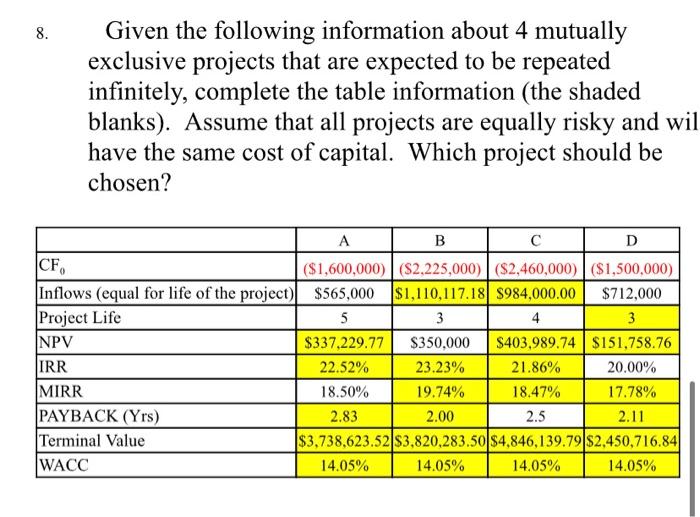

Question: using the information in the yellow cells, i need to know how to arrive at the answers in the yellow cells 8. Given the following

8. Given the following information about 4 mutually exclusive projects that are expected to be repeated infinitely, complete the table information (the shaded blanks). Assume that all projects are equally risky and wil have the same cost of capital. Which project should be chosen? B D CF, ($1,600,000) (S2.225,000) ($2,460,000) ($1,500,000) Inflows (equal for life of the project) $565,000 $1,110,117.18 $984,000.00 $712,000 Project Life 5 3 4 3 NPV $337,229.77 $350,000 S403,989.74 $151,758.76 IRR 22.52% 23.23% 21.86% 20.00% MIRR 18.50% 19.74% 18.47% 17.78% PAYBACK (Yrs) 2.83 2.00 2.5 2.11 Terminal Value $3,738,623.52 $3,820,283.50 $4,846,139.79 $2.450,716,84 WACC 14.05% 14.05% 14.05% 14.05%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts