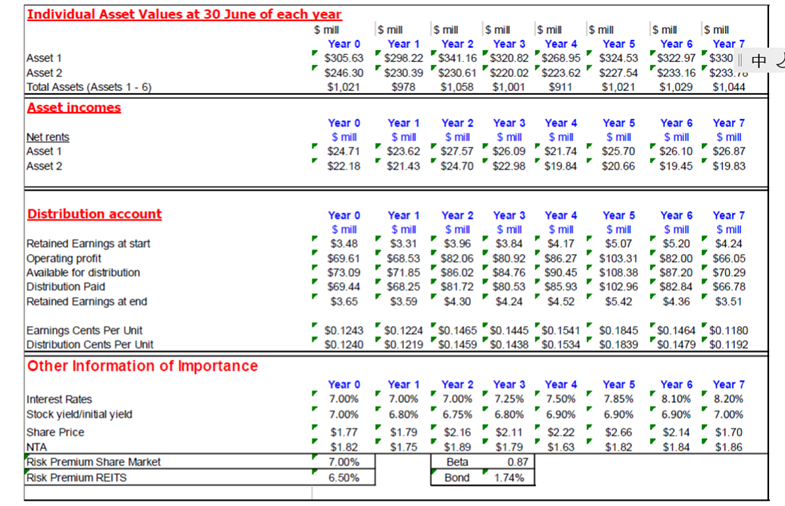

Question: Using the share/unit price data shown, what is the NPV for the purchase of 10,000 units in this REIT? Buy the units on 1 July

Using the share/unit price data shown, what is the NPV for the purchase of 10,000 units in this REIT? Buy the units on 1 July Year 0 and sell them on 30 June Year 5

$ mill Year 1 $298.22 Individual Asset Values at 30 June of each year $ mill Year o Asset 1 $305.63 Asset 2 $246.30 Total Assets (Assets 1 - 6) $1,021 Asset incomes Year o Netrents $ mill Asset 1 $24.71 Asset 2 $22.18 $ mill Smil $ mil $ mill Smil $ mill Year 2 Year 3 Year 4 Year 5 Year 6 Year 7 $341.16 $320.82 $268.95 $324.53 5322.975330 $230.61 $220.02 $223.62' $227.54 $233.16 $233.0 $1,058 $1,001 $911 $1,021 $1,029 $1,044 $230.39 $978 Year 1 Year 2 $ mil $ mil $23.62 $27.57 $21.43 $24.70 Year 3 Year 4 $ mill $ mill $26.09 $21.74 $22.98 $19.84 Year 5 $ mill $25.70 $20.66 Year 6 $ mill $26.10 $19.45 Year 7 $ mill $26.87 $19.83 Distribution account Year o $ mill $3.48 $69.61 $73.09 $69.44 $3.65 Year 1 $ mil $3.31 $68.53 $71.85 $68.25 $3.59 Year 2 $ mil $3.96 $82.06 $86.02 $81.72 $4.30 Year 3 $ mill $3.84 $80.92 $84.76 $80.53 $4.24 Retained Earnings at start Operating profit Available for distribution Distribution Paid Retained Earnings at end Earnings Cents Per Unit Distribution Cents Per Unit Other Information of Importance Year 4 $ mill $4.17 $86.27 $90.45 $85.93 $4.52 Year 5 $ mil $5.07 $103.31 $108.38 $102.96 $5.42 Year 6 $ mill $5.20 $82.00 r $87.20 $82.84 $4.36 Year 7 S mill $4.24 $66.05 $70.29 $66.78 $3.51 F r $0.1243 $0.1240 $0.1224 $0.1465 $0.1445 0.1541 $0.1845 SO.1464 $0.1180 $0.1219 $0.1459 50.1438 'So. 1534' $0.1839 5.1479 $0.1192 Interest Rates Stock yield/initial yield Share Price NTA Risk Premium Share Market Risk Premium REITS Year o 7.00% 7.00% $1.77 $1.82 7.00% 6.50% Year 1 7.00% 6.80% $1.79 $1.75 Year 2 7.00% 6.75% $2.16 $1.89 Beta Bond Year 3 7.25% 6.80% $2.11 $1.79 0.87 1.74% Year 4 7.50% 6.90% $2.22 $1.63 Year 5 7.85% 6.90% $2.66 $1.82 Year 6 8.10% 6.90% 7 $2.14 $1.84 Year 7 8.20% 7.00% $1.70 $1.86 $ mill Year 1 $298.22 Individual Asset Values at 30 June of each year $ mill Year o Asset 1 $305.63 Asset 2 $246.30 Total Assets (Assets 1 - 6) $1,021 Asset incomes Year o Netrents $ mill Asset 1 $24.71 Asset 2 $22.18 $ mill Smil $ mil $ mill Smil $ mill Year 2 Year 3 Year 4 Year 5 Year 6 Year 7 $341.16 $320.82 $268.95 $324.53 5322.975330 $230.61 $220.02 $223.62' $227.54 $233.16 $233.0 $1,058 $1,001 $911 $1,021 $1,029 $1,044 $230.39 $978 Year 1 Year 2 $ mil $ mil $23.62 $27.57 $21.43 $24.70 Year 3 Year 4 $ mill $ mill $26.09 $21.74 $22.98 $19.84 Year 5 $ mill $25.70 $20.66 Year 6 $ mill $26.10 $19.45 Year 7 $ mill $26.87 $19.83 Distribution account Year o $ mill $3.48 $69.61 $73.09 $69.44 $3.65 Year 1 $ mil $3.31 $68.53 $71.85 $68.25 $3.59 Year 2 $ mil $3.96 $82.06 $86.02 $81.72 $4.30 Year 3 $ mill $3.84 $80.92 $84.76 $80.53 $4.24 Retained Earnings at start Operating profit Available for distribution Distribution Paid Retained Earnings at end Earnings Cents Per Unit Distribution Cents Per Unit Other Information of Importance Year 4 $ mill $4.17 $86.27 $90.45 $85.93 $4.52 Year 5 $ mil $5.07 $103.31 $108.38 $102.96 $5.42 Year 6 $ mill $5.20 $82.00 r $87.20 $82.84 $4.36 Year 7 S mill $4.24 $66.05 $70.29 $66.78 $3.51 F r $0.1243 $0.1240 $0.1224 $0.1465 $0.1445 0.1541 $0.1845 SO.1464 $0.1180 $0.1219 $0.1459 50.1438 'So. 1534' $0.1839 5.1479 $0.1192 Interest Rates Stock yield/initial yield Share Price NTA Risk Premium Share Market Risk Premium REITS Year o 7.00% 7.00% $1.77 $1.82 7.00% 6.50% Year 1 7.00% 6.80% $1.79 $1.75 Year 2 7.00% 6.75% $2.16 $1.89 Beta Bond Year 3 7.25% 6.80% $2.11 $1.79 0.87 1.74% Year 4 7.50% 6.90% $2.22 $1.63 Year 5 7.85% 6.90% $2.66 $1.82 Year 6 8.10% 6.90% 7 $2.14 $1.84 Year 7 8.20% 7.00% $1.70 $1.86

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts