Question: Using the information from PR 5-3B. Answer the following True or False multiple choice. Sales and Purchase-Related Transactions Using Perpetual Inventory System Obj. 2 The

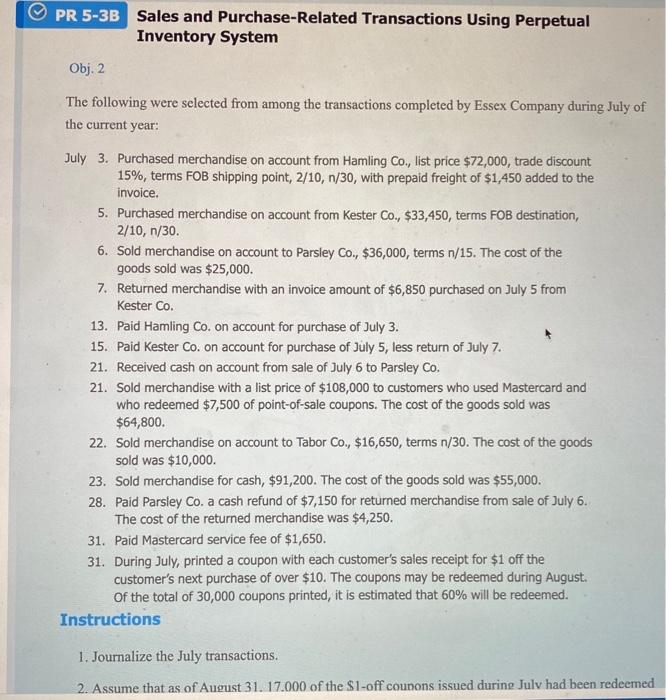

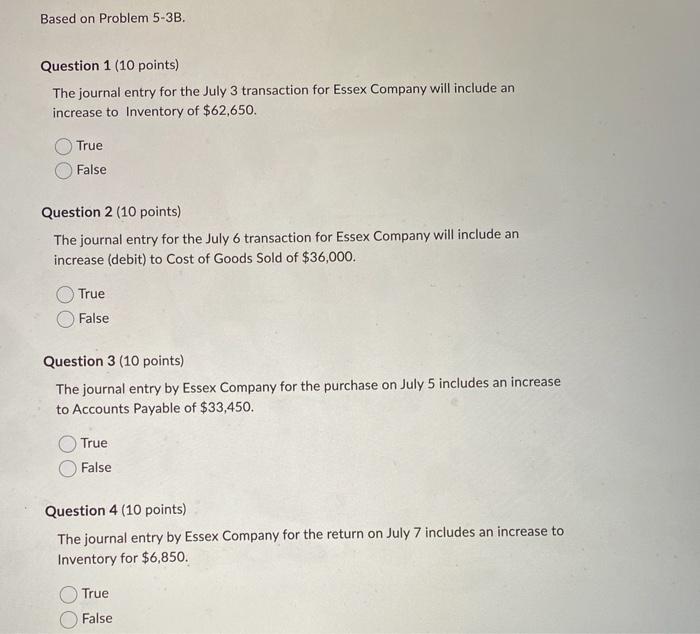

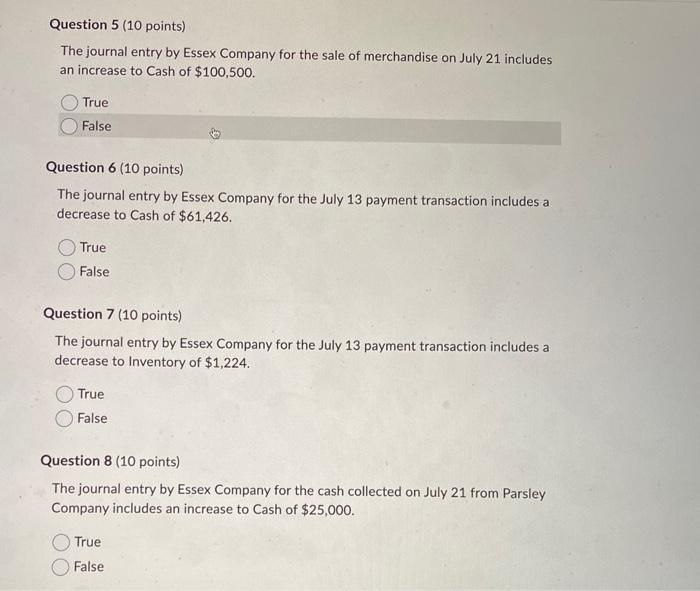

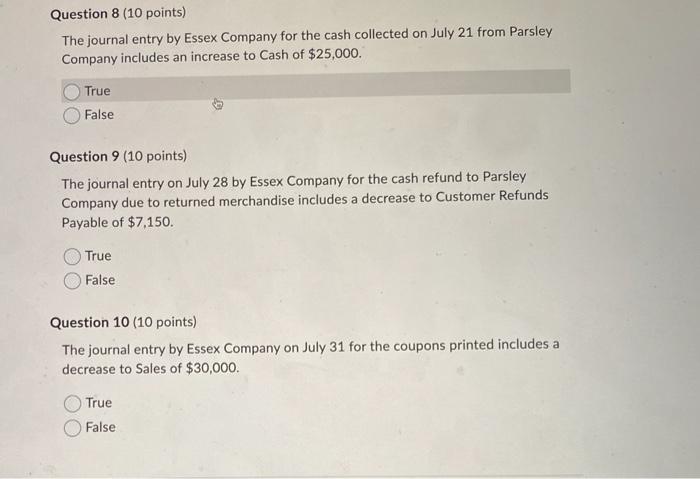

Sales and Purchase-Related Transactions Using Perpetual Inventory System Obj. 2 The following were selected from among the transactions completed by Essex Company during July of the current year: July 3. Purchased merchandise on account from Hamling Co., list price $72,000, trade discount 15%, terms FOB shipping point, 2/10,n/30, with prepaid freight of $1,450 added to the invoice. 5. Purchased merchandise on account from Kester Co., $33,450, terms FOB destination, 2/10,n/30. 6. Sold merchandise on account to Parsley Co., $36,000, terms n/15. The cost of the goods sold was $25,000. 7. Returned merchandise with an invoice amount of $6,850 purchased on July 5 from Kester Co. 13. Paid Hamling Co. on account for purchase of July 3. 15. Paid Kester Co. on account for purchase of Jly 5 , less return of July 7. 21. Received cash on account from sale of July 6 to Parsley Co. 21. Sold merchandise with a list price of $108,000 to customers who used Mastercard and who redeemed $7,500 of point-of-sale coupons. The cost of the goods sold was $64,800. 22. Sold merchandise on account to Tabor Co., $16,650, terms n/30. The cost of the goods sold was $10,000. 23. Sold merchandise for cash, $91,200. The cost of the goods sold was $55,000. 28. Paid Parsley Co. a cash refund of $7,150 for returned merchandise from sale of July 6. The cost of the returned merchandise was $4,250. 31. Paid Mastercard service fee of $1,650. 31. During July, printed a coupon with each customer's sales receipt for $1 off the customer's next purchase of over $10. The coupons may be redeemed during August. Of the total of 30,000 coupons printed, it is estimated that 60% will be redeemed. Instructions 1. Journalize the July transactions. 2. Assume that as of August 31.17.000 of the $1-off counons issued during Julv had been redeemed The journal entry for the July 3 transaction for Essex Company will include an increase to Inventory of $62,650. True False Question 2 (10 points) The journal entry for the July 6 transaction for Essex Company will include an increase (debit) to Cost of Goods Sold of $36,000. True False Question 3 (10 points) The journal entry by Essex Company for the purchase on July 5 includes an increase to Accounts Payable of $33,450. True False Question 4 (10 points) The journal entry by Essex Company for the return on July 7 includes an increase to Inventory for $6,850. True False The journal entry by Essex Company for the sale of merchandise on July 21 includes an increase to Cash of $100,500. True False Question 6 (10 points) The journal entry by Essex Company for the July 13 payment transaction includes a decrease to Cash of $61,426. True False Question 7 (10 points) The journal entry by Essex Company for the July 13 payment transaction includes a decrease to Inventory of $1,224. True False Question 8 (10 points) The journal entry by Essex Company for the cash collected on July 21 from Parsley Company includes an increase to Cash of $25,000. True False The journal entry by Essex Company for the cash collected on July 21 from Parsley Company includes an increase to Cash of $25,000. True False Question 9 (10 points) The journal entry on July 28 by Essex Company for the cash refund to Parsley Company due to returned merchandise includes a decrease to Customer Refunds Payable of $7,150. True False Question 10 (10 points) The journal entry by Essex Company on July 31 for the coupons printed includes a decrease to Sales of $30,000. True False

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts