Question: Using the information below, please complete a Form 940 for Titans' Sporting Goods for the current year. Additional information needed to complete the form is

Using the information below, please complete a Form 940 for Titans' Sporting Goods for the current year. Additional information needed to complete the form is as follows:

October

|

|

|

| FICA |

| |

| Employee | Monthly Earnings | YTD Earnings | Social Security | Medicare | Federal Income Tax |

| Lillian Park | $2,850 | $138,700 | $176.70 | $41.33 | $534.00 |

| William Long | 3,460 | 39,700 | 214.52 | 50.17 | 422.00 |

| Tom Waxman | 3,700 | 43,850 | 229.40 | 53.65 | 534.00 |

| $10,010 | $222,250 | $620.62 | $145.15 | $1,490.00 | |

November

|

|

|

| FICA |

| |

| Employee | Monthly Earnings | YTD Earnings | Social Security | Medicare | Federal Income Tax |

| Lillian Park | $2,980 | $141,680 | $184.76 | $43.21 | $603.00 |

| William Long | 4,000 | 43,700 | 248.00 | 58.00 | 469.00 |

| Tom Waxman | 3,760 | 47,610 | 233.12 | 54.52 | 561.00 |

| $10,740 | $232,990 | $665.88 | $155.73 | $1,633.00 | |

December

|

|

|

| FICA |

| |

| Employee | Monthly Earnings | YTD Earnings | Social Security | Medicare | Federal Income Tax |

| Lillian Park | $4,200 | $145,880 | $69.44 | $60.90 | $868.00 |

| William Long | 3,860 | 47,560 | 239.32 | 55.97 | 478.00 |

| Tom Waxman | 4,420 | 52,030 | 274.04 | 64.09 | 706.00 |

| $12,480 | $245,470 | $582.80 | $180.96 | $2,052.00 | |

| a. | State reporting number: 025-319-2 |

| b. | No FUTA tax deposits were made for this year. |

| c. | Titans' three employees for the year all earned over $7,000. |

(Assume that none of the FUTA wages paid were excluded from state unemployment tax and that no credit reduction applies.)

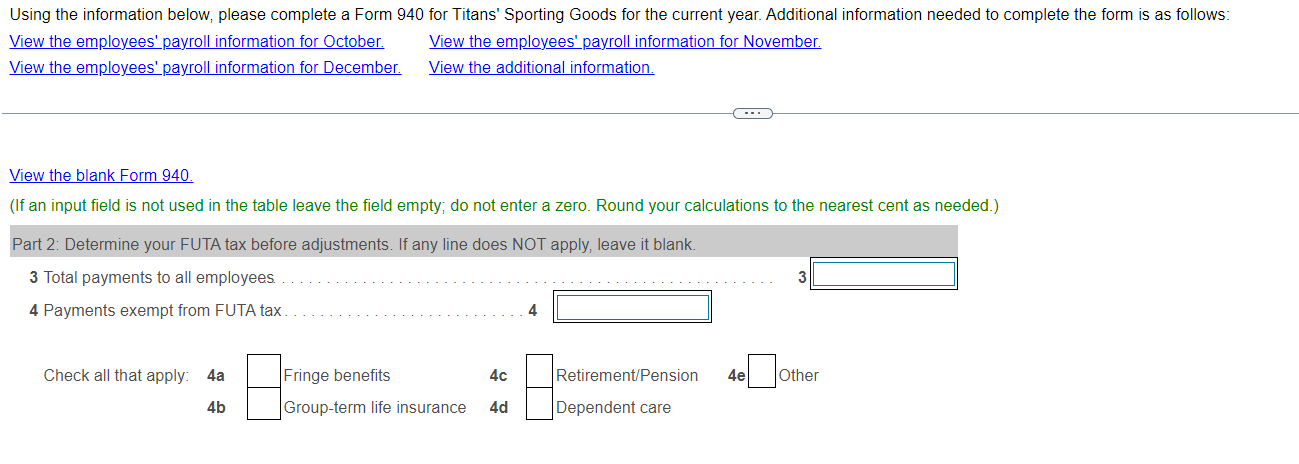

Using the information below, please complete a Form 940 for Titans' Sporting Goods for the current year. Additional information needed to complete the form is as follows: View the employees' payroll information for October. View the employees' payroll information for November. View the employees' payroll information for December. View the blank Form 940. (If an input field is not used in the table leave the field empty; do not enter a zero. Round your calculations to the nearest cent as needed.) Part 2: Determine your FUTA tax before adjustments. If any line does NOT apply, leave it blank. 3 Total payments to all employees. 3 4 Payments exempt from FUTA tax. 4 Check all that apply: 4 a Fringe benefits 4c Retirement/Pension 4 ether 4b Group-term life insurance 4d Dependent care Using the information below, please complete a Form 940 for Titans' Sporting Goods for the current year. Additional information needed to complete the form is as follows: View the employees' payroll information for October. View the employees' payroll information for November. View the employees' payroll information for December. View the blank Form 940. (If an input field is not used in the table leave the field empty; do not enter a zero. Round your calculations to the nearest cent as needed.) Part 2: Determine your FUTA tax before adjustments. If any line does NOT apply, leave it blank. 3 Total payments to all employees. 3 4 Payments exempt from FUTA tax. 4 Check all that apply: 4 a Fringe benefits 4c Retirement/Pension 4 ether 4b Group-term life insurance 4d Dependent care

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts