Question: Using the information below to determine the call option value based on a single binomial model assuming that you buy a share of stock and

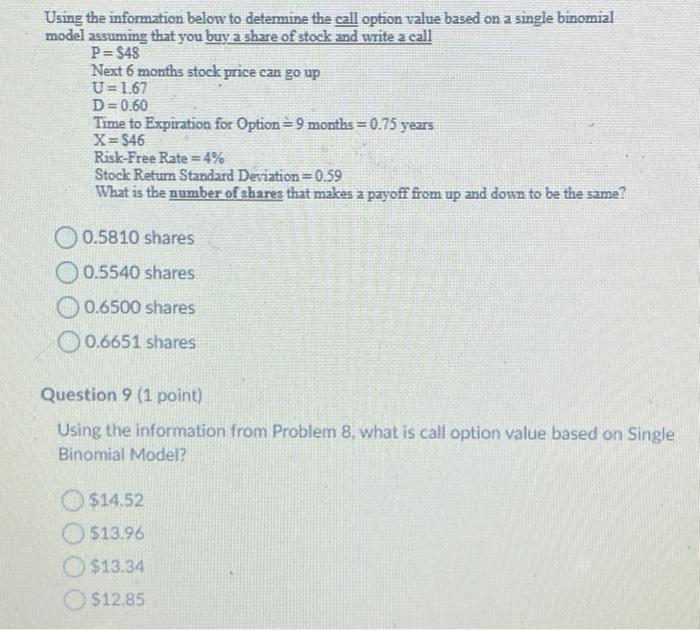

Using the information below to determine the call option value based on a single binomial model assuming that you buy a share of stock and write a call P= $48 Next 6 months stock price can go up U= 1.67 D=0.60 Time to Expiration for Option=9 months = 0.75 years X= $46 Risk-Free Rate = 4% Stock Return Standard Deviation=0.59 What is the number of shares that makes a payoff from up and down to be the same? O 0.5810 shares 0.5540 shares 0 0.6500 shares 0.6651 shares Question 9 (1 point) Using the information from Problem 8. what is call option value based on Single Binomial Model? $14.52 $13.96 $13.34 $12.85 Using the information below to determine the call option value based on a single binomial model assuming that you buy a share of stock and write a call P= $48 Next 6 months stock price can go up U= 1.67 D=0.60 Time to Expiration for Option=9 months = 0.75 years X= $46 Risk-Free Rate = 4% Stock Return Standard Deviation=0.59 What is the number of shares that makes a payoff from up and down to be the same? O 0.5810 shares 0.5540 shares 0 0.6500 shares 0.6651 shares Question 9 (1 point) Using the information from Problem 8. what is call option value based on Single Binomial Model? $14.52 $13.96 $13.34 $12.85

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts