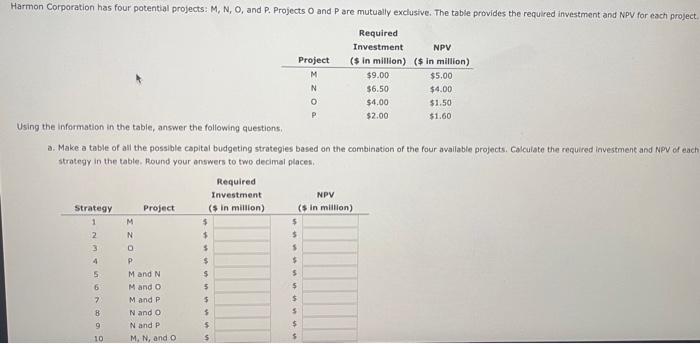

Question: Using the information in the table, answer the following questions. a. Make a table of afl the possible capital budgeting strategies based on the combination

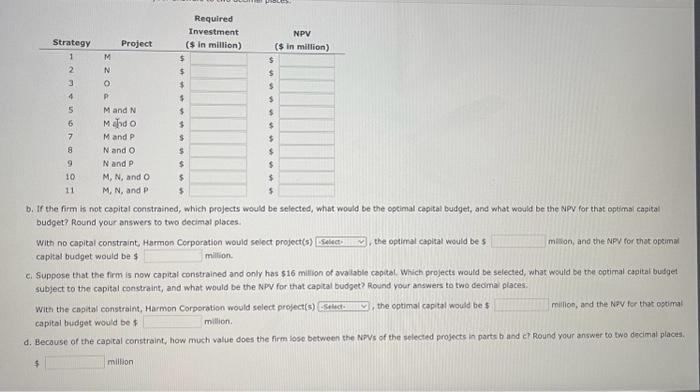

Using the information in the table, answer the following questions. a. Make a table of afl the possible capital budgeting strategies based on the combination of the four available projects. Calculate the required investment and Npv of eac strategy in the table. Round your answers to two decimal places. b. If the firm is not capital constrained, which projects would be selected, what would be the optimal capital budget, and what would be the NPV for that optimai eagita: budget? Round your answers to two decimal places. With no capital constraint, Harmen Corporation would select project(s) , the optimal capital would be 5 mision, and the NPV for that opeimal capital budget would be $ milion: c. Suppose that the firm is now capital constrained and only has $16 million of avalable capital. Which projects would be selected, what would be the optirnal capital bufget subject to the capital constraint, and what would be the NPV for that capital budget? Round your answers to two decima places: With the copital constraint, Harmon Corporation woold select project(s) , the optimal captal would be 5 million, and the Nov for that optimal capital budget would be \& milion. d. Becouse of the capical constraint, how much value does the firm lose betwoen the Novs of the selected projects in parts b and c Round your answer to two decimal places. 4 milition

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts