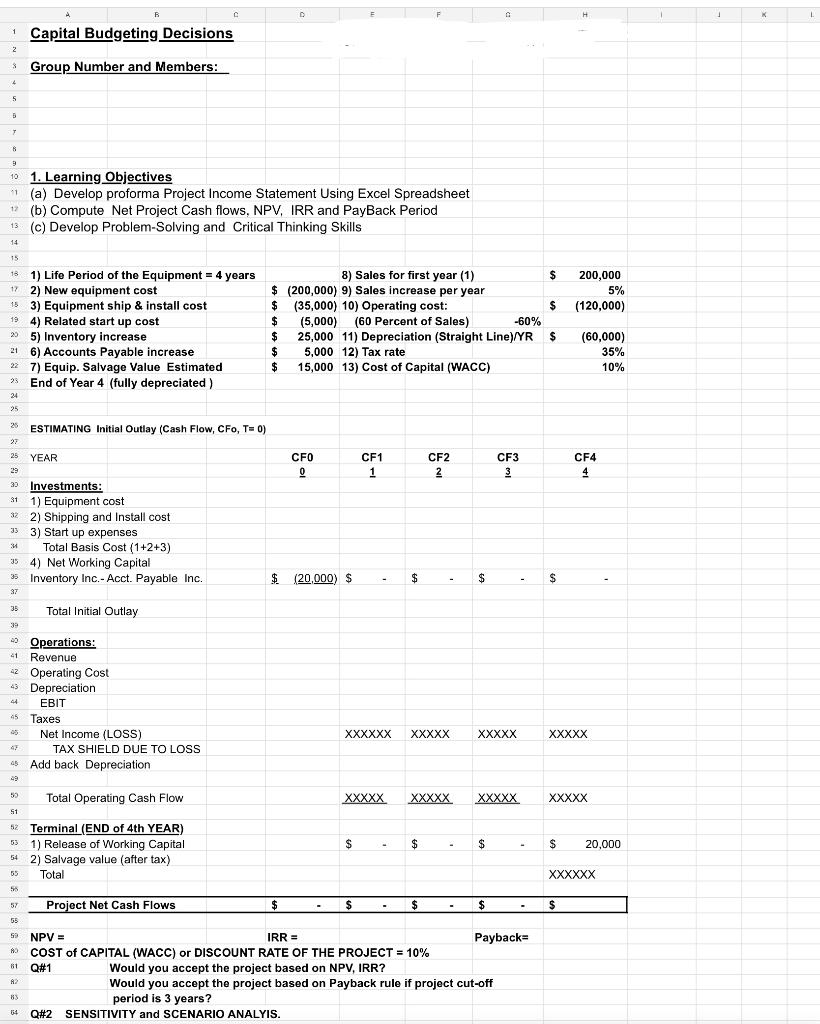

Question: D F H 1 K ! Capital Budgeting Decisions 2 Group Number and Members: 4 5 T R 9 10 1. Learning Objectives (a)

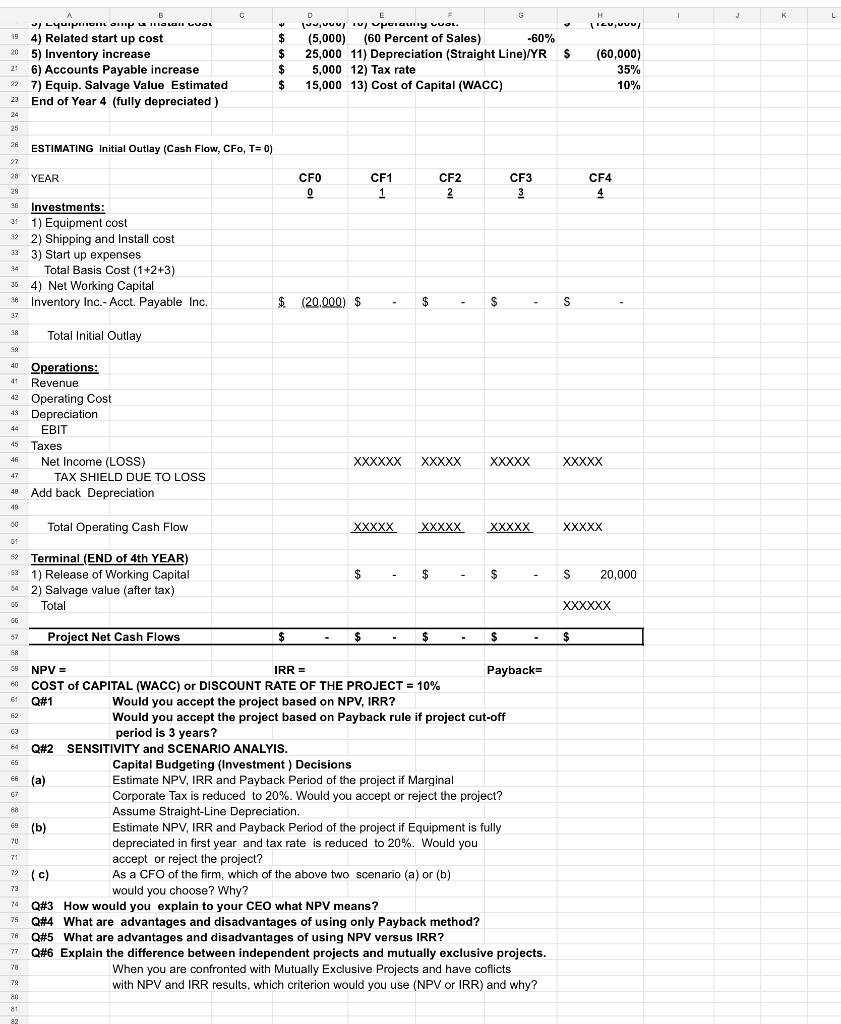

D F H 1 K ! Capital Budgeting Decisions 2 Group Number and Members: 4 5 T R 9 10 1. Learning Objectives " (a) Develop proforma Project Income Statement Using Excel Spreadsheet (b) Compute Net Project Cash flows, NPV, IRR and PayBack Period (c) Develop Problem Solving and Critical Thinking Skills 14 15 200,000 5% (120,000) 1) Life Period of the Equipment = 4 years 172) New equipment cost 15 3) Equipment ship & install cost 194) Related start up cost 235) Inventory increase 216) Accounts Payable increase 227) Equip. Salvage Value Estimated End of Year 4 (fully depreciated) 8) Sales for first year (1) $ $ (200,000) 9) Sales increase per year $ (35,000) 10) Operating cost: $ $ (5,000) (60 Percent of Sales) -60% $ 25,000 11) Depreciation (Straight Line)/YR $ $ 5,000 12) Tax rate $ 15,000 13) Cost of Capital (WACC) (60,000) 35% 10% 24 25 25 ESTIMATING Initial Outlay (Cash Flow, CFO, T= 0) 27 25 YEAR CFO O CF1 1 CF2 2 CF3 3 CF4 4 29 39 31 Investments: 1) Equipment cost 32 2) Shipping and Install cost 33 3) Start up expenses ) Total Basis Cost (1+2+3) 35 4) Net Working Capital 35 Inventory Inc.- Acct. Payable Inc. 3 $ (20,000) $ - $ $ $ 37 35 Total Initial Outlay 39 2 Ope Operations: 41 Revenue 42 Operating Cost 43 Depreciation EBIT Taxes Net Income (LOSS) TAX SHIELD DUE TO LOSS 46 Add back Depreciation 45 45 XXXXXX XXXXX XXXXX XXXXX 4F 45 53 Total Operating Cash Flow XXXXX XXXXX XXXXX 51 52 53 42 Terminal (END of 4th YEAR) 1) Release of Working Capital 642) Salvage value (after tax) Total $ $ $ $ $ 20,000 55 XXXXXX 56 57 Project Net Cash Flows $ $ - $ $ 55 53 A3 81 NPV = IRR = Payback COST of CAPITAL (WACC) or DISCOUNT RATE OF THE PROJECT = 10% Q#1 Would you accept the project based on NPV, IRR? Would you accept the project based on Payback rule if project cut-off period is 3 years? Q#2 SENSITIVITY and SCENARIO ANALYIS. E G H 1 K L Tev, UV) A Jj LyUIHIILGIH TI LUOL 19 4) Related start up cost 205) Inventory increase 21 6) Accounts Payable increase 7) Equip. Salvage Value Estimated 23 End of Year 4 (fully depreciated) $ $ $ $ D wwwuuu peruunty CUOL. (5,000) (60 Percent of Sales) -60% 25,000 11) Depreciation (Straight Line)/YR S $ 5,000 12) Tax rate 15,000 13) Cost of Capital (WACC) (60,000) 35% 10% 24 25 26 00 ESTIMATING Initial Outlay (Cash Flow, CFO, T=0) 37 28 YEAR CFO 0 CF1 1 CF2 2 CF3 3 CF4 4 29 90 Investments: 3: 1) Equipment cost 32 2) Shipping and Install cost 32 3) Start up expenses Total Basis Cost (1+2+3) 364) Net Working Capital Inventory Inc.- Acct. Payable Inc. $ (20.000) $ $ $ S s 37 38 Total Initial Outlay 99 41 40 Operations: Revenue 42 Operating Cost 43 Depreciation EBIT Taxes Net Income (LOSS) TAX SHIELD DUE TO LOSS Add back Depreciation 44 45 46 XXXXXX XXXXX XXXXX XXXXX 47 48 10 48 50 Total Operating Cash Flow XXXXX XXXXX XXXXX XXXXX 01 52 $ - $ $ S 20,000 Terminal (END of 4th YEAR) 63 1) Release of Working Capital 642) 2) Salvage value (after tax) 00 Total XXXXXX GG Project Net Cash Flows $ $ $ . $ $ 58 09 61 62 63 64 6G 67 88 NPV = IRR - Payback COST of CAPITAL (WACC) or DISCOUNT RATE OF THE PROJECT = 10% Q#1 Would you accept the project based on NPV, IRR? Would you accept the project based on Payback rule if project cut-off period is 3 years? Q#2 SENSITIVITY and SCENARIO ANALYIS. Capital Budgeting (Investment ) Decisions 64 (a) Estimate NPV, IRR and Payback Period of the project if Marginal Corporate Tax is reduced to 20%. Would you accept or reject the project? Assume Straight-Line Depreciation. 69 (b) Estimate NPV, IRR and Payback Period of the project if Equipment is fully depreciated in first year and tax rate is reduced to 20%. Would you accept or reject the project? 72 (c) As a CFO of the firm, which of the above two scenario (a) or (b) would you choose? Why? Q#3 How would you explain to your CEO what NPV means? Q#4 What are advantages and disadvantages of using only Payback method? 78 Q#5 What are advantages and disadvantages of using NPV versus IRR? Q#6 Explain the difference between independent projects and mutually exclusive projects. When you are confronted with Mutually Exclusive Projects and have coflicts with NPV and IRR results, which criterion would you use (NPV or IRR) and why? 70 71 73 74 75 77 70 79 an 87 82 D F H 1 K ! Capital Budgeting Decisions 2 Group Number and Members: 4 5 T R 9 10 1. Learning Objectives " (a) Develop proforma Project Income Statement Using Excel Spreadsheet (b) Compute Net Project Cash flows, NPV, IRR and PayBack Period (c) Develop Problem Solving and Critical Thinking Skills 14 15 200,000 5% (120,000) 1) Life Period of the Equipment = 4 years 172) New equipment cost 15 3) Equipment ship & install cost 194) Related start up cost 235) Inventory increase 216) Accounts Payable increase 227) Equip. Salvage Value Estimated End of Year 4 (fully depreciated) 8) Sales for first year (1) $ $ (200,000) 9) Sales increase per year $ (35,000) 10) Operating cost: $ $ (5,000) (60 Percent of Sales) -60% $ 25,000 11) Depreciation (Straight Line)/YR $ $ 5,000 12) Tax rate $ 15,000 13) Cost of Capital (WACC) (60,000) 35% 10% 24 25 25 ESTIMATING Initial Outlay (Cash Flow, CFO, T= 0) 27 25 YEAR CFO O CF1 1 CF2 2 CF3 3 CF4 4 29 39 31 Investments: 1) Equipment cost 32 2) Shipping and Install cost 33 3) Start up expenses ) Total Basis Cost (1+2+3) 35 4) Net Working Capital 35 Inventory Inc.- Acct. Payable Inc. 3 $ (20,000) $ - $ $ $ 37 35 Total Initial Outlay 39 2 Ope Operations: 41 Revenue 42 Operating Cost 43 Depreciation EBIT Taxes Net Income (LOSS) TAX SHIELD DUE TO LOSS 46 Add back Depreciation 45 45 XXXXXX XXXXX XXXXX XXXXX 4F 45 53 Total Operating Cash Flow XXXXX XXXXX XXXXX 51 52 53 42 Terminal (END of 4th YEAR) 1) Release of Working Capital 642) Salvage value (after tax) Total $ $ $ $ $ 20,000 55 XXXXXX 56 57 Project Net Cash Flows $ $ - $ $ 55 53 A3 81 NPV = IRR = Payback COST of CAPITAL (WACC) or DISCOUNT RATE OF THE PROJECT = 10% Q#1 Would you accept the project based on NPV, IRR? Would you accept the project based on Payback rule if project cut-off period is 3 years? Q#2 SENSITIVITY and SCENARIO ANALYIS. E G H 1 K L Tev, UV) A Jj LyUIHIILGIH TI LUOL 19 4) Related start up cost 205) Inventory increase 21 6) Accounts Payable increase 7) Equip. Salvage Value Estimated 23 End of Year 4 (fully depreciated) $ $ $ $ D wwwuuu peruunty CUOL. (5,000) (60 Percent of Sales) -60% 25,000 11) Depreciation (Straight Line)/YR S $ 5,000 12) Tax rate 15,000 13) Cost of Capital (WACC) (60,000) 35% 10% 24 25 26 00 ESTIMATING Initial Outlay (Cash Flow, CFO, T=0) 37 28 YEAR CFO 0 CF1 1 CF2 2 CF3 3 CF4 4 29 90 Investments: 3: 1) Equipment cost 32 2) Shipping and Install cost 32 3) Start up expenses Total Basis Cost (1+2+3) 364) Net Working Capital Inventory Inc.- Acct. Payable Inc. $ (20.000) $ $ $ S s 37 38 Total Initial Outlay 99 41 40 Operations: Revenue 42 Operating Cost 43 Depreciation EBIT Taxes Net Income (LOSS) TAX SHIELD DUE TO LOSS Add back Depreciation 44 45 46 XXXXXX XXXXX XXXXX XXXXX 47 48 10 48 50 Total Operating Cash Flow XXXXX XXXXX XXXXX XXXXX 01 52 $ - $ $ S 20,000 Terminal (END of 4th YEAR) 63 1) Release of Working Capital 642) 2) Salvage value (after tax) 00 Total XXXXXX GG Project Net Cash Flows $ $ $ . $ $ 58 09 61 62 63 64 6G 67 88 NPV = IRR - Payback COST of CAPITAL (WACC) or DISCOUNT RATE OF THE PROJECT = 10% Q#1 Would you accept the project based on NPV, IRR? Would you accept the project based on Payback rule if project cut-off period is 3 years? Q#2 SENSITIVITY and SCENARIO ANALYIS. Capital Budgeting (Investment ) Decisions 64 (a) Estimate NPV, IRR and Payback Period of the project if Marginal Corporate Tax is reduced to 20%. Would you accept or reject the project? Assume Straight-Line Depreciation. 69 (b) Estimate NPV, IRR and Payback Period of the project if Equipment is fully depreciated in first year and tax rate is reduced to 20%. Would you accept or reject the project? 72 (c) As a CFO of the firm, which of the above two scenario (a) or (b) would you choose? Why? Q#3 How would you explain to your CEO what NPV means? Q#4 What are advantages and disadvantages of using only Payback method? 78 Q#5 What are advantages and disadvantages of using NPV versus IRR? Q#6 Explain the difference between independent projects and mutually exclusive projects. When you are confronted with Mutually Exclusive Projects and have coflicts with NPV and IRR results, which criterion would you use (NPV or IRR) and why? 70 71 73 74 75 77 70 79 an 87 82

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts