Question: Using the options table below, answer questions 2a. and 2b. 2a. Calculate payoff, profit/loss, breakeven stock price, and HPR%, if applicable. 2b. Calculate payoff and

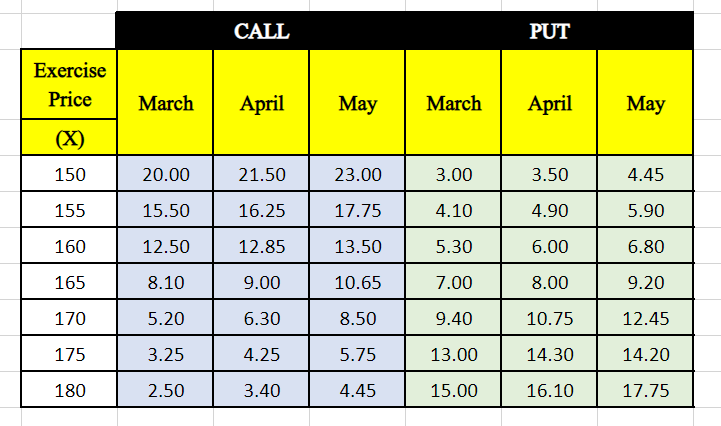

Using the options table below, answer questions 2a. and 2b.

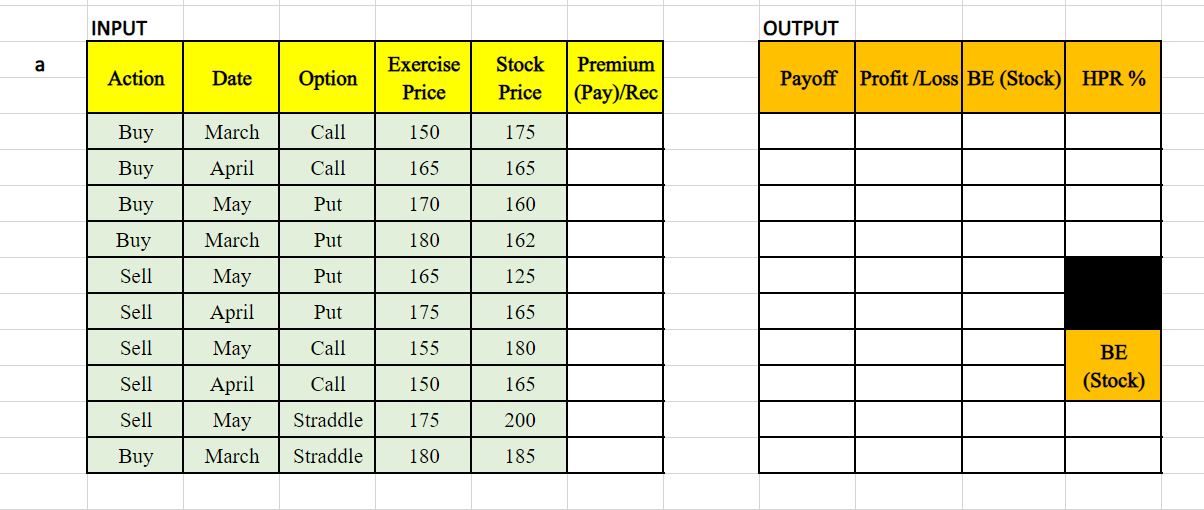

2a. Calculate payoff, profit/loss, breakeven stock price, and HPR%, if applicable.

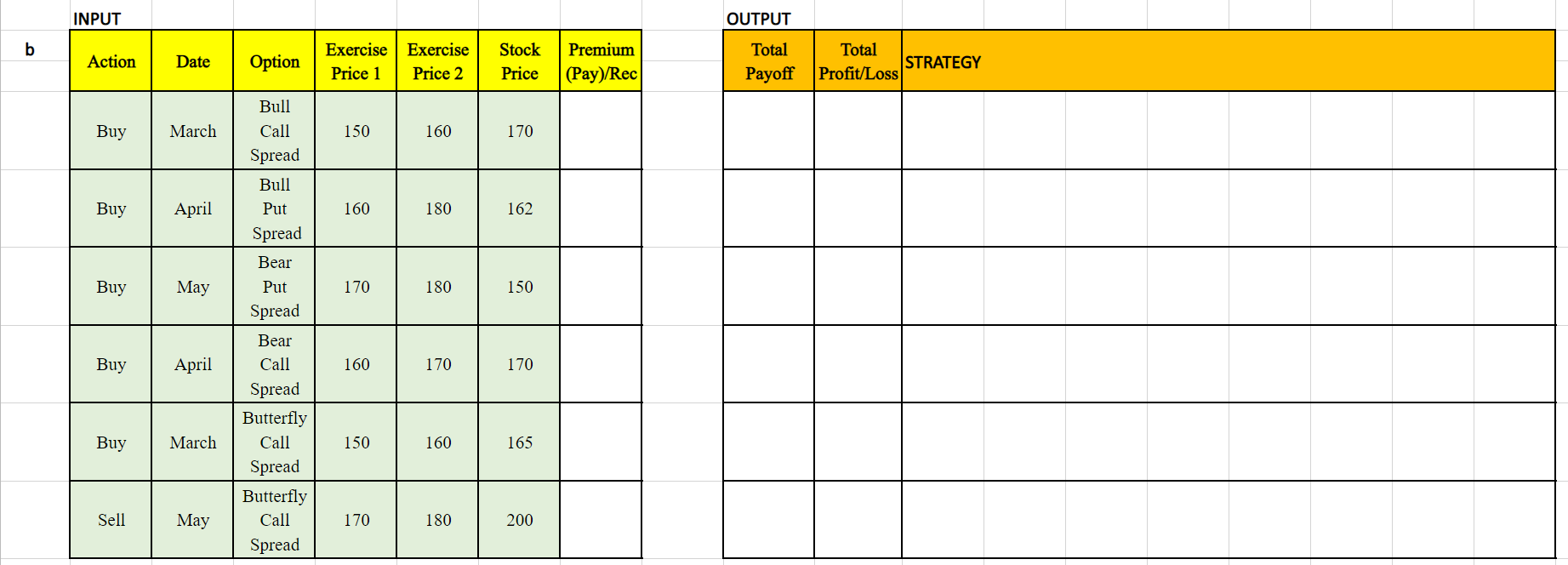

2b. Calculate payoff and profit/loss for the spread option strategies below.

2b. Calculate payoff and profit/loss for the spread option strategies below.

Can you show the formulas, thanks

Can you show the formulas, thanks

CALL PUT Exercise Price March April May March April May (X) 150 20.00 21.50 23.00 3.00 3.50 4.45 155 15.50 16.25 17.75 4.10 4.90 5.90 160 12.50 12.85 13.50 5.30 6.00 6.80 165 8.10 9.00 10.65 7.00 8.00 9.20 170 5.20 6.30 8.50 9.40 10.75 12.45 175 3.25 4.25 5.75 13.00 14.30 14.20 180 2.50 3.40 4.45 15.00 16.10 17.75 INPUT OUTPUT a Action Date Option Exercise Price Stock Price Premium (Pay) Rec Payoff Profit/Loss BE (Stock)| HPR % Buy March Call 150 175 Buy Call 165 165 Buy Put 170 160 Buy April May March May April Put 180 162 Sell Put 165 125 Sell Put 175 165 Sell May Call 155 180 BE (Stock) Sell Call 150 165 April May Sell Straddle 175 200 Buy March Straddle 180 185 INPUT OUTPUT b Action Date Option Exercise | Exercise Price 1 Price 2 Stock Price Premium (Pay)/Rec Total Total STRATEGY Payoff Profit/Loss Buy March Bull Call Spread 150 160 170 Bull Put Buy April 160 180 162 Buy May 170 180 150 Buy April 160 170 170 Spread Bear Put Spread Bear Call Spread Butterfly Call Spread Butterfly Call Spread Buy March 150 160 165 Sell May 170 180 200 CALL PUT Exercise Price March April May March April May (X) 150 20.00 21.50 23.00 3.00 3.50 4.45 155 15.50 16.25 17.75 4.10 4.90 5.90 160 12.50 12.85 13.50 5.30 6.00 6.80 165 8.10 9.00 10.65 7.00 8.00 9.20 170 5.20 6.30 8.50 9.40 10.75 12.45 175 3.25 4.25 5.75 13.00 14.30 14.20 180 2.50 3.40 4.45 15.00 16.10 17.75 INPUT OUTPUT a Action Date Option Exercise Price Stock Price Premium (Pay) Rec Payoff Profit/Loss BE (Stock)| HPR % Buy March Call 150 175 Buy Call 165 165 Buy Put 170 160 Buy April May March May April Put 180 162 Sell Put 165 125 Sell Put 175 165 Sell May Call 155 180 BE (Stock) Sell Call 150 165 April May Sell Straddle 175 200 Buy March Straddle 180 185 INPUT OUTPUT b Action Date Option Exercise | Exercise Price 1 Price 2 Stock Price Premium (Pay)/Rec Total Total STRATEGY Payoff Profit/Loss Buy March Bull Call Spread 150 160 170 Bull Put Buy April 160 180 162 Buy May 170 180 150 Buy April 160 170 170 Spread Bear Put Spread Bear Call Spread Butterfly Call Spread Butterfly Call Spread Buy March 150 160 165 Sell May 170 180 200

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts