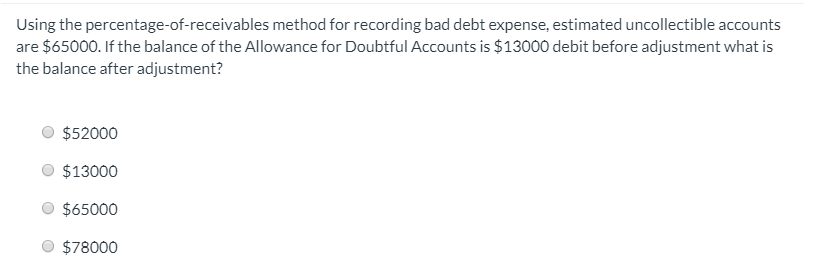

Question: Using the percentage-of-receivables method for recording bad debt expense, estimated uncollectible accounts are $65000. If the balance of the Allowance for Doubtful Accounts is $13000

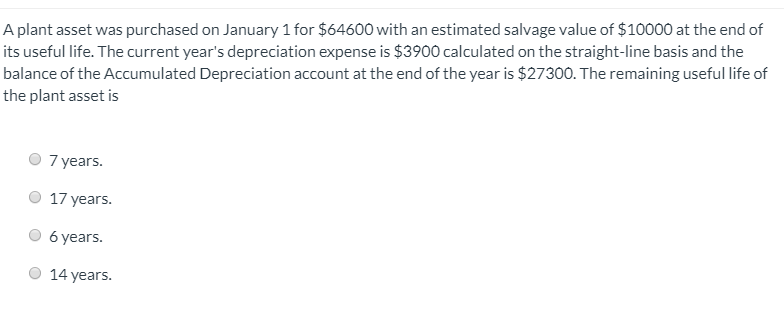

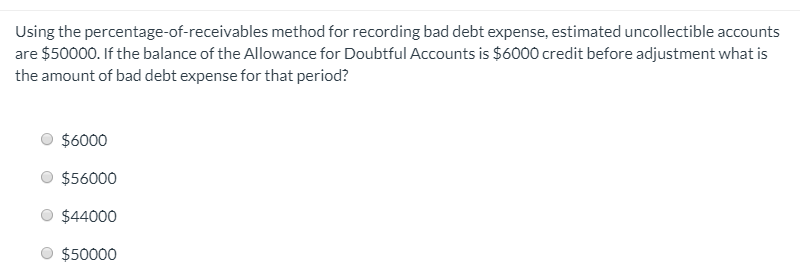

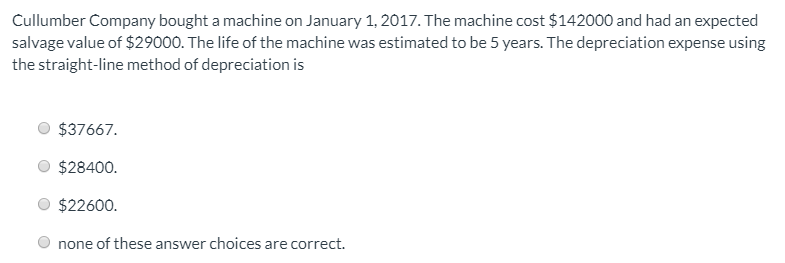

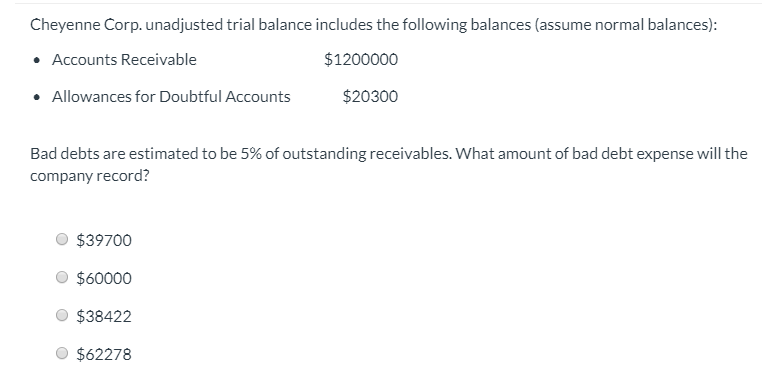

Using the percentage-of-receivables method for recording bad debt expense, estimated uncollectible accounts are $65000. If the balance of the Allowance for Doubtful Accounts is $13000 debit before adjustment what is the balance after adjustment? $52000 $13000 $65000 $78000 A plant asset was purchased on January 1 for $64600 with an estimated salvage value of $10000 at the end of its useful life. The current year's depreciation expense is $3900 calculated on the straight-line basis and the balance of the Accumulated Depreciation account at the end of the year is $27300. The remaining useful life of the plant asset is 7 years. 17 years. 6 years. O 14 years. Using the percentage-of-receivables method for recording bad debt expense, estimated uncollectible accounts are $50000. If the balance of the Allowance for Doubtful Accounts is $6000 credit before adjustment what is the amount of bad debt expense for that period? $6000 $56000 $44000 $50000 Cullumber Company bought a machine on January 1, 2017. The machine cost $142000 and had an expected salvage value of $29000. The life of the machine was estimated to be 5 years. The depreciation expense using the straight-line method of depreciation is $37667. $28400. $22600. none of these answer choices are correct. Cheyenne Corp. unadjusted trial balance includes the following balances (assume normal balances): Accounts Receivable $1200000 Allowances for Doubtful Accounts $20300 Bad debts are estimated to be 5% of outstanding receivables. What amount of bad debt expense will the company record? $39700 $60000 $38422 $62278

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts