Question: Using the information that you have gathered and the adjusted trial balance from December, plus the new information above, do the following: (a) Answer Natalie's

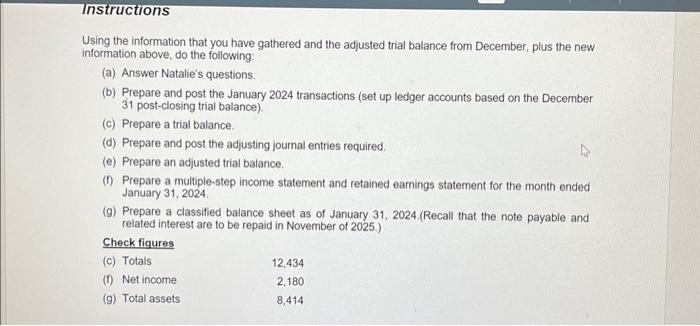

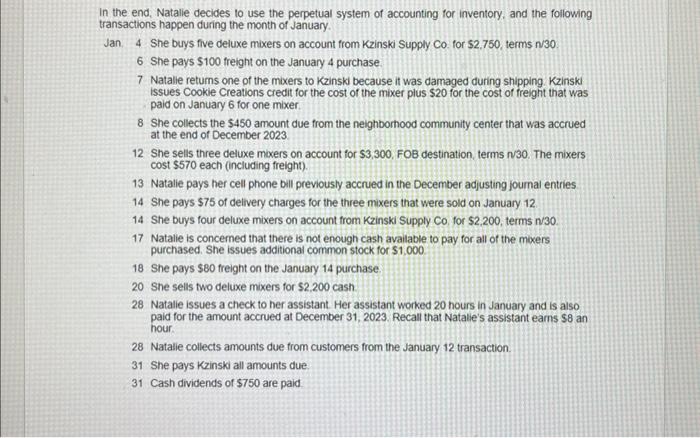

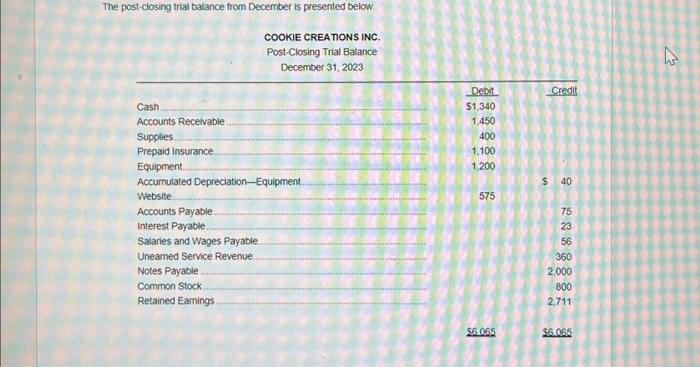

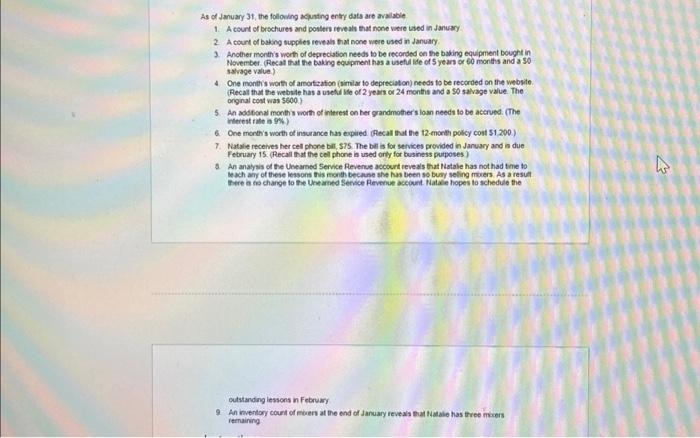

Using the information that you have gathered and the adjusted trial balance from December, plus the new information above, do the following: (a) Answer Natalie's questions. (b) Prepare and post the January 2024 transactions (set up ledger accounts based on the December 31 post-closing trial balance). (c) Prepare a trial balance. (d) Prepare and post the adjusting journal entries required. (e) Prepare an adjusted trial balance. (f) Prepare a multiple-step income statement and retained eamings statement for the month ended January 31,2024. (g) Prepare a classified balance sheet as of January 31, 2024. (Recall that the note payable and related interest are to be repaid in November of 2025.) In the end, Natalie decides 10 use the perpetual system of accounting for inventory, and the following transactions happen during the month of January. Jan. 4 She buys five deluxe mixers on account from Kzinski Supply Co. for $2,750, terms n/30. 6 She pays $100 freight on the January 4 purchase. 7 Natalie retums one of the mixers to Kzinsk because it was damaged during shipping. Kzinski issues cookie Creations credit for the cost of the mixer plus $20 for the cost of freight that was paid on January 6 for one mixer 8 She collects the $450 amount due from the neighborhood community center that was accrued at the end of December 2023 12 She sells three deluxe moxers on account for $3,300. FOB destination, terms n/30. The mixers cost $570 each (including freight). 13 Natalie pays her cell phone bill previously accrued in the December adjusting joumal entries 14 She pays $75 of delivery charges for the three mixers that were sold on January 12 14 She buys four deluxe mixers on account from Kzinski Supply Co, for $2,200, terms n/30. 17 Natalie is concemed that there is not enough cash available to pay for all of the moxers purchased. She issues additional common stock for $1,000 18 She pays $80 freight on the January 14 purchase 20 She sells two deluxe mixers for $2.200 cash 28 Natalie issues a check to her assistant. Her assistant worked 20 hours in January and is also paid for the amount accrued at December 31, 2023. Recall that Natale's assistant eams $8 an hour. 28 Natalie collects amounts due from customers from the January 12 transaction. 31 She pays Kzinski all amounts due. 31 Cash dividends of $750 are paid The post-closing trial balance from December is presented below. As of danuary 31, the following acuating enty dats are avalabie 1. A count of brachuret and posters reve aly that none vicre used in fanuary 2. A court of baking tupples reveals that none were used in January. 3. Another month's worth of depreciation netds to be recorded on the baking equipment bought in November (Recat that the baking equipment has a usetul ide of 5 yeart or 60 months and a 50 3.vage value.) 4 One monthis worth of amoritation (similar to depreciaton) needs to be recorded on the website. (Recal that the website has a used lile of 2 yeais of 24 monthe and a 50 salvage value. The onginal cost was 5600. 5. An adbconal month's worth of interest on her grandmothers losn needt to be acerued. (The Blerest rate is 9% ) 6. Coe month's worth of insurance has exped. (Fecall that the 12-enortti policy cost $1200 ) 7. Natale recehes her cell phone bill, $75. The bil is for services provided in January and a due Fetruary 15. (Recal that the cell phone is used orly for business puiposes.) 5. An analyais of the Ueiearned Semice Revenue accourt teveais that Patale has not had tme to be ach amy of these lesons this month bechuse she has been so buty seing moers. As a resuat There a te change to the Une arned Sendce Hevenue aceount. Natale hopes to schedule the cutstanding lessons in Februsy 9. An inentory court of moen at the end of danuary reveals thal halale has three mweces lemaining

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts