's total dosing costs are of her mortgage, and her monthly costs are of monthly income

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts