Question: Using the information below, calculate the beta that should be used in Sheff's cost of capital calculation. - Current capital structure includes 300.0 equity and

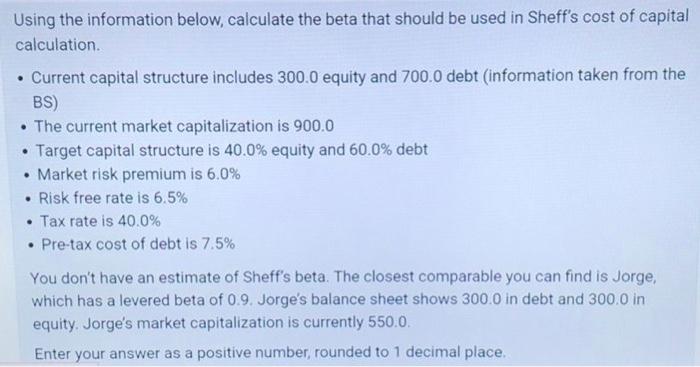

Using the information below, calculate the beta that should be used in Sheff's cost of capital calculation. - Current capital structure includes 300.0 equity and 700.0 debt (information taken from the BS) - The current market capitalization is 900.0 - Target capital structure is 40.0% equity and 60.0% debt - Market risk premium is 6.0% - Risk free rate is 6.5% - Tax rate is 40.0% - Pre-tax cost of debt is 7.5% You don't have an estimate of Sheff's beta. The closest comparable you can find is Jorge, which has a levered beta of 0.9 . Jorge's balance sheet shows 300.0 in debt and 300.0 in equity. Jorge's market capitalization is currently 550.0 . Enter your answer as a positive number, rounded to 1 decimal place

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts