Question: Using the information provided here and in your text, complete the following: a. Input / Select the correct answer: 1. The 2017 OASDI rate is,

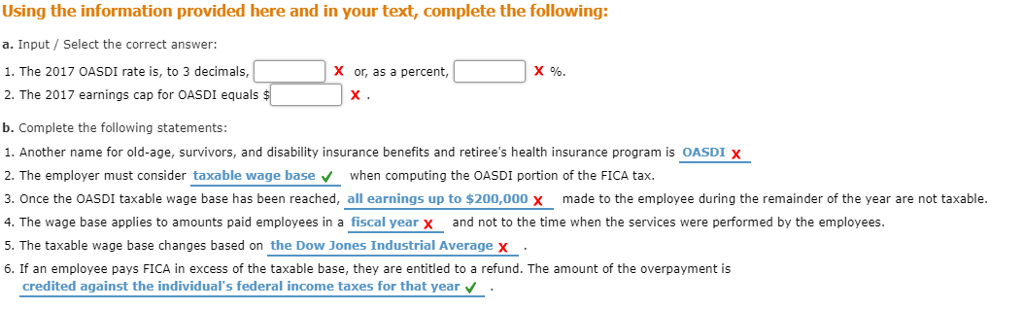

Using the information provided here and in your text, complete the following: a. Input / Select the correct answer: 1. The 2017 OASDI rate is, to 3 decimals, 2. The 2017 earnings cap for OASDI equals $1 x b. Complete the following statements: 1. Another name for old-age, survivors, and disability insurance benefits and retiree's health insurance program is OASDI X 2. The employer must consider taxable wage base when computing the OASDI portion of the FICA tax. x or, as a percent, 3. Once the OASDI taxable wage base has been reached, all earnings up to $200,000 X made to the employee during the remainder of the year are not taxable. 4. The wage base applies to amounts paid employees in a fiscal year x and not to the time when the services were performed by the employees 5. The taxable wage base changes based on the Dow Jones Industrial Average x 6. If an employee pays FICA in excess of the taxable base, they are entitled to a refund. The amount of the overpayment is credited against the individual's federal income taxes for that year V

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts