Question: Using the scenarios in case Exhibit 9, what role does leverage play in affecting the return on equity (ROE) for CPK? What about the cost

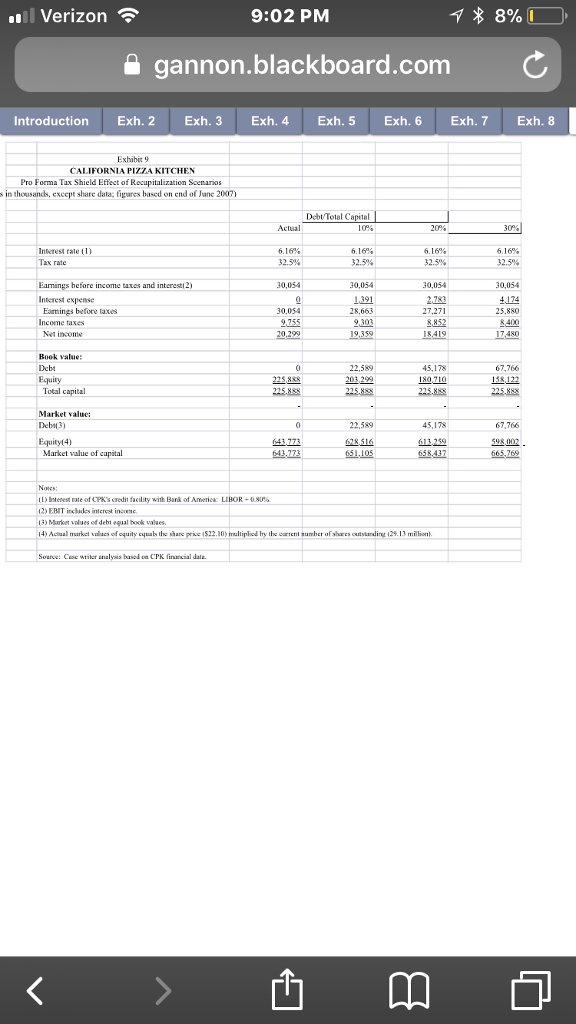

Using the scenarios in case Exhibit 9, what role does leverage play in affecting the return on equity (ROE) for CPK? What about the cost of capital? In assessing the effect of leverage on the cost of capital, you may assume that a firms CAPM beta can be modeled in the following manner: ?L = ?U[1 + (1 ? T)D/E], where ?U is the firms beta without leverage, T is the corporate income tax rate, D is the market value of debt, and E is the market value of equity.

I cannot figure this out. Thank you.

l Verizon 9:02 PM a gannon.blackboard.comC Introduction Exh. 2 Exh. 3Exh. 4 Exh. 5 Exh. 6 Exh.7 Exh. 8 Exhibit 9 CALIFORNIA PIZZA KITCHEN Pro Forma Tax Shield Effect of Recupitalization Scenarios sin thousands, except share data: figaes based on end of Janc 2007) Debt Total Ca Actual 200% Interest rate (1) Tax rate 6.16% 32.5% 6.160% 32.5% 6.16% 32.5% 6.16% 32.5% Earnings before income taxes and interest2) Interest expense 0,054 0,054 30,054 30,054 2783 27.271 28,663 9,303 Earnings before taxes 30,054 25,880 Income taxes 9.755 Net incoe 7.480 Book value: Debt 22,589 45,178 67,766 Total capital Market value: Debw3) Equityt4) 22,589 45,178 67,766 Market value of capatal > Interest rate of CFK's credit facility with Bank of Americ? 2) EBIT inclades intert incomc LIBOR-(..80%. Market values of debt equal book vaes 4) Acoual markct valucs ofequity equsls the share price 1522.10) multiplied by the crrent sumber of shares outstardin 12.13 million Soarve: Coe wier enalyous based va CPK finncial date l Verizon 9:02 PM a gannon.blackboard.comC Introduction Exh. 2 Exh. 3Exh. 4 Exh. 5 Exh. 6 Exh.7 Exh. 8 Exhibit 9 CALIFORNIA PIZZA KITCHEN Pro Forma Tax Shield Effect of Recupitalization Scenarios sin thousands, except share data: figaes based on end of Janc 2007) Debt Total Ca Actual 200% Interest rate (1) Tax rate 6.16% 32.5% 6.160% 32.5% 6.16% 32.5% 6.16% 32.5% Earnings before income taxes and interest2) Interest expense 0,054 0,054 30,054 30,054 2783 27.271 28,663 9,303 Earnings before taxes 30,054 25,880 Income taxes 9.755 Net incoe 7.480 Book value: Debt 22,589 45,178 67,766 Total capital Market value: Debw3) Equityt4) 22,589 45,178 67,766 Market value of capatal > Interest rate of CFK's credit facility with Bank of Americ? 2) EBIT inclades intert incomc LIBOR-(..80%. Market values of debt equal book vaes 4) Acoual markct valucs ofequity equsls the share price 1522.10) multiplied by the crrent sumber of shares outstardin 12.13 million Soarve: Coe wier enalyous based va CPK finncial date

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts