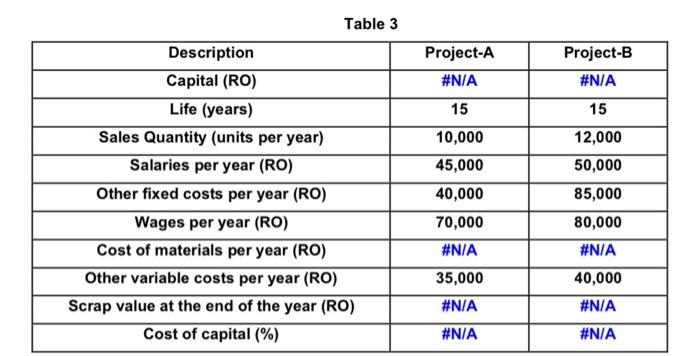

Question: Using the information from table 3 and Discount Cash Flow criteria, calculate Pay Back Period (PBP), Account Rate of Return (ARR), Net Present Value (NPV)

Table 3 Description Capital (RO) Life (years) Sales Quantity (units per year) Salaries per year (RO) Other fixed costs per year (RO) Wages per year (RO) Cost of materials per year (RO) Other variable costs per year (RO) Scrap value at the end of the year (RO) Cost of capital (%) Project-A #N/A 15 10,000 45,000 40,000 70,000 #N/A 35,000 #N/A #N/A Project-B #N/A 15 12,000 50,000 85,000 80,000 #N/A 40,000 #N/A #N/A Table 3 Description Capital (RO) Life (years) Sales Quantity (units per year) Salaries per year (RO) Other fixed costs per year (RO) Wages per year (RO) Cost of materials per year (RO) Other variable costs per year (RO) Scrap value at the end of the year (RO) Cost of capital (%) Project-A #N/A 15 10,000 45,000 40,000 70,000 #N/A 35,000 #N/A #N/A Project-B #N/A 15 12,000 50,000 85,000 80,000 #N/A 40,000 #N/A #N/A

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts