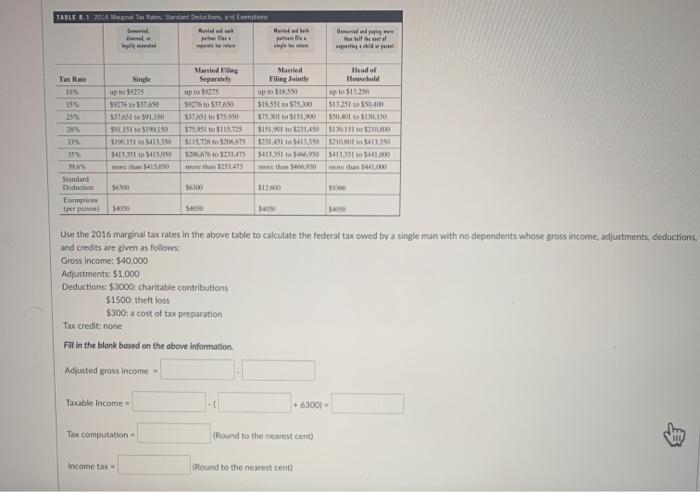

Question: using the informaiton from the table, please answer this question. am 50 & trying to pass class. will leave good rating / comment TABLE 1

TABLE 1 2006 Mol Toate catechon widt ws wewe Tus 10% Single up to 75 59776 1.115 SL151519150 $1911 in Su 540 54150 Manied Separte up to 105 7670571 3.5 to 75.50 57351101115.735 5115.750 TS S76213.475 1425 stand Head of Filing Jointly Tad po SIRS up to $135110575.30 $13.52400 17.11.20 50 to 300.150 5151.0533140 512015110 52,451 5413.50 30T SUIS 5411_15950111110111.00 15. Sundard Ded 300 100 11 perp S. HO Use the 2016 marginal tax rates in the above table to calculate the federal tax owed by a single man with no dependents whose gross income, adjustments, deductions and credits are given as follows: Gross income: $40,000 Adjustments: $1,000 Deductions: $3000: charitable contributions $1500-theft loss 5300: a cost of tax preparation Tax credit: none Fill in the blonk based on the above information Adjusted grow income Taxable income -63001 - Tax computation - (Round to the nearest Cent) income tax Round to the nearest cent

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts