Question: Using the mutual fund quotes in Exhibit 13.3, and assuming that you can buy these funds at their quoted NAVs, how much would you have

Using the mutual fund quotes in Exhibit 13.3, and assuming that you can buy these funds at their quoted NAVs, how much would you have to pay to buy each of the following funds?

a. Aberdeen Select Opportunities Fund, class A shares (GlbEqA )

b. Aberdeen Select Opportunities Fund (GlbEql)

c. Artisan Small Cap Value Investor (ARTVX)

d. Aberdeen International Equity Fund II, class I shares (JETIX)

Using the mutual fund quotes in Exhibit 13.3, and assuming that you can buy these funds at their quoted NAVs, how much would you have to pay to buy each of the following funds?

a. Aberdeen Select Opportunities Fund, class A shares (GlbEqA )

b. Aberdeen Select Opportunities Fund (GlbEql)

c. Artisan Small Cap Value Investor (ARTVX)

d. Aberdeen International Equity Fund II, class I shares (JETIX)

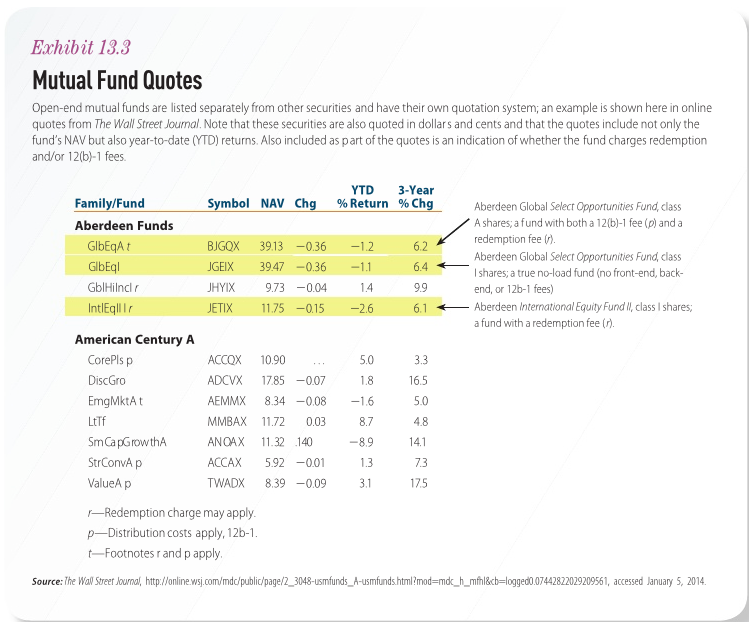

Exhibit 13.3 Mutual Fund Quotes Open-end mutual funds are listed separately from other securities and have their own quotation system; an example is shown here in online quotes from The Wall Street Journal. Note that these securities are also quoted in dollars and cents and that the quotes include not only the fund's NAV but also year-to-date (YTD) returns. Also included as part of the quotes is an indication of whether the fund charges redemption and/or 12(b)-1 fees. YTD 3-Year Family/Fund Symbol NAV Chg %Return %Chg Aberdeen Global Select Opportunities Fund, clas A shares, a fund with both a 12(b)-1 fee (p) anda redemption fee Aberdeen Global Select Opportunities Fund, class I shares; a true no-load fund (no front-end, back end, or 12b-1 fees) Aberdeen Funds GlbEqA t GlbEql GblHilncl r BIGOX 3913 -036 JGEIX 3947 -0.36 HYIX 973-004 JETIX 11.75 -0.15 -2.6 1.2 6.2 9.9 6.1 -Aberdeen InternationalEquityFund", class I shares; a fund with a redemption fee (r) American Century A CorePls p DiscGro EmgMktA t LtTf SmCa pGrowthA StrConvA p ValueA p 3.3 16.5 5.0 4.8 14.1 7.3 175 5.0 ACCOX 10.90 ADCVX 785-007 AEMMX 8.34-008 -1.6 MMBAX 11.72 0.038.7 ANOAX 11.32 140 ACCAX 5.92-001 TWADX 8.39 -09 3. -8.9 1.3 r-Redemption charge may apply p Distribution costs apply, 12b-1 t-Footnotes r and p apply Source: The Wal Steerouna http://online s com mdc/public/page/2 3048 nds Hsm ds.html?mod moc h lik ogge074428220292 9561, accessed January 5, 2014

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts