Question: Using the information provided in each link below, complete three tax returns for the following clients (Tax Return 1, 2, and 3) in TaxAct: Robert

Using the information provided in each link below, complete three tax returns for the following clients (Tax Return 1, 2, and 3) in TaxAct: Robert and Amy Pax; Heather and Nick Johnson; and Kiara and Brock Smith.

Using the information provided in each link below, complete three tax returns for the following clients (Tax Return 1, 2, and 3) in TaxAct: Robert and Amy Pax; Heather and Nick Johnson; and Kiara and Brock Smith.

Heather and Nick Johnson

Heather and Nick Johnson are married and file a joint income tax return. Their address is 3847 Indian Trail, Madison, WI 58493.

Nicks Social Security number is 527-01-1115 and birthdate 10/15/1968.

Heathers social security number is 655-10-2224 and birthdate 6/12/1970.

Nick is an electrical engineer, and Heather is a speech therapist. She is self-employed. They report all their income and expenses on the cash method.

For 2018, they report the following items of income and expense.

Forms:

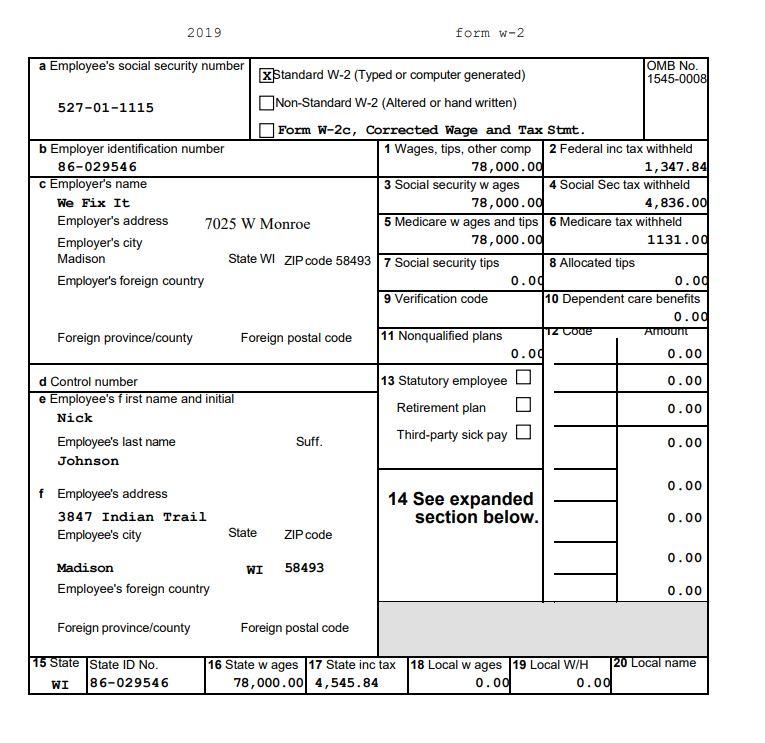

Nick W2

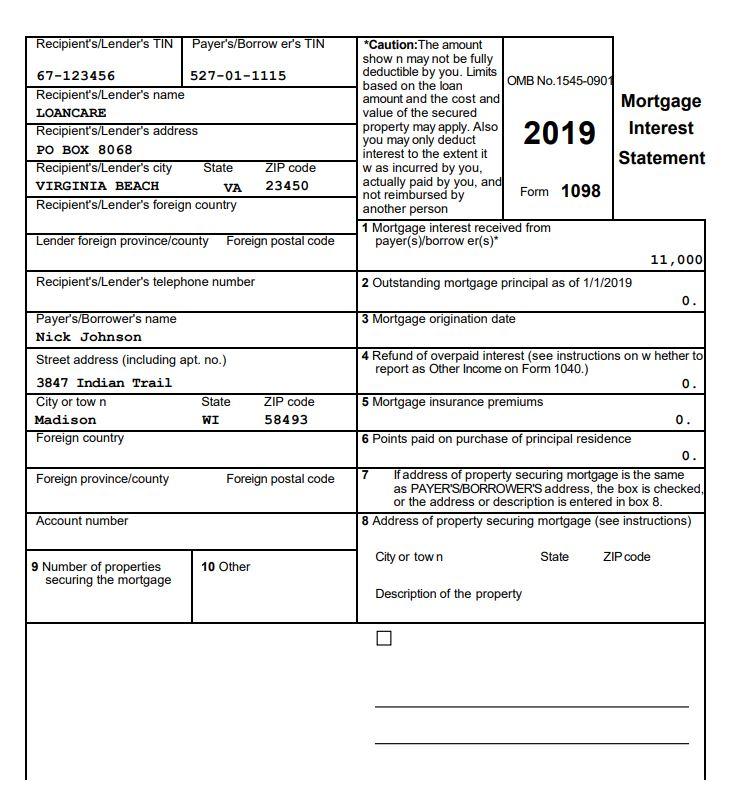

Form 1098

Other data:

- Gross receipts from Heathers business $130,000

- Rent on Heathers office $14,500

- Receivables written off during the year (received in Heathers business) $1,200

- Subscriptions to linguistic journals for Heather $200

- Salary for Heathers secretary-receptionist $33,000

- Qualified medical expenses $12,000

- Property taxes on their personal residence $5,000

- State income tax refund received this year (the tax benefit was received in the prior year from the state income tax deduction) $600

- Heathers estimated tax payments $20,000

- Income tax preparation fee for the prior years return paid this year $900

Heather and Nick sold the following assets:

| Asset | Aquired | Sold | Sales Price | Cost |

| KNA Stock | 2/12/2015 | 3/13/2019 | $14,000 | $8,000 |

| AEN Stock | 3/2/2019 | 7/17/2019 | $20,000 | $22,000 |

| KLN Stock | 6/8/2011 | 4/10/2019 | $13,000 | $17,000 |

| Motorcycle | 5/3/2008 | 9/12/2019 | $2,500 | $6,000 |

Heather owned the KLN stock and sold it to her brother, Jack. Heather and Nick used the motorcycle for personal recreation.

Complete Heather and Nick's Form 1040 for tax year 2019, Schedules A, C, D, and any forms applicable. For purposes of this tax problem, disregard the alternative minimum tax and any credits.

2019 form w-2 a Employee's social security number OMB No. XStandard W-2 (Typed or computer generated) 1545-0008 527-01-1115 Non-Standard W-2 (Altered or hand written) Form W-2c, Corrected Wage and Tax Stmt. b Employer identification number 1 Wages, tips, other comp 2 Federal inc tax withheld 86-029546 78,000.00 1,347.84 c Employer's name 3 Social security w ages 4 Social Sec tax withheld We Fix It 78,000.od 4,836.00 Employer's address 7025 W Monroe 5 Medicare w ages and tips 6 Medicare tax withheld Employer's city 78,000.00 1131.00 Madison State WI ZIP code 58493 7 Social security tips 8 Allocated tips Employer's foreign country 0.00 0.00 9 Verification code 10 Dependent care benefits 0.00 Foreign province/county Foreign postal code 11 Nonqualified plans 0.00 0.00 d Control number 13 Statutory employee 0.00 e Employee's first name and initial Retirement plan 0.00 Nick Employee's last name Suff. Third-party sick pay 0.00 Johnson 0.00 f Employee's address 14 See expanded 3847 Indian Trail section below. 0.00 Employee's city State ZIP code 0.00 Madison WI 58493 Employee's foreign country 0.00 12 Code Amount Foreign province/county Foreign postal code 115 State State ID No. WI 86-029546 16 State w ages 17 State inc tax 18 Local w ages 19 Local W/H 120 Local name 78,000.00 4,545.84 0.00 0.00 Recipient's/Lender's TIN Payer's/Borrow er's TIN 67-123456 527-01-1115 Recipients/Lender's name LOANCARE Recipient's/Lender's address PO BOX 8068 Recipient's/Lender's city State ZIP code VIRGINIA BEACH VA 23450 Recipient's/Lender's foreign country 2019 *Caution:The amount shown may not be fully deductible by you. Limits based on the loan OMB No. 1545-0901 amount and the cost and Mortgage value of the secured property may apply. Also Interest you may only deduct interest to the extent it Statement was incurred by you, actually paid by you, and not reimbursed by Form 1098 another person 1 Mortgage interest received from payer(s)/borrow er(s)* 11,000 2 Outstanding mortgage principal as of 1/1/2019 0. 3 Mortgage origination date Lender foreign province/county Foreign postal code Recipient's/Lender's telephone number Payer's/Borrower's name Nick Johnson Street address (including apt. no.) 3847 Indian Trail City or town State Madison WI Foreign country ZIP code 58493 4 Refund of overpaid interest (see instructions on whether to report as Other Income on Form 1040.) 0. 5 Mortgage insurance premiums 0. 6 Points paid on purchase of principal residence 0. If address of property securing mortgage is the same as PAYER'S/BORROWER'S address, the box is checked, or the address or description is entered in box 8. 8 Address of property securing mortgage (see instructions) 7 Foreign province/county Foreign postal code Account number City or town State ZIP code 10 Other 9 Number of properties securing the mortgage Description of the property 2019 form w-2 a Employee's social security number OMB No. XStandard W-2 (Typed or computer generated) 1545-0008 527-01-1115 Non-Standard W-2 (Altered or hand written) Form W-2c, Corrected Wage and Tax Stmt. b Employer identification number 1 Wages, tips, other comp 2 Federal inc tax withheld 86-029546 78,000.00 1,347.84 c Employer's name 3 Social security w ages 4 Social Sec tax withheld We Fix It 78,000.od 4,836.00 Employer's address 7025 W Monroe 5 Medicare w ages and tips 6 Medicare tax withheld Employer's city 78,000.00 1131.00 Madison State WI ZIP code 58493 7 Social security tips 8 Allocated tips Employer's foreign country 0.00 0.00 9 Verification code 10 Dependent care benefits 0.00 Foreign province/county Foreign postal code 11 Nonqualified plans 0.00 0.00 d Control number 13 Statutory employee 0.00 e Employee's first name and initial Retirement plan 0.00 Nick Employee's last name Suff. Third-party sick pay 0.00 Johnson 0.00 f Employee's address 14 See expanded 3847 Indian Trail section below. 0.00 Employee's city State ZIP code 0.00 Madison WI 58493 Employee's foreign country 0.00 12 Code Amount Foreign province/county Foreign postal code 115 State State ID No. WI 86-029546 16 State w ages 17 State inc tax 18 Local w ages 19 Local W/H 120 Local name 78,000.00 4,545.84 0.00 0.00 Recipient's/Lender's TIN Payer's/Borrow er's TIN 67-123456 527-01-1115 Recipients/Lender's name LOANCARE Recipient's/Lender's address PO BOX 8068 Recipient's/Lender's city State ZIP code VIRGINIA BEACH VA 23450 Recipient's/Lender's foreign country 2019 *Caution:The amount shown may not be fully deductible by you. Limits based on the loan OMB No. 1545-0901 amount and the cost and Mortgage value of the secured property may apply. Also Interest you may only deduct interest to the extent it Statement was incurred by you, actually paid by you, and not reimbursed by Form 1098 another person 1 Mortgage interest received from payer(s)/borrow er(s)* 11,000 2 Outstanding mortgage principal as of 1/1/2019 0. 3 Mortgage origination date Lender foreign province/county Foreign postal code Recipient's/Lender's telephone number Payer's/Borrower's name Nick Johnson Street address (including apt. no.) 3847 Indian Trail City or town State Madison WI Foreign country ZIP code 58493 4 Refund of overpaid interest (see instructions on whether to report as Other Income on Form 1040.) 0. 5 Mortgage insurance premiums 0. 6 Points paid on purchase of principal residence 0. If address of property securing mortgage is the same as PAYER'S/BORROWER'S address, the box is checked, or the address or description is entered in box 8. 8 Address of property securing mortgage (see instructions) 7 Foreign province/county Foreign postal code Account number City or town State ZIP code 10 Other 9 Number of properties securing the mortgage Description of the property

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts