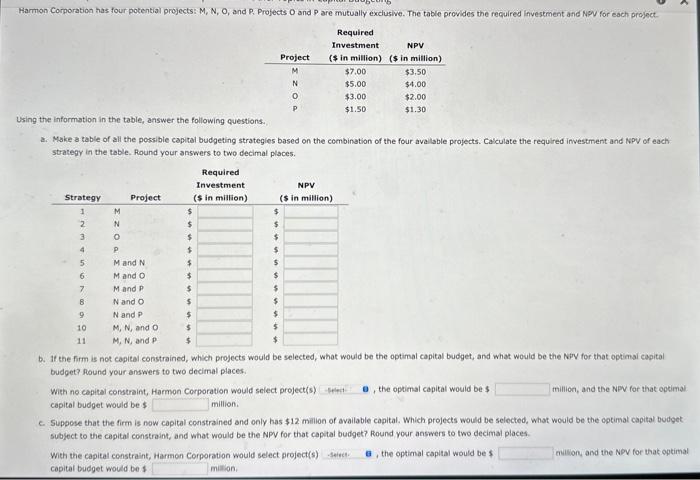

Question: Using the information in the table, answer the following questionam a. Make a table of all the possible capital budgeting strategles based on the combination

Using the information in the table, answer the following questionam a. Make a table of all the possible capital budgeting strategles based on the combination of the four avallable projects. Calculate the required investment and NPV of each. stratepy in the table. Round your answers to two decimal places. b. If the firm is not capital constrained, which projects would be selected, what would be the optimal capital budget, and what would be the Niry for that optimal capital budget? Round your answers to two decimal places: with ne capital constraint, Harmon Corporation would select project(s) , the optimal capital would be $ million, and the NPV for that optimal copital budget would be $ million. c. Suppose that the firm is now capital constrained and only has $12 milion of available capital. Which projects would be selected, whot would be the eptimal capital budget subject to the capital constraint, and what would be the NPV for that capital budget? Round your answers to two decimal places. Wht the capital constraint, Harmon Corporation would select project(s) , the optimal capital would be $ millory and the NPV for that optima copital budget would be 4 million. 1. Because of the capital constraint, how much value does the firm lose between the NPVs of the selected projects in parts b and c? Round your answer to taia decirtal places. 5 milion

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts