Question: **Using the restated numbers, recompute ROA and ROE for both years(2018 & 2019) Compute and Interpret Ratios Selected balance sheet and income statement information from

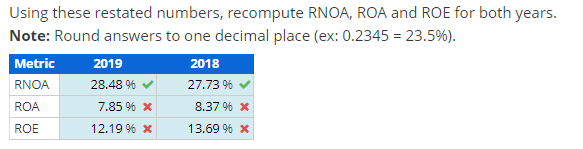

**Using the restated numbers, recompute ROA and ROE for both years(2018 & 2019)

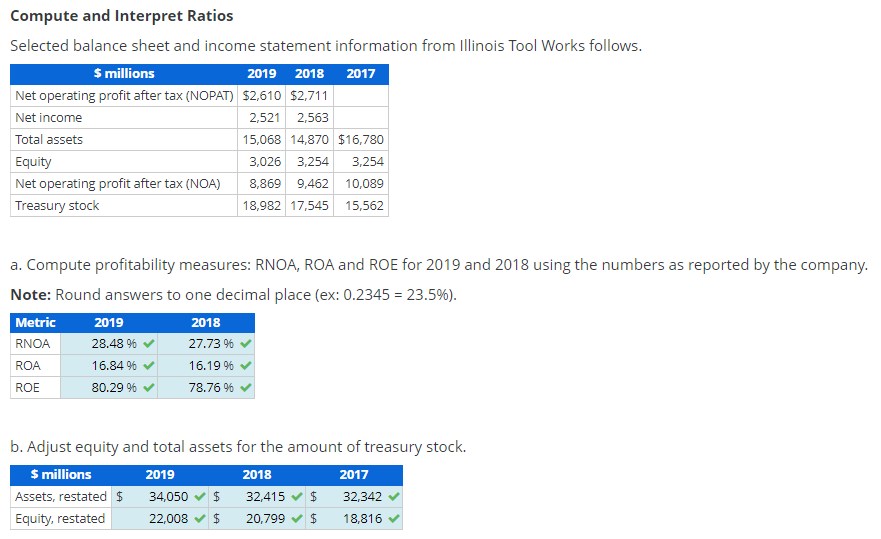

Compute and Interpret Ratios Selected balance sheet and income statement information from Illinois Tool Works follows. $ millions 2019 2018 2017 Net operating profit after tax (NOPAT) $2,610 $2,711 Net income 2,521 2,563 Total assets 15,068 14,870 $16,780 Equity 3,026 3,254 3,254 8,869 9,462 10,089 Net operating profit after tax (NOA) Treasury stock 18,982 17,545 15,562 a. Compute profitability measures: RNOA, ROA and ROE for 2019 and 2018 using the numbers as reported by the company. Note: Round answers to one decimal place (ex: 0.2345 = 23.5%). Metric 2019 2018 RNOA 28.48 % 27.73 % ROA 16.84% 16.19% ROE 80.29% 78.76% b. Adjust equity and total assets for the amount of treasury stock. $ millions 2019 2018 2017 Assets, restated $ 34,050 32,415 $ 32,342 Equity, restated 22,008 $ 20,799 $ 18,816 Using these restated numbers, recompute RNOA, ROA and ROE for both years. Note: Round answers to one decimal place (ex: 0.2345 = 23.5%). Metric 2019 2018 RNOA 28.48 % 27.73 % ROA ROE 7.85 % * 12.19 % * 8.37% * 13.69 % *

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts