Question: Using the Profit Equation - Exercise 2 Your Company won $35,400,000 in different contracts for this year. The cumulative at time-of-bid Gross Margin was 12.8%

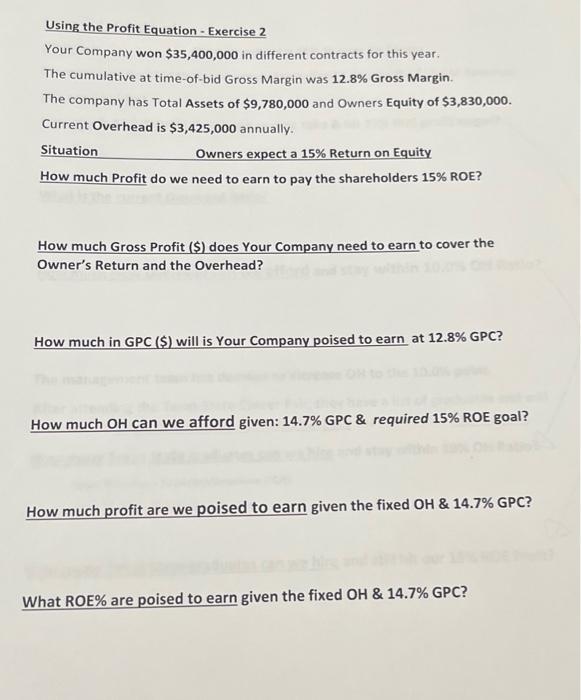

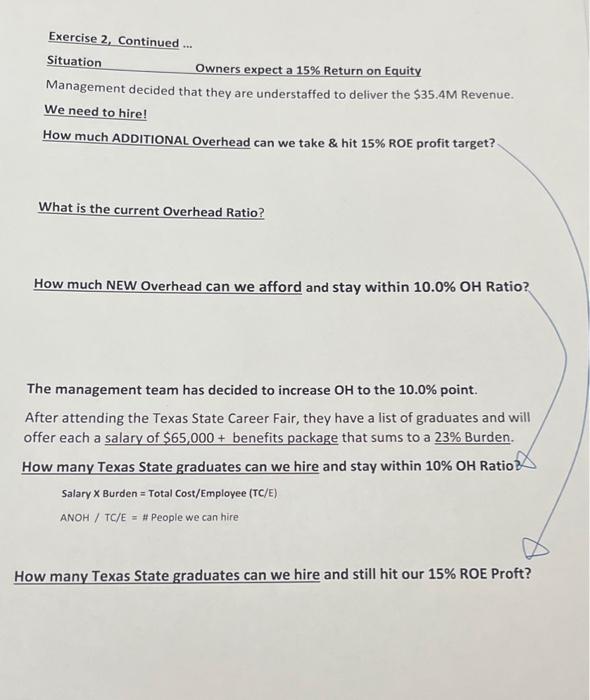

Using the Profit Equation - Exercise 2 Your Company won $35,400,000 in different contracts for this year. The cumulative at time-of-bid Gross Margin was 12.8% Gross Margin. The company has Total Assets of $9,780,000 and Owners Equity of $3,830,000. Current Overhead is $3,425,000 annually. Situation Owners expect a 15% Return on Equity How much Profit do we need to earn to pay the shareholders 15% ROE? How much Gross Profit (\$) does Your Company need to earn to cover the Owner's Return and the Overhead? How much in GPC (\$) will is Your Company poised to earn at 12.8% GPC? How much OH can we afford given: 14.7% GPC \& required 15% ROE goal? How much profit are we poised to earn given the fixed OH&14.7% GPC? What ROE % are poised to earn given the fixed OH&14.7%GPC ? Exercise 2, Continued... Situation Owners expect a 15% Return on Equity Management decided that they are understaffed to deliver the $35.4M Revenue. We need to hire! How much ADDITIONAL Overhead can we take \& hit 15\% ROE profit target? What is the current Overhead Ratio? How much NEW Overhead can we afford and stay within 10.0%OH Ratio? The management team has decided to increase OH to the 10.0% point. After attending the Texas State Career Fair, they have a list of graduates and will offer each a salary of $65,000 + benefits package that sums to a 23% Burden. How many Texas State graduates can we hire and stay within 10%OH Ratio? Salary Burden = Total Cost / Employee (TC/E) ANOH /TC/E= \# People we can hire How many Texas State graduates can we hire and still hit our 15% ROE Proft

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts