Question: Using the information in Problem 4 and assuming the beginning of the year (20X3) balance in the Investment in A account is $716,000 complete the

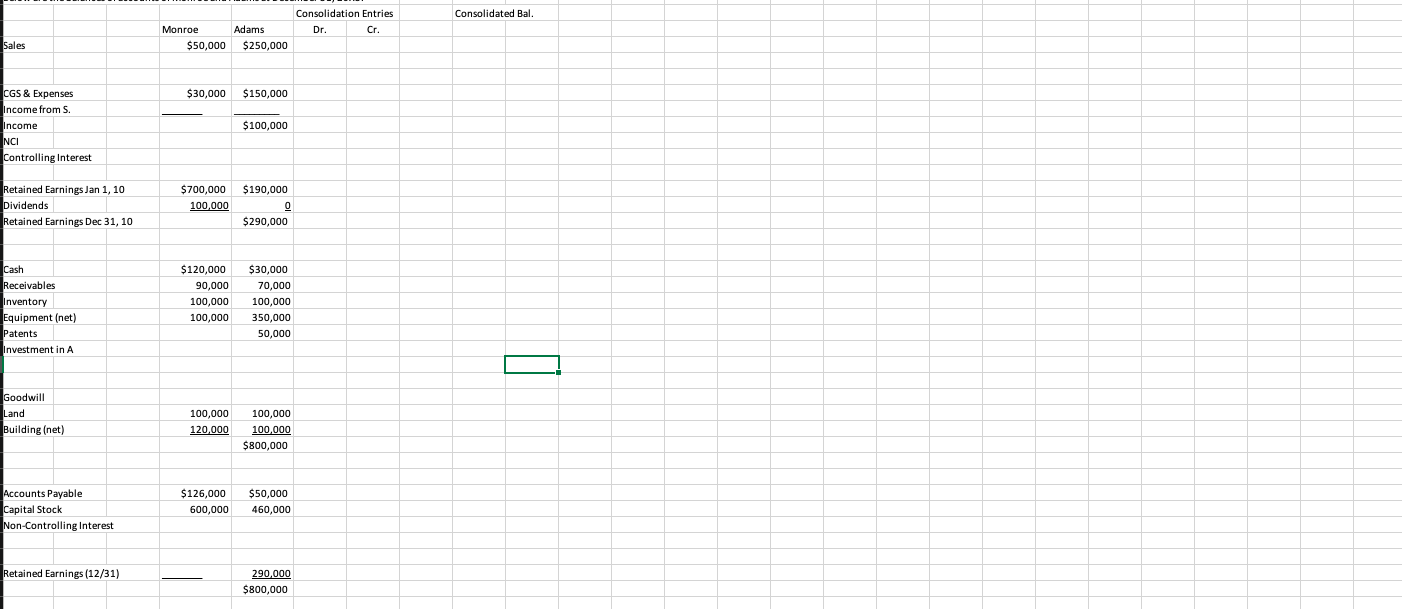

Using the information in Problem 4 and assuming the beginning of the year (20X3) balance in the Investment in A account is $716,000 complete the consolidated worksheet below. To aid in this, Information from Problem 4 is repeated below. Monroe Company purchased 80% of Adams Company on January 1, 20X1. The purchase price paid was $600,000. On that day, the book value of Adams was $500,000. Excess of cost over book value is due to goodwill. Included in Adams's income are intercompany sales to Monroe of $40,000 with a cost to Adams of $25,000. 30% of this inventory is on hand in the Monroe inventory at December 31, 20X3. In addition, inventory sold at a profit of $5,000 was in the inventory of Monroe at December 31, 20X2. Below are the balances of accounts of Monroe and Adams at December 31, 20X3.

Consolidation Entries Dr. Cr. 1 Consolidated Bal. Monroe $50,000 Adams $250,000 Sales $30,000 $150,000 CGS & Expenses Income from S. Income NCI Controlling Interest $100,000 Retained Earnings Jan 1, 10 Dividends Retained Earnings Dec 31, 10 $700,000 100,000 $190,000 0 $290,000 Cash Receivables Inventory Equipment (net) Patents Investment in A $120,000 90,000 100,000 100,000 $30,000 70,000 100,000 350,000 50,000 O Goodwill Land Building (net) 100,000 120,000 100,000 100,000 $800,000 Accounts Payable Capital Stock Non-Controlling Interest $126,000 600,000 $50,000 460,000 Retained Earnings (12/31) 290.000 $800,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts