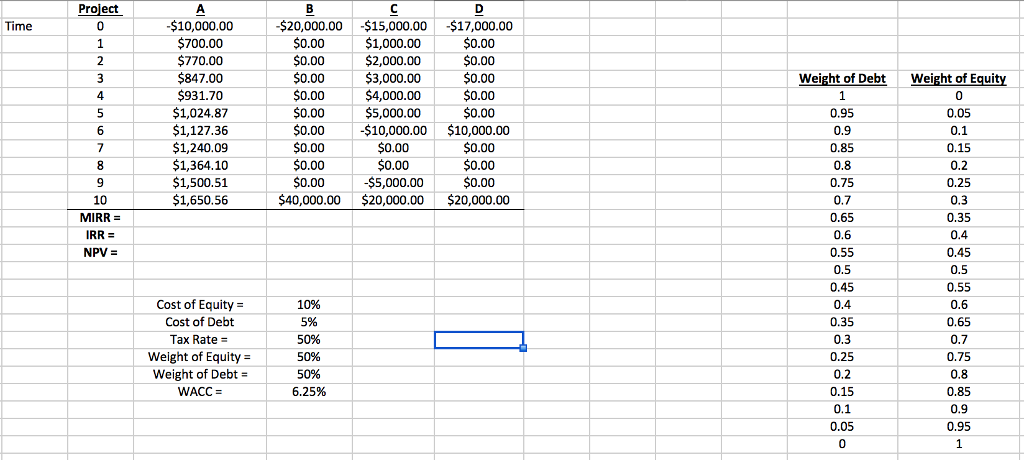

Question: Using the spreadsheet labeled project 1, please calculate the NPV, IRR and MIRR for projects A, B, C and D. Which projects would you accept

Using the spreadsheet labeled project 1, please calculate the NPV, IRR and MIRR for projects A, B, C and D. Which projects would you accept and why?

Graph the WACC on a graph allowing the weights of debt and equity to shift from 0 to 100%. The x axis should be the weights and the y should be the WACC. Use increments of .05.

Now allow the tax rate to go to zero, what happens to your graph (paste it here).

Project $10,000.00 $700.00 $770.00 $847.00 $931.70 $1,024.87 $1,127.36 $1,240.09 $1,364.10 $1,500.51 $1,650.56 $20,000.00 $15,000.00-$17,000.00 $1,000.00 $2,000.00 $3,000.00 4,000.00 $5,000.00 Time 0.00 $0.00 0.00 $0.00 0.00 0.00 $0.00 0.00 $0.00 0.00 $0.00 0.00 0.00 0.00 Weight of Equity 0 0.05 0.1 0.15 0.2 0.25 0.3 0.35 0.4 0.45 0.5 0.55 0.6 0.65 0.7 0.75 0.8 0.85 0.9 0.95 Weight of Debt 4 0.95 0.9 0.85 0.8 0.75 0.7 0.65 0.6 0.55 0.5 0.45 0.4 0.35 0.3 0.25 0.2 0.15 0.1 0.05 0 $10,000.00 $10,000.00 $0.00 $0.00 $5,000.00 $40,000.00 $20,000.00 $20,000.00 $0.00 0.00 $0.00 9 10 MIRR = NPV = Cost of Equity = Cost of Debt Tax Rate- Weight of Equity- Weight of Debt- WACC= 10% 5% 50% 50% 5% 6.25%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts