Question: could someone can solve the Q2/c for me (by excel) Imagine that the option described in Question 2 was a European option, and that the

could someone can solve the Q2/c for me (by excel)

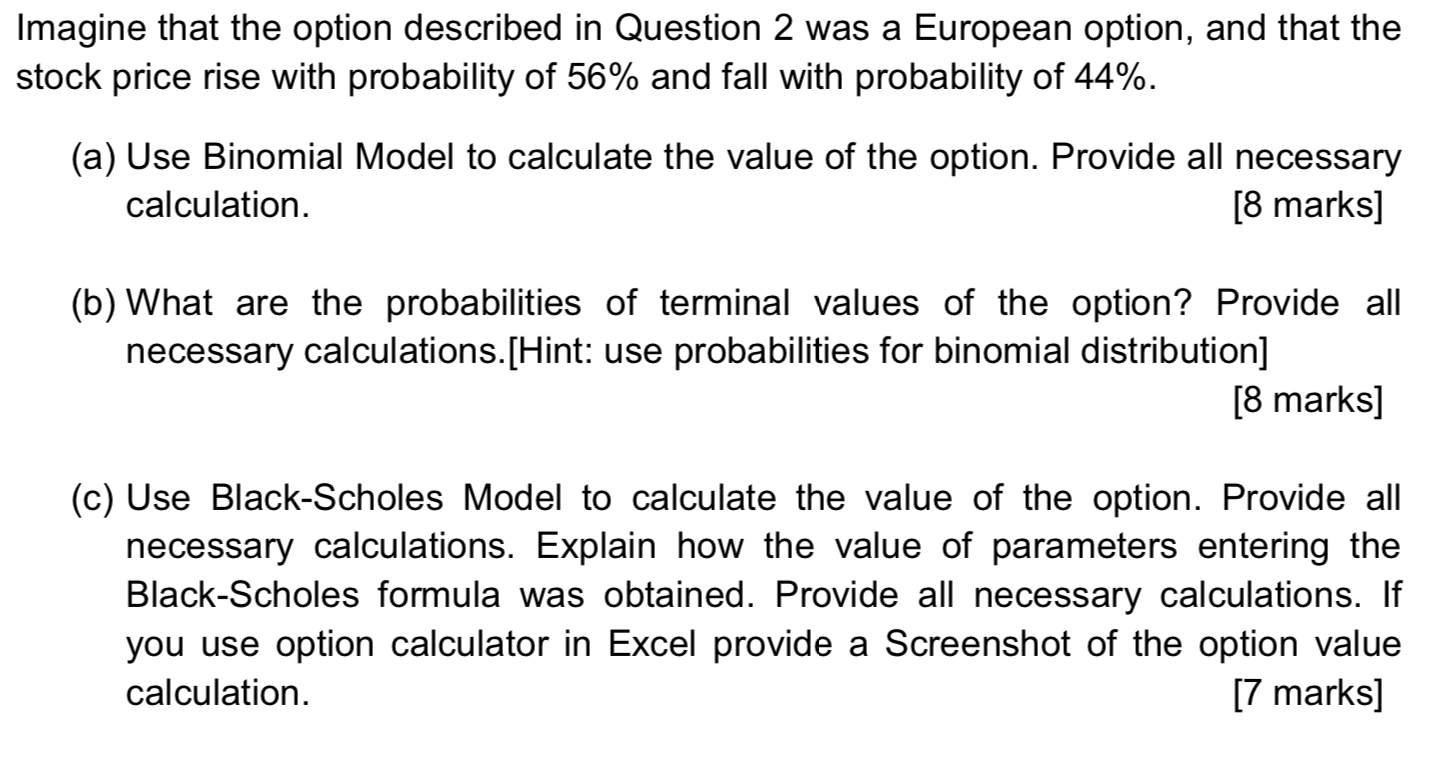

Imagine that the option described in Question 2 was a European option, and that the stock price rise with probability of 56% and fall with probability of 44%. (a) Use Binomial Model to calculate the value of the option. Provide all necessary calculation. [8 marks] (b) What are the probabilities of terminal values of the option? Provide all necessary calculations. [Hint: use probabilities for binomial distribution] [8 marks] (c) Use Black-Scholes Model to calculate the value of the option. Provide all necessary calculations. Explain how the value of parameters entering the Black-Scholes formula was obtained. Provide all necessary calculations. If you use option calculator in Excel provide a Screenshot of the option value calculation. [7 marks] Imagine that the option described in Question 2 was a European option, and that the stock price rise with probability of 56% and fall with probability of 44%. (a) Use Binomial Model to calculate the value of the option. Provide all necessary calculation. [8 marks] (b) What are the probabilities of terminal values of the option? Provide all necessary calculations. [Hint: use probabilities for binomial distribution] [8 marks] (c) Use Black-Scholes Model to calculate the value of the option. Provide all necessary calculations. Explain how the value of parameters entering the Black-Scholes formula was obtained. Provide all necessary calculations. If you use option calculator in Excel provide a Screenshot of the option value calculation. [7 marks]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts