Question: Using the information provided in the table and the sales, fixed Assets, EBIT, and depreciation figures from the financial forecast provided to you in your

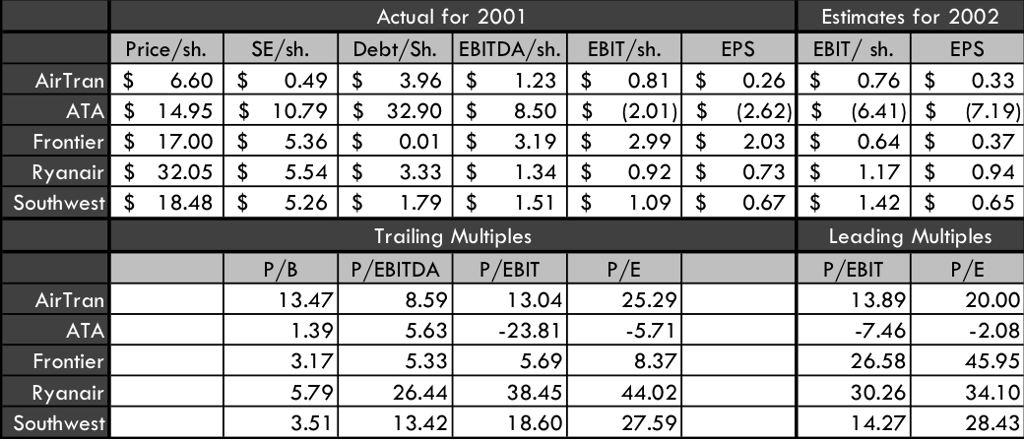

Using the information provided in the table and the sales, fixed Assets, EBIT, and depreciation figures from the financial forecast provided to you in your student worksheet JetBlue IPO case file, you decide to value JetBlues IPO using either a P/EBIT or P/E multiple. Assume JetBlues IPO price was for $25.00 per share and there were 35 total units of common shares. To remove outliers, calculate the five company median for each multiple. You decide to compare the valuation you get for JetBlue using lagging P/EBIT and lagging P/E (weighed equally) to the valuation you get for JetBlue using leading P/EBIT and leading P/E (weighted equally). Which of the following statement is most likely TRUE:

A. JetBlues IPO price was at a 38% discount to the value derived from leading multiple relative valuation

B. JetBlues IPO price was at a 47% discount to the value derived from leading multiple relative valuation

C. JetBlues IPO price was at a 62% discount to the value derived from lagging multiple relative valuation

D. JetBlues IPO price was at a 62% premium to the value derived from lagging multiple relative valuation

E. JetBlues IPO price was at a 87% premium to the value derived from leading multiple relative valuation

Actual for 2001 Estimates for 2002 EBIT/sh.EPS $0.76 $ 0.33 Price/sh. SE/sh.Debt/Sh. EBITDA/sh. EBIT/sh. EPS 6.60 0.49 $3.96 $ 1.23 $ 6.60$ AirTran Frontier Ryanair Southwest S 14.95 $ 10.79 $ 32.90 $ 8.50 2.01) $ (2.62) $ (6.4 .19) $ 17.005.360.0$ 3.19$ 2.9 2.03 0.64 0.37 $ 32.05 5.543.33$ 1.34$ 0.92$ 0.73$ 1.170.94 $ 18.48 | $ 5.26 | $ 1.79 | $ 1.51|$ 1,09 | $ 0.67 | $ 1.42 |$ o.65 Trailing Multiples P/B P/EBITDA P/EBIT Leading Multiples P EBIT PIE PIE 8.591 AirTran ATA Frontier Ryanair Southwest 13.47 13.0425.29 3.8920.00 2.08 45.95 30.2634.10 28.43 1.395-5.71 7.46 26.58 5.63 -23.81 3.17 5.33 5.69 8.37 579 26.44 38.4544.0 3.51 13.4218.6027.59 14.27

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts