Question: Using the Information below explain in a paragraph what has happened to Netflix financial leverage position? Total Asset Turnover Ratio Sales/Total Assets 2019 - 20,156,447/33,975,

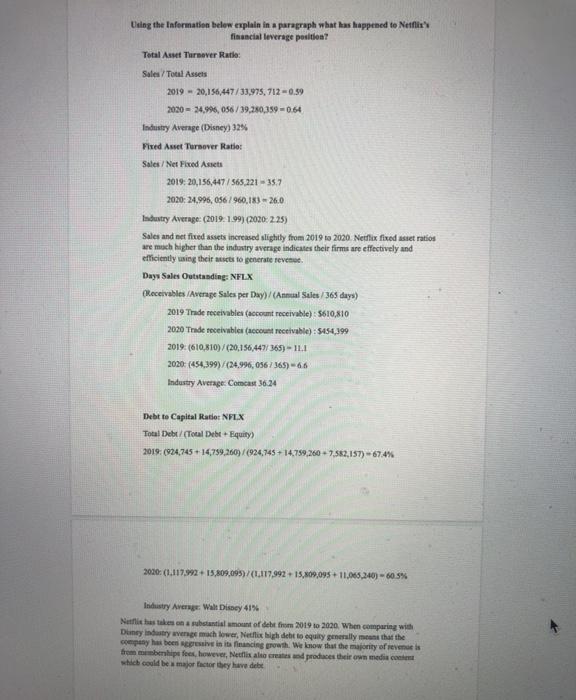

Using the Information below explain in a paragraph what has happened to Netflix financial leverage position? Total Asset Turnover Ratio Sales/Total Assets 2019 - 20,156,447/33,975, 712 - 0,99 2020 - 24,996, 056/39,280,359-054 Industry Average (Disney) 32% Fixed Anset Turnover Ratio Sales/ Net Fixed Assets 2019: 20,156,447/565,221 - 357 2020: 24.996, 056 / 960.183 - 26.0 Industry Average: (2019. 1.99) (2030-2.25) Sales and net fixed assets increased slightly from 2019 to 2020 Nedix fixed asset ratios are much higher than the industry average indicates their firms are effectively and efficiently using their acts to generate teven Days Sales Outstanding: NFLX Receivables/Average Salesper Day)/(Annual Sales / 365 days) 2019 Trade receivables (account receivable) 5610,810 2020 Trade receivables (account receivable): 5454,199 2019 (610,810)/(20,156,447 365) - 11.1 2020 (454.399)/(24.996, 036/365) -66 Industry Average Comcast 36.24 Debt to Capital Ratier NFLX Total Debt / (Total Debt + Equity) 2019: (934,745 +14,789,260)/(924,745 +14,759,260 7.582,157) - 67.4% 2010: (1.117.992 +15,809,095)/(1.117.992 +15,09,095 +11,605,240) - 60.3% Industry Average: Walt Disney 41% Net has takes on substantial amount of debt from 2019 to 2020. When comparing with Dune industry eng much lower, Netflix high detto equity generally means that the company has been presive in its financing growth. We know that the majority of revenue from membership fees, however, Netflix also create produces their own medico which could be major factor they have det

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts