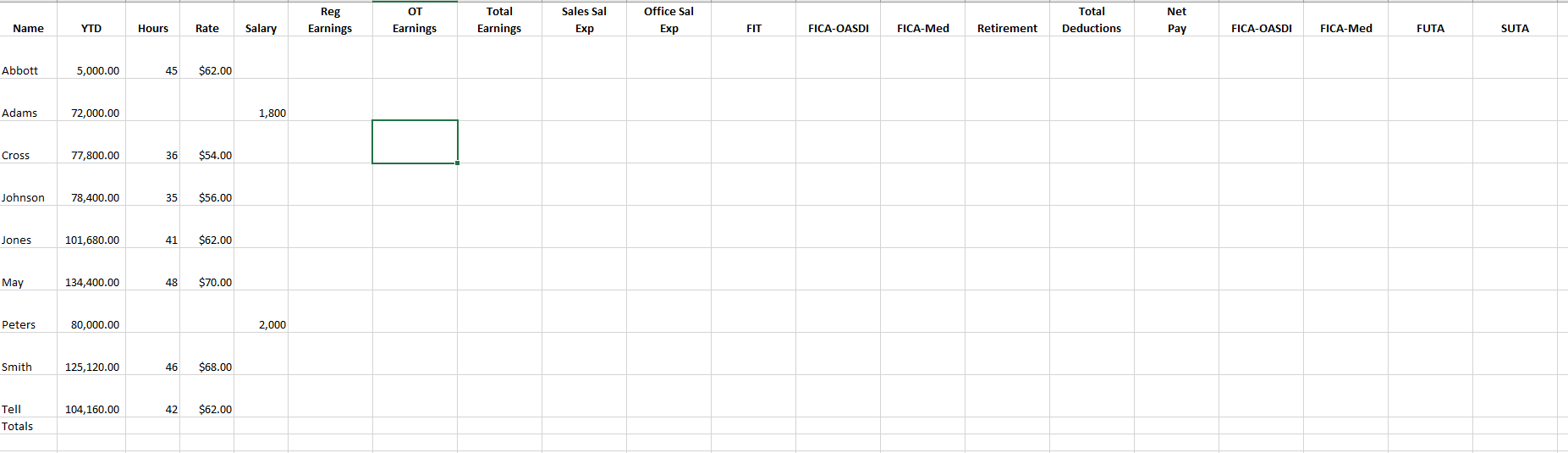

Question: Using the provided template complete the Payroll Register for the week of Oct 4-17 for Bonneau Enterprises. All employees are paid on a biweekly basis

Using the provided template complete the Payroll Register for the week of Oct 4-17 for Bonneau Enterprises.

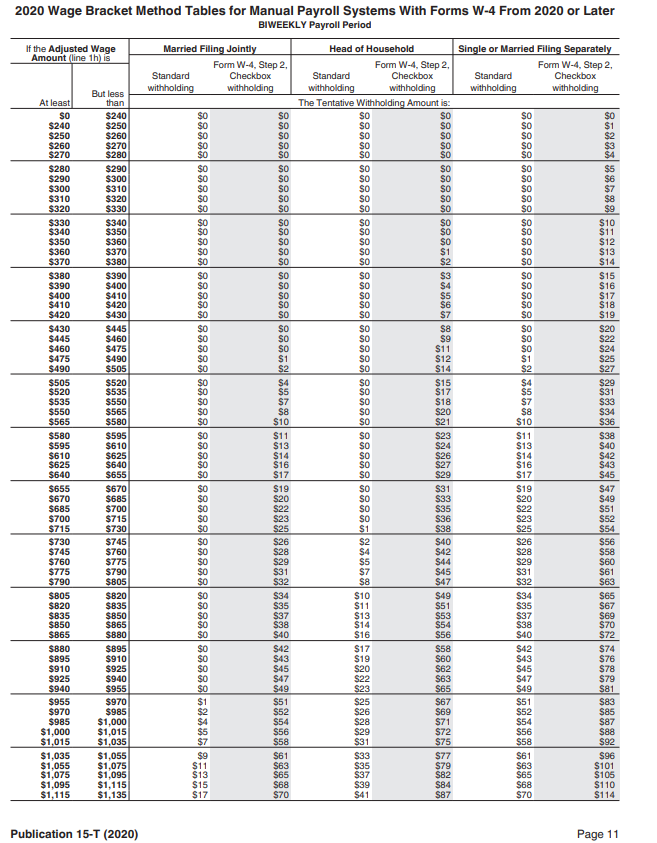

All employees are paid on a biweekly basis and according to their W-4 are all married and do not request any additional withholding (Use the tables that start on page 11 of the Pub 15-T that is posted under the Chapter 12 Module). Each employee has requested that 5% of their pay is withheld for the retirement plan.

The employees with an hourly rate are the Sales reps and those earning a salary are the Office staff.

The merit rating for SUTA is 4.8%.

Prepare the necessary journal entries.

(YOU CAN ALSO RIGHT CLICK ON THE IMAGE AND OPEN IT IN A NEW TAB FOR MORE CLEAR VIEW. THIS IS THE BEST I I CAN DO)

8.983338689 $330 $360 $520 2020 Wage Bracket Method Tables for Manual Payroll Systems With Forms W-4 From 2020 or Later BIWEEKLY Payroll Period If the Adjusted Wage Married Filing Jointly Head of Household Amount (line 1h) is Single or Married Filing Separately Form W-4, Step 2 Form W-4, Step 2 Form W-4, Step 2 Standard Checkbox Standard Checkbox Standard Checkbox withholding But less withholding withholding withholding withholding withholding At least than The Tentative Withholding Amount is: SO $240 SO SO SO SO $240 $250 SO SO SO SO $250 $260 SO SO SO $260 $270 SO SO SO $270 $280 SO SO SO SO $280 $290 SO SO SO $290 $300 SO SO SO $300 $310 SO SO SO $310 $320 SO SO SO $320 SO SO SO $330 $340 SO SO SO $10 $340 $350 SO SO SO S11 $350 SO SO SO $360 $370 $12 SO S1 $13 $370 $380 SO S2 $14 $380 $390 SO $3 SO S15 $390 $400 SO $4 SO $400 $410 $16 SO $5 SO S17 $410 $420 SO SO $6 SO S18 $420 $430 SO SO $7 so $19 $430 $445 SO SO $8 SO S20 $445 $460 SO $9 SO $22 $460 $475 SO $11 SO S24 $475 $490 $1 $12 $25 $490 $505 $2 $14 S2 S27 $505 $4 $15 $29 $520 $535 S5 SO $17 $31 $535 $7 SO $18 $33 $550 $565 $8 S20 S8 $34 $565 $580 $10 $21 $10 $36 $580 $595 S11 SO S23 $11 $38 $595 $610 $13 SO S24 $13 $40 $610 $625 $14 S26 $14 $42 $625 $640 $16 $27 $43 $640 $655 $17 SO $29 $17 $45 $655 $670 $31 $19 $47 $670 $685 S20 $33 S20 $49 $685 $700 $35 $22 $700 $51 $715 S23 SO $36 S23 $52 $715 $730 $25 $38 $25 S54 $730 $745 S26 $40 S26 $56 $745 $760 $28 S28 $760 $775 $58 S29 $44 S29 $60 $775 $790 $31 $45 $31 $790 $805 $32 S8 $47 $32 $63 $805 $820 $34 $10 $49 $34 $65 $820 $835 $35 $11 $51 $35 $67 $835 $850 $37 $13 $53 $37 $69 $850 $865 $54 $38 $70 $865 $880 $40 $16 $56 $40 $72 $880 $895 $42 S17 $58 $42 $74 $895 $910 $43 $19 $60 $43 $76 $910 $925 $45 S20 $62 $45 $78 $925 $940 $47 $22 $63 $79 $940 $955 $49 S23 $65 $49 $81 $955 $970 $51 $25 $67 $51 $83 $970 $985 $52 S26 $69 $52 S8S $985 $1,000 S28 $71 $1,000 S87 $1.015 $56 S29 $72 $56 S88 $1,015 $1,035 $58 $31 $75 $58 $1,035 $1,055 $9 $61 $33 $77 $61 S96 $1,055 $1,075 $11 $63 $35 $79 $63 $1,075 $1,095 $101 $13 $65 $37 $82 $105 $1,095 $1,115 S15 $68 $39 $84 $68 $110 $1,115 $1,135 $17 $70 $41 $87 $114 $550 =816*188888888888888888888888888888888888888888888888888888888 $16 $19 $22 $42 $61 $38 $14 $47 $54 $54 $92 $65 $70 Publication 15-T (2020) Page 11 OT Reg Earnings Total Earnings Sales Sal Exp Office Sal Exp Total Deductions Net Pay Name YTD Hours Rate Salary Earnings FIT FICA-OASDI FICA-Med Retirement FICA-OASDI FICA-Med FUTA SUTA Abbott 5,000.00 45 $62.00 Adams 72,000.00 1,800 Cross 77,800.00 36 $54.00 Johnson 78,400.00 35 $56.00 Jones 101,680.00 41 $62.00 May 134,400.00 48 $70.00 Peters 80,000.00 2,000 Smith 125,120.00 46 $68.00 104,160.00 42 $62.00 Tell Totals 8.983338689 $330 $360 $520 2020 Wage Bracket Method Tables for Manual Payroll Systems With Forms W-4 From 2020 or Later BIWEEKLY Payroll Period If the Adjusted Wage Married Filing Jointly Head of Household Amount (line 1h) is Single or Married Filing Separately Form W-4, Step 2 Form W-4, Step 2 Form W-4, Step 2 Standard Checkbox Standard Checkbox Standard Checkbox withholding But less withholding withholding withholding withholding withholding At least than The Tentative Withholding Amount is: SO $240 SO SO SO SO $240 $250 SO SO SO SO $250 $260 SO SO SO $260 $270 SO SO SO $270 $280 SO SO SO SO $280 $290 SO SO SO $290 $300 SO SO SO $300 $310 SO SO SO $310 $320 SO SO SO $320 SO SO SO $330 $340 SO SO SO $10 $340 $350 SO SO SO S11 $350 SO SO SO $360 $370 $12 SO S1 $13 $370 $380 SO S2 $14 $380 $390 SO $3 SO S15 $390 $400 SO $4 SO $400 $410 $16 SO $5 SO S17 $410 $420 SO SO $6 SO S18 $420 $430 SO SO $7 so $19 $430 $445 SO SO $8 SO S20 $445 $460 SO $9 SO $22 $460 $475 SO $11 SO S24 $475 $490 $1 $12 $25 $490 $505 $2 $14 S2 S27 $505 $4 $15 $29 $520 $535 S5 SO $17 $31 $535 $7 SO $18 $33 $550 $565 $8 S20 S8 $34 $565 $580 $10 $21 $10 $36 $580 $595 S11 SO S23 $11 $38 $595 $610 $13 SO S24 $13 $40 $610 $625 $14 S26 $14 $42 $625 $640 $16 $27 $43 $640 $655 $17 SO $29 $17 $45 $655 $670 $31 $19 $47 $670 $685 S20 $33 S20 $49 $685 $700 $35 $22 $700 $51 $715 S23 SO $36 S23 $52 $715 $730 $25 $38 $25 S54 $730 $745 S26 $40 S26 $56 $745 $760 $28 S28 $760 $775 $58 S29 $44 S29 $60 $775 $790 $31 $45 $31 $790 $805 $32 S8 $47 $32 $63 $805 $820 $34 $10 $49 $34 $65 $820 $835 $35 $11 $51 $35 $67 $835 $850 $37 $13 $53 $37 $69 $850 $865 $54 $38 $70 $865 $880 $40 $16 $56 $40 $72 $880 $895 $42 S17 $58 $42 $74 $895 $910 $43 $19 $60 $43 $76 $910 $925 $45 S20 $62 $45 $78 $925 $940 $47 $22 $63 $79 $940 $955 $49 S23 $65 $49 $81 $955 $970 $51 $25 $67 $51 $83 $970 $985 $52 S26 $69 $52 S8S $985 $1,000 S28 $71 $1,000 S87 $1.015 $56 S29 $72 $56 S88 $1,015 $1,035 $58 $31 $75 $58 $1,035 $1,055 $9 $61 $33 $77 $61 S96 $1,055 $1,075 $11 $63 $35 $79 $63 $1,075 $1,095 $101 $13 $65 $37 $82 $105 $1,095 $1,115 S15 $68 $39 $84 $68 $110 $1,115 $1,135 $17 $70 $41 $87 $114 $550 =816*188888888888888888888888888888888888888888888888888888888 $16 $19 $22 $42 $61 $38 $14 $47 $54 $54 $92 $65 $70 Publication 15-T (2020) Page 11 OT Reg Earnings Total Earnings Sales Sal Exp Office Sal Exp Total Deductions Net Pay Name YTD Hours Rate Salary Earnings FIT FICA-OASDI FICA-Med Retirement FICA-OASDI FICA-Med FUTA SUTA Abbott 5,000.00 45 $62.00 Adams 72,000.00 1,800 Cross 77,800.00 36 $54.00 Johnson 78,400.00 35 $56.00 Jones 101,680.00 41 $62.00 May 134,400.00 48 $70.00 Peters 80,000.00 2,000 Smith 125,120.00 46 $68.00 104,160.00 42 $62.00 Tell Totals

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts