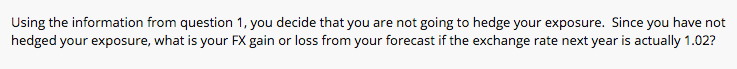

Question: Using the information from question 1, you decide that you are not going to hedge your exposure. Since you have not hedged your exposure, what

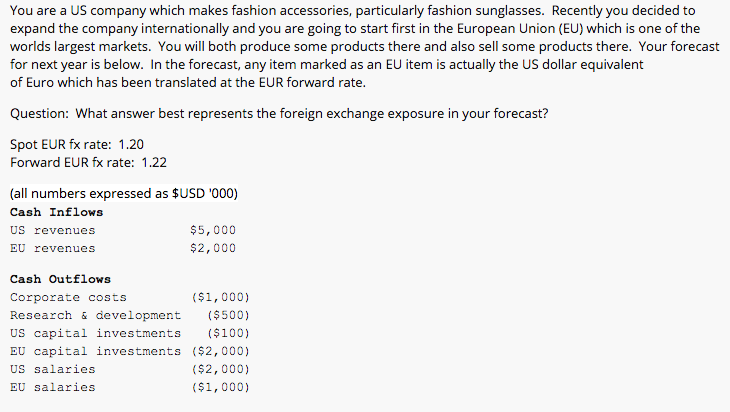

Using the information from question 1, you decide that you are not going to hedge your exposure. Since you have not hedged your exposure, what is your FX gain or loss from your forecast if the exchange rate next year is actually 1.02? You are a US company which makes fashion accessories, particularly fashion sunglasses. Recently you decided to expand the company internationally and you are going to start first in the European Union (EU) which is one of the worlds largest markets. You will both produce some products there and also sell some products there. Your forecast for next year is below. In the forecast, any item marked as an EU item is actually the US dollar equivalent of Euro which has been translated at the EUR forward rate Question: What answer best represents the foreign exchange exposure in your forecast? Spot EUR fx rate: 1.20 Forward EUR fx rate: 1.22 (all numbers expressed as $USD '000) Cash Inflows US revenues EU revenues $5,000 $2,000 Cash Outflows Corporate costs Research & development 500) US capital investments EU capital investments ($2,000) Us salaries EU salaries ($1,000) ($100) ($2,000) ($1,000) Using the information from question 1, you decide that you are not going to hedge your exposure. Since you have not hedged your exposure, what is your FX gain or loss from your forecast if the exchange rate next year is actually 1.02? You are a US company which makes fashion accessories, particularly fashion sunglasses. Recently you decided to expand the company internationally and you are going to start first in the European Union (EU) which is one of the worlds largest markets. You will both produce some products there and also sell some products there. Your forecast for next year is below. In the forecast, any item marked as an EU item is actually the US dollar equivalent of Euro which has been translated at the EUR forward rate Question: What answer best represents the foreign exchange exposure in your forecast? Spot EUR fx rate: 1.20 Forward EUR fx rate: 1.22 (all numbers expressed as $USD '000) Cash Inflows US revenues EU revenues $5,000 $2,000 Cash Outflows Corporate costs Research & development 500) US capital investments EU capital investments ($2,000) Us salaries EU salaries ($1,000) ($100) ($2,000) ($1,000)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts