Question: Using the same Solver techniques, what would be the weight for WFC in the optimal risky portfolio on the efficient frontier consisting of WFC

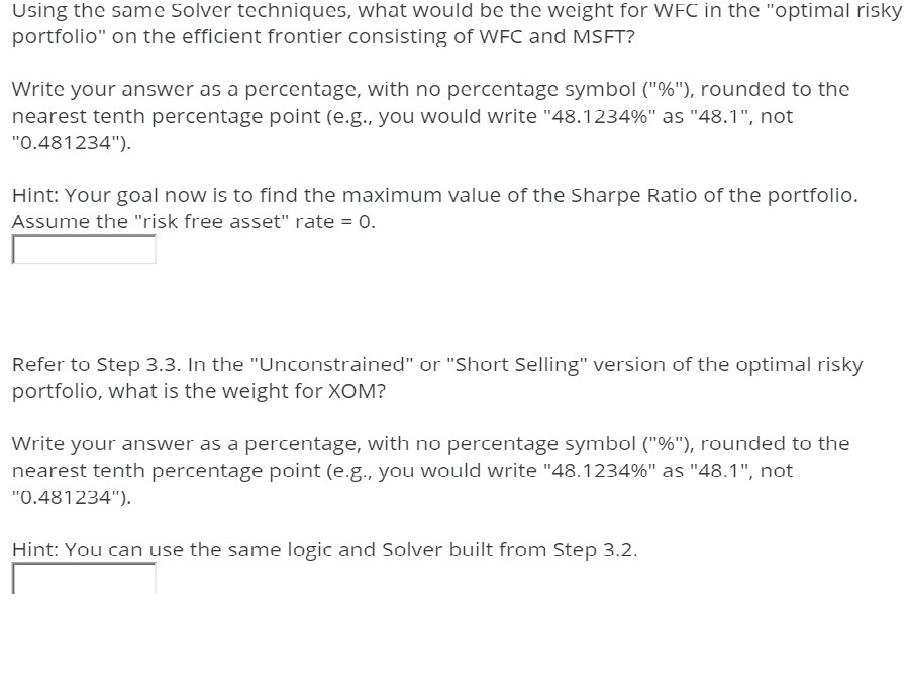

Using the same Solver techniques, what would be the weight for WFC in the "optimal risky portfolio" on the efficient frontier consisting of WFC and MSFT? Write your answer as a percentage, with no percentage symbol ("%"), rounded to the nearest tenth percentage point (e.g., you would write "48.1234%" as "48.1", not "0.481234"). Hint: Your goal now is to find the maximum value of the Sharpe Ratio of the portfolio. Assume the "risk free asset" rate = 0. Refer to Step 3.3. In the "Unconstrained" or "Short Selling" version of the optimal risky portfolio, what is the weight for XOM? Write your answer as a percentage, with no percentage symbol ("%"), rounded to the nearest tenth percentage point (e.g., you would write "48.1234%" as "48.1", not "0.481234"). Hint: You can use the same logic and Solver built from Step 3.2.

Step by Step Solution

There are 3 Steps involved in it

Req A1 Compute the weight for WFC in the optimal risky portfolio on the efficient frontier c... View full answer

Get step-by-step solutions from verified subject matter experts