Question: Using the information below, please complete a Form 940 for Harris' Sporting Goods for the current year. Additional information needed to complete the form is

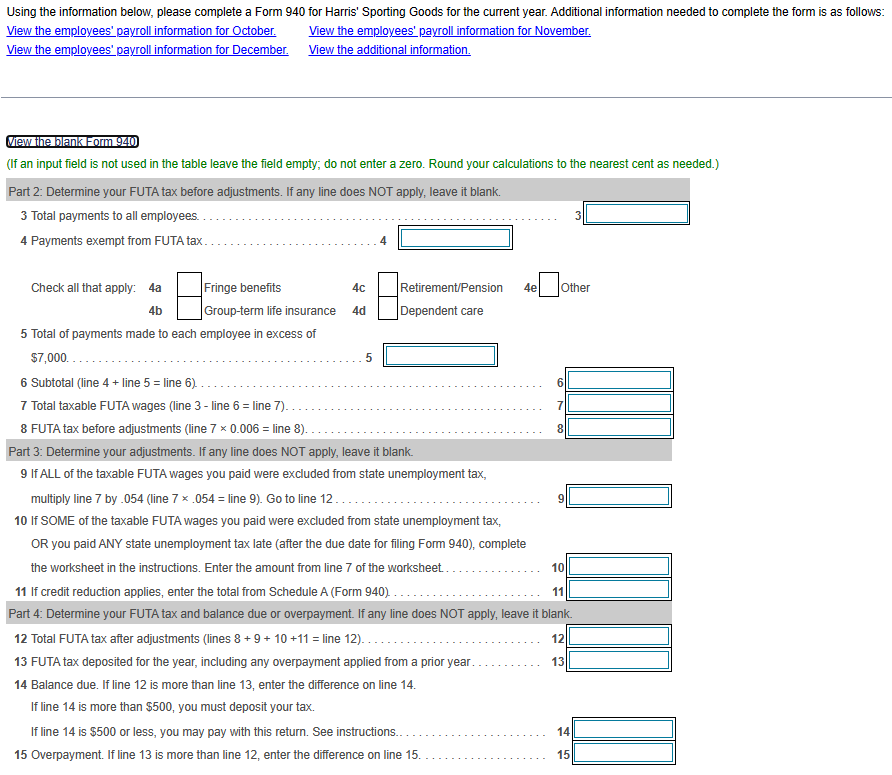

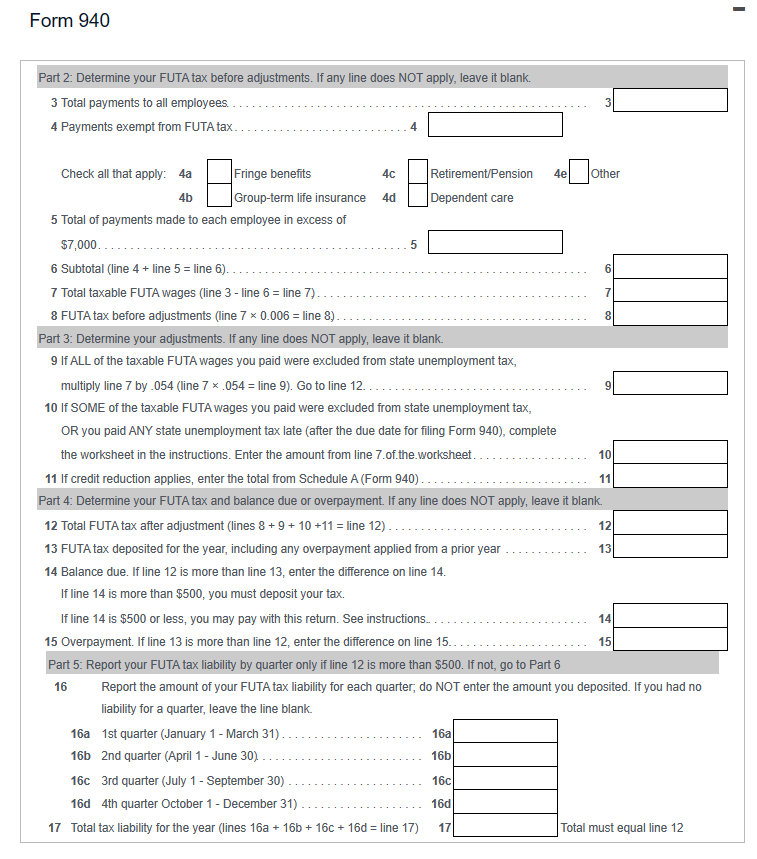

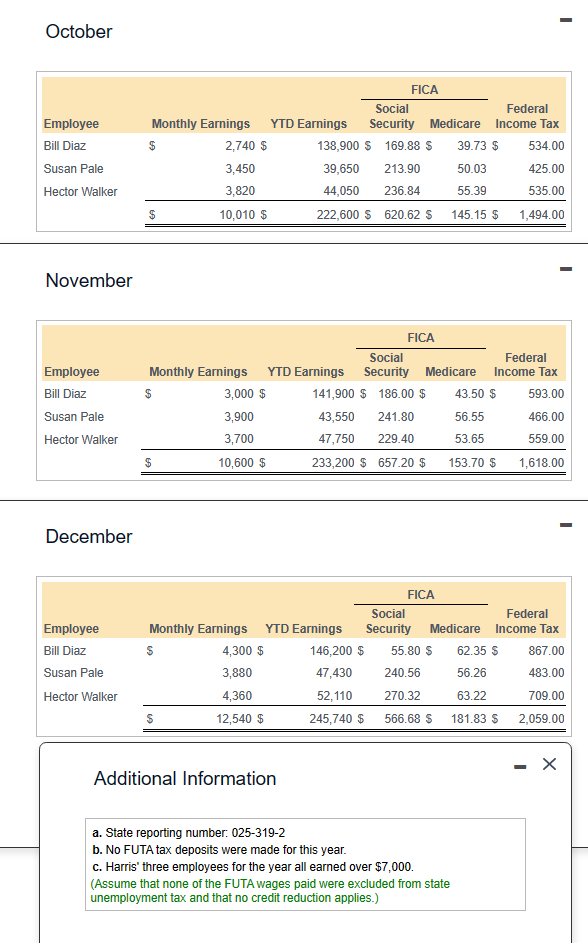

Using the information below, please complete a Form 940 for Harris' Sporting Goods for the current year. Additional information needed to complete the form is as follows: View the employees' payroll information for October. View the employees' payroll information for November. View the employees' payroll information for December. View the additional information. led.) Form 940 Part 2: Determine your FUTA tax before adjustments. If any line does NOT apply, leave it blank. 3 Total payments to all employees. 4 Payments exempt from FUTA tax Check all that apply: 5 Total of payments made to each employee in excess of 6 Subtotal (line 4 + line 5= line 6 ). 7 Total taxable FUTA wages (line 3 - line 6= line 7). 8 FUTA tax before adjustments (line 70.006= line 8) \begin{tabular}{l|} 6 \\ 7 \\ 7 \\ 8 \\ \\ \\ \hline \end{tabular} Part 3: Determine your adjustments. If any line does NOT apply, leave it blank. 9 If ALL of the taxable FUTA wages you paid were excluded from state unemployment tax, multiply line 7 by .054 (line 7.054= line 9 ). Go to line 12 . 10 If SOME of the taxable FUTA wages you paid were excluded from state unemployment tax, OR you paid ANY state unemployment tax late (after the due date for filing Form 940), complete the worksheet in the instructions. Enter the amount from line 7.of.the.worksheet. 11 If credit reduction applies, enter the total from Schedule A (Form 940 ) Part 4: Determine your FUTA tax and balance due or overpayment. If any line does NOT apply, leave it blank. 12 Total FUTA tax after adjustment (lines 8+9+10+11= line 12) 13 FUTA tax deposited for the year, including any overpayment applied from a prior year 14 Balance due. If line 12 is more than line 13 , enter the difference on line 14. If line 14 is more than $500, you must deposit your tax. If line 14 is $500 or less, you may pay with this return. See instructions. 15 Overpayment. If line 13 is more than line 12, enter the difference on line 15. Part 5: Report your FUTA tax liability by quarter only if line 12 is more than $500. If not, go to Part 6 16 Report the amount of your FUTA tax liability for each quarter, do NOT enter the amount you deposited. If you had no liability for a quarter, leave the line blank. 16 1st quarter (January 1 - March 31) 16b 2nd quarter (April 1 - June 30). 16c 3rd quarter (July 1 - September 30) 16d 4th quarter October 1 - December 31) 17 Total tax liability for the year (lines 16a+16b+16c+16d= line 17) \begin{tabular}{r|l|} 16a & \\ & \\ 16c & \\ 16d & \\ 17 & \\ 1 & \\ \hline \end{tabular} October November December Additional Information a. State reporting number: 025-319-2 b. No FUTA tax deposits were made for this year. c. Harris' three employees for the year all earned over $7,000. (Assume that none of the FUTA wages paid were excluded from state unemployment tax and that no credit reduction applies. Using the information below, please complete a Form 940 for Harris' Sporting Goods for the current year. Additional information needed to complete the form is as follows: View the employees' payroll information for October. View the employees' payroll information for November. View the employees' payroll information for December. View the additional information. led.) Form 940 Part 2: Determine your FUTA tax before adjustments. If any line does NOT apply, leave it blank. 3 Total payments to all employees. 4 Payments exempt from FUTA tax Check all that apply: 5 Total of payments made to each employee in excess of 6 Subtotal (line 4 + line 5= line 6 ). 7 Total taxable FUTA wages (line 3 - line 6= line 7). 8 FUTA tax before adjustments (line 70.006= line 8) \begin{tabular}{l|} 6 \\ 7 \\ 7 \\ 8 \\ \\ \\ \hline \end{tabular} Part 3: Determine your adjustments. If any line does NOT apply, leave it blank. 9 If ALL of the taxable FUTA wages you paid were excluded from state unemployment tax, multiply line 7 by .054 (line 7.054= line 9 ). Go to line 12 . 10 If SOME of the taxable FUTA wages you paid were excluded from state unemployment tax, OR you paid ANY state unemployment tax late (after the due date for filing Form 940), complete the worksheet in the instructions. Enter the amount from line 7.of.the.worksheet. 11 If credit reduction applies, enter the total from Schedule A (Form 940 ) Part 4: Determine your FUTA tax and balance due or overpayment. If any line does NOT apply, leave it blank. 12 Total FUTA tax after adjustment (lines 8+9+10+11= line 12) 13 FUTA tax deposited for the year, including any overpayment applied from a prior year 14 Balance due. If line 12 is more than line 13 , enter the difference on line 14. If line 14 is more than $500, you must deposit your tax. If line 14 is $500 or less, you may pay with this return. See instructions. 15 Overpayment. If line 13 is more than line 12, enter the difference on line 15. Part 5: Report your FUTA tax liability by quarter only if line 12 is more than $500. If not, go to Part 6 16 Report the amount of your FUTA tax liability for each quarter, do NOT enter the amount you deposited. If you had no liability for a quarter, leave the line blank. 16 1st quarter (January 1 - March 31) 16b 2nd quarter (April 1 - June 30). 16c 3rd quarter (July 1 - September 30) 16d 4th quarter October 1 - December 31) 17 Total tax liability for the year (lines 16a+16b+16c+16d= line 17) \begin{tabular}{r|l|} 16a & \\ & \\ 16c & \\ 16d & \\ 17 & \\ 1 & \\ \hline \end{tabular} October November December Additional Information a. State reporting number: 025-319-2 b. No FUTA tax deposits were made for this year. c. Harris' three employees for the year all earned over $7,000. (Assume that none of the FUTA wages paid were excluded from state unemployment tax and that no credit reduction applies

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts