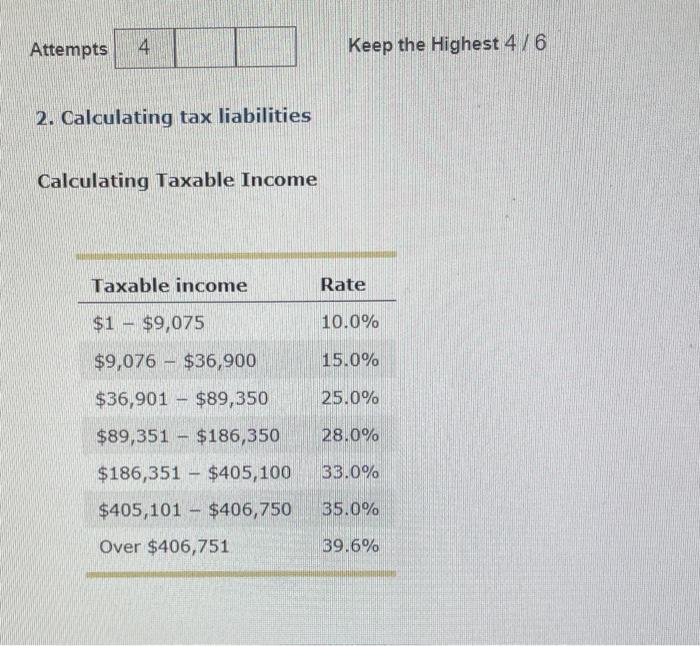

Question: Using the previous tax table, compute the tax liability for each individual in the scenarios presented, rounding the ability to the nearest dollar. In addition,

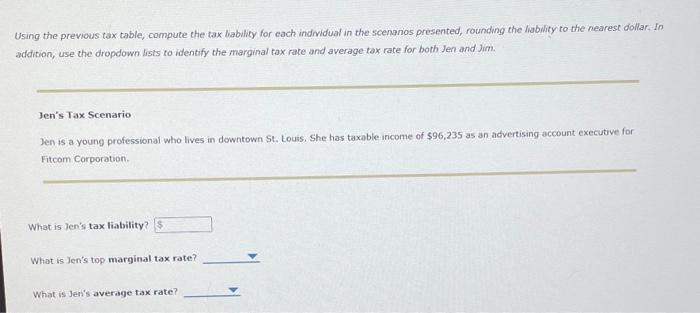

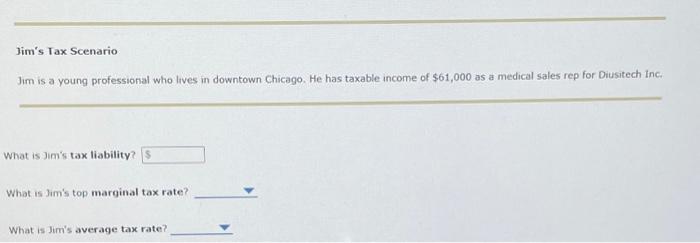

Using the previous tax table, compute the tax liability for each individual in the scenarios presented, rounding the ability to the nearest dollar. In addition, use the dropdown lists to identify the marginal tox rate and average tax rate for both Jen and Jim Jen's Tax Scenario Jen is a young professional who lives in downtown St. Louis. She has taxable income of $96,235 as an advertising account executive for Fitcom Corporation What is Jen's tax liability What is Jen's top marginal tax rate? What is Jen's average tax rate

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts