Question: Using the informaton from Apple Inc. below, fill out the Statement of Shareholders Equity for year ending on December 31, 2017 Apple, Inc. Statement of

Using the informaton from Apple Inc. below, fill out the Statement of Shareholders Equity for year ending on December 31, 2017

| Apple, Inc. | |||||

| Statement of Stockholders' Equity | |||||

| For the Year Ending December 31, 2017 | |||||

| Common Stock, $.00001 Par | APIC - CS | Retained Earnings | Treasury Stock | Total Stockholders' Equity | |

| Balance, January 1 | ____________ | ___________ | _________ | ____________ | _______________ |

| Issuance for additiona shares for cash | ____________. | ___________ | _________ | ____________ | _______________ |

| Purchase of treasury stock | ____________ | ___________ | _________ | ____________ | _______________ |

| Net income (loss) | ____________. | ___________ | __________ | ____________ | _______________ |

| Cash dividends. | ____________ | ___________ | __________ | ____________ | _______________ |

| Treasury stock | ____________ | ___________ | __________ | ____________ | _______________ |

| Balance, December 31 | ____________ | ___________ | __________ | ____________ | _______________ |

| 2 Years Prior (2015) | Prior Year (2016) | Current Year (2017) | |||

| Number of shares outstanding | ______________ | ____________ | ____________ | ||

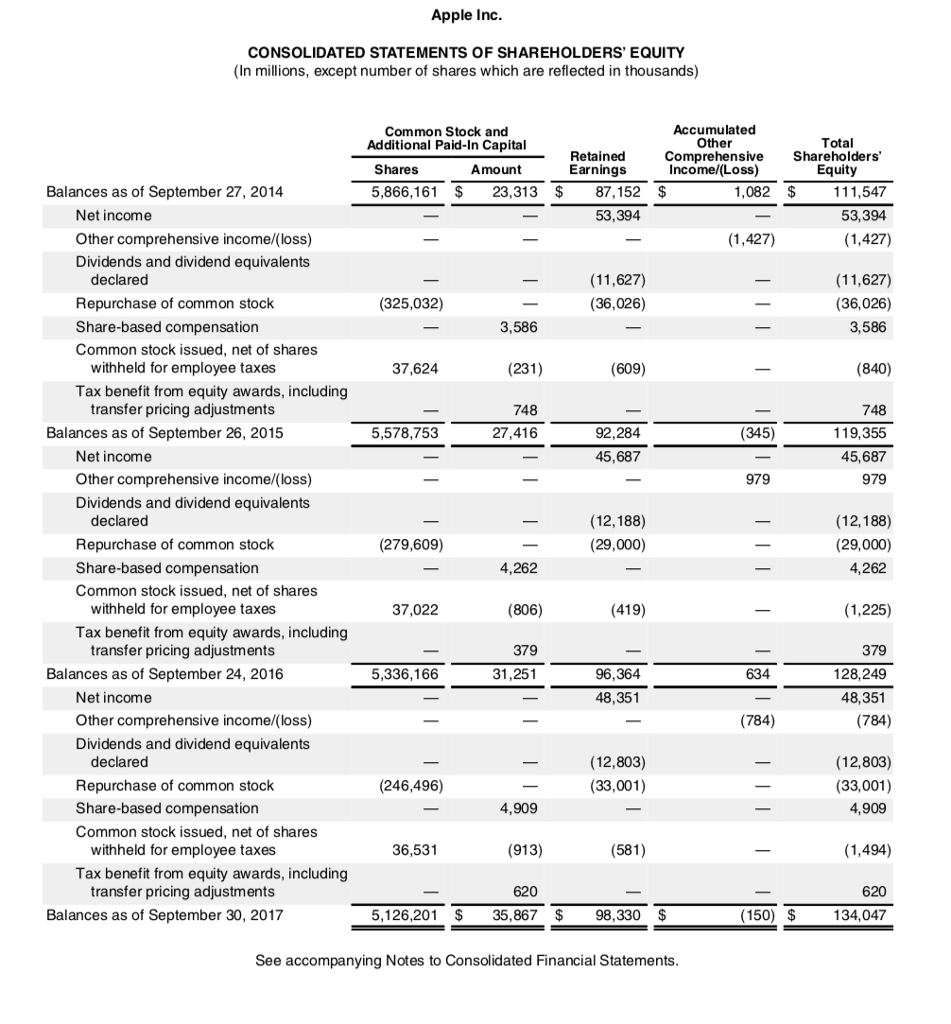

Apple Inc CONSOLIDATED STATEMENTS OF SHAREHOLDERS' EQUITY (In millions, except number of shares which are reflected in thousands) Accumulated Common Stock and Additional Paid-In Capital Other Total Retained Earnings Comprehesive Shareholders Incomel(Loss) Shares Amount 1,082 111,547 53,394 Balances as of September 27, 2014 5,866,161 23,313 87,152 $ Net income Other comprehensive income/(loss) Dividends and dividend equivalents 53,394 (1,427) declared Repurchase of common stock Share-based compensation Common stock issued, net of shares (11,627) (36,026) 3,586 (325,032) (36,026) 3,586 withheld for employee taxes 37,624 (609) Tax benefit from equity awards, including transfer pricing adjustments 748 27,416 Balances as of September 26, 2015 5,578,753 92,284 45,687 119,355 45,687 Net income Other comprehensive income/(loss) Dividends and dividend equivalents (12,188) (29,000) declared Repurchase of common stock Share-based compensation Common stock issued, net of shares (12,188) (29,000) 4,262 (279,609) 4,262 (1,225) 379 128,249 withheld for employee taxes 37,022 806 Tax benefit from equity awards, including transfer pricing adjustments 379 Balances as of September 24, 2016 96,364 48,351 5,336,166 634 Net income Other comprehensive income/(loss) Dividends and dividend equivalents (784) declared Repurchase of common stock Share-based compensation Common stock issued, net of shares (12,803) (33,001) (12,803) (33,001) 4,909 (246,496) 4,909 withheld for employee taxes 36,531 (581) (1,494) Tax benefit from equity awards, including transfer pricing adjustments 620 620 Balances as of September 30, 2017 5,126,201 $35,867 $ 98,330$ (150) $134,047 See accompanying Notes to Consolidated Financial Statements Apple Inc CONSOLIDATED STATEMENTS OF SHAREHOLDERS' EQUITY (In millions, except number of shares which are reflected in thousands) Accumulated Common Stock and Additional Paid-In Capital Other Total Retained Earnings Comprehesive Shareholders Incomel(Loss) Shares Amount 1,082 111,547 53,394 Balances as of September 27, 2014 5,866,161 23,313 87,152 $ Net income Other comprehensive income/(loss) Dividends and dividend equivalents 53,394 (1,427) declared Repurchase of common stock Share-based compensation Common stock issued, net of shares (11,627) (36,026) 3,586 (325,032) (36,026) 3,586 withheld for employee taxes 37,624 (609) Tax benefit from equity awards, including transfer pricing adjustments 748 27,416 Balances as of September 26, 2015 5,578,753 92,284 45,687 119,355 45,687 Net income Other comprehensive income/(loss) Dividends and dividend equivalents (12,188) (29,000) declared Repurchase of common stock Share-based compensation Common stock issued, net of shares (12,188) (29,000) 4,262 (279,609) 4,262 (1,225) 379 128,249 withheld for employee taxes 37,022 806 Tax benefit from equity awards, including transfer pricing adjustments 379 Balances as of September 24, 2016 96,364 48,351 5,336,166 634 Net income Other comprehensive income/(loss) Dividends and dividend equivalents (784) declared Repurchase of common stock Share-based compensation Common stock issued, net of shares (12,803) (33,001) (12,803) (33,001) 4,909 (246,496) 4,909 withheld for employee taxes 36,531 (581) (1,494) Tax benefit from equity awards, including transfer pricing adjustments 620 620 Balances as of September 30, 2017 5,126,201 $35,867 $ 98,330$ (150) $134,047 See accompanying Notes to Consolidated Financial Statements

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts