Question: Using the sales forecasts for Tysabri presented in Exhibit A, and using the discounted cash flow model presented in Exhibit B, what do you think

Using the sales forecasts for Tysabri presented in Exhibit A, and using the discounted cash flow model presented in Exhibit B, what do you think Elan is worth?

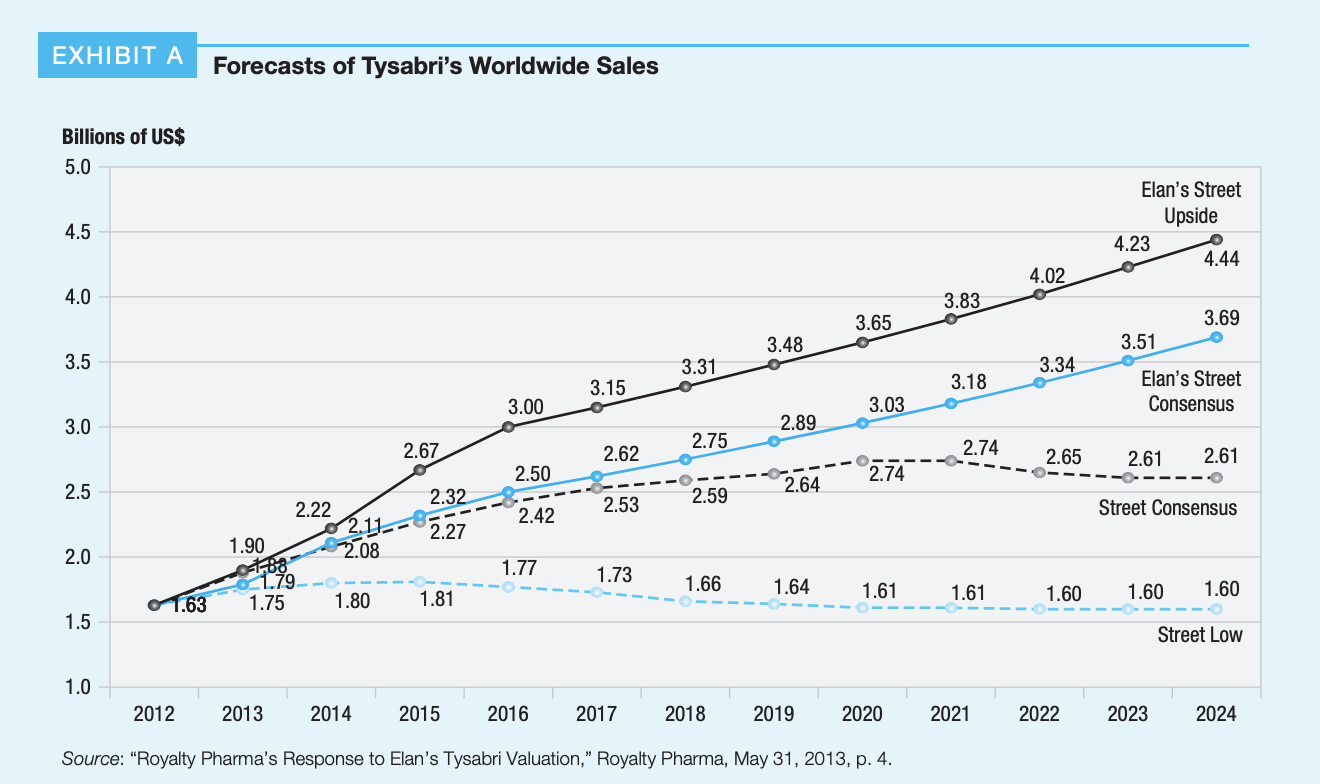

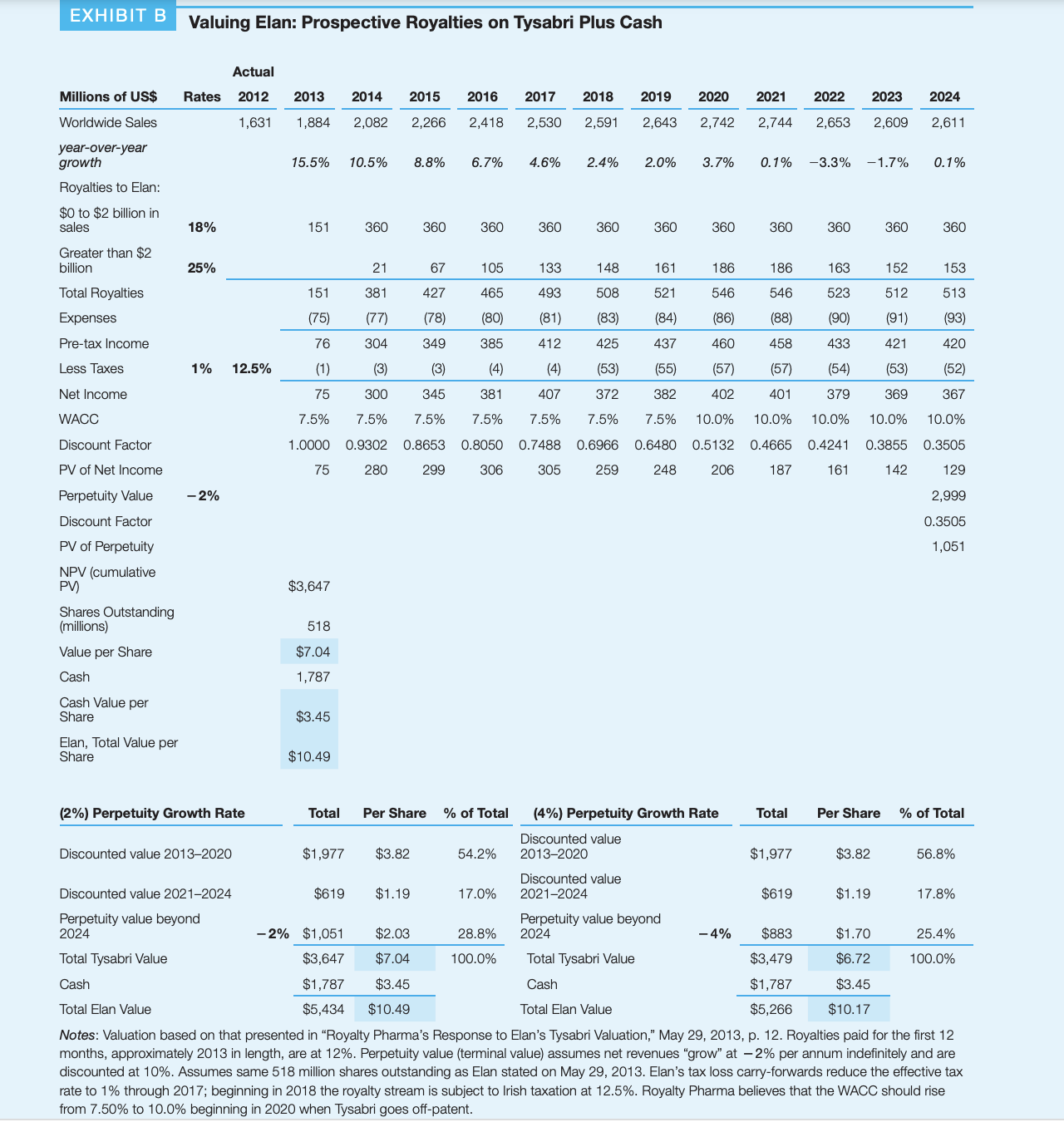

Forecasts of Tysabri's Worldwide Sales EXHIBIT B Valuing Elan: Prospective Royalties on Tysabri Plus Cash Actual NPV (cumulative PV) $3,647 Shares Outstanding (millions) Value per Share 518 Cash Cash Value per Share $3.45 Elan, Total Value per Share $10.49 Notes: Valuation based on that presented in "Royalty Pharma's Response to Elan's Tysabri Valuation," May 29, 2013, p. 12. Royalties paid for the first 12 months, approximately 2013 in length, are at 12%. Perpetuity value (terminal value) assumes net revenues "grow" at 2% per annum indefinitely and are discounted at 10\%. Assumes same 518 million shares outstanding as Elan stated on May 29, 2013. Elan's tax loss carry-forwards reduce the effective tax rate to 1% through 2017 ; beginning in 2018 the royalty stream is subject to Irish taxation at 12.5%. Royalty Pharma believes that the WACC should rise from 7.50% to 10.0% beginning in 2020 when Tysabri goes off-patent

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts