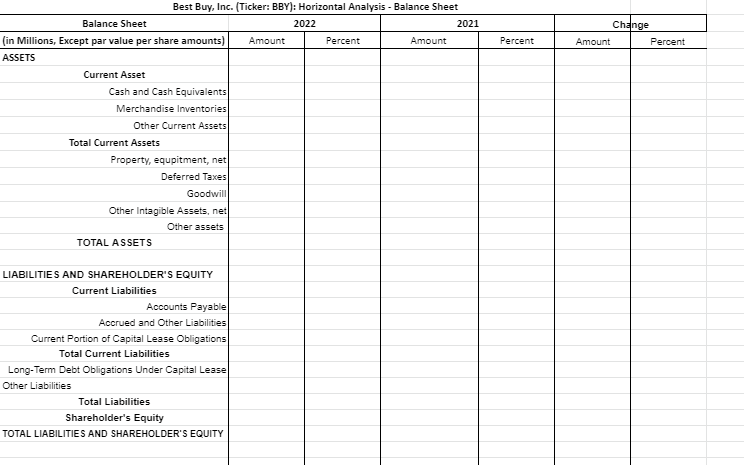

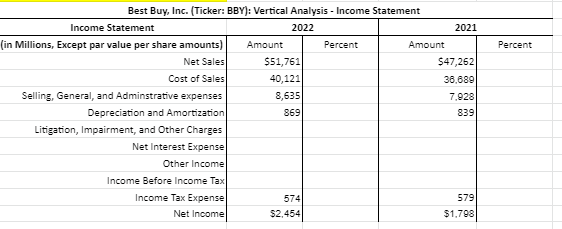

Question: Using the spreadsheet, prepare the following for the most recent two years from Best Buy, Inc. Comparative Income Statement - Vertical Analysis (Illustration 13.12) (FILL

Using the spreadsheet, prepare the following for the most recent two years from Best Buy, Inc.

- Comparative Income Statement - Vertical Analysis (Illustration 13.12) (FILL IN THE TABLE BELOW)

- Comparative Balance Sheet - Horizontal Analysis (Illustration 13.11) (FILL IN THE TABLE BELOW)

-

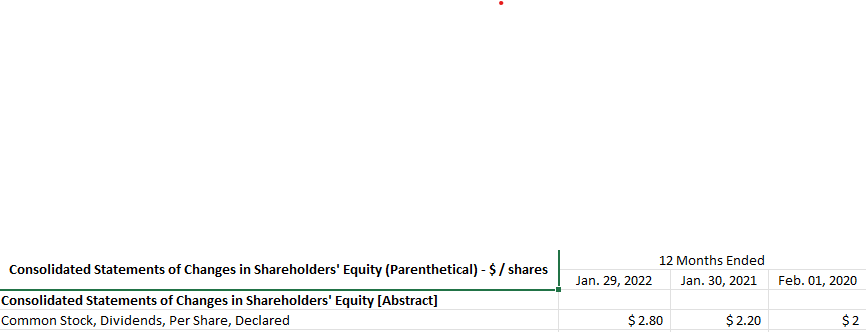

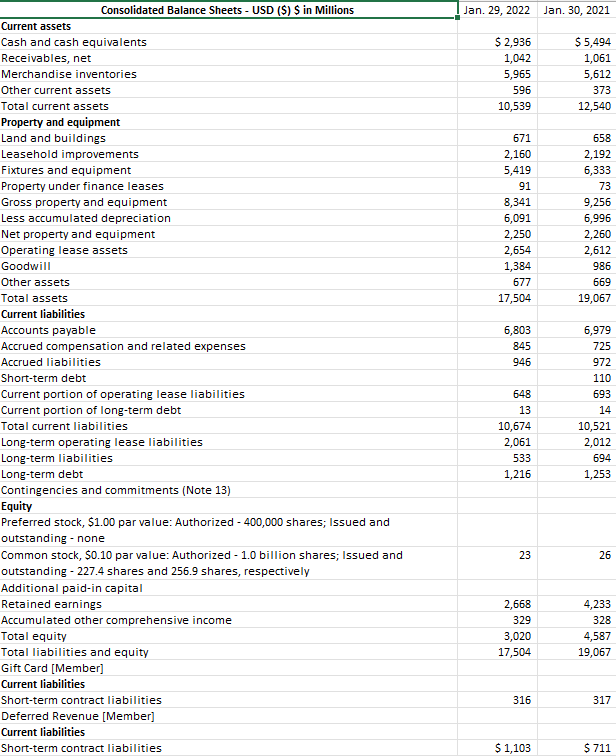

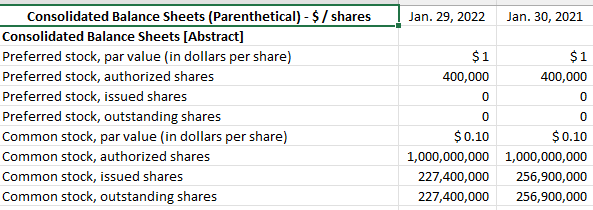

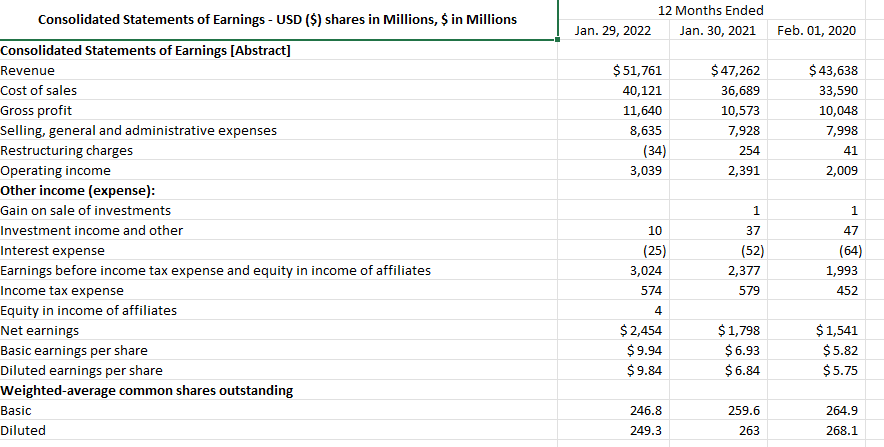

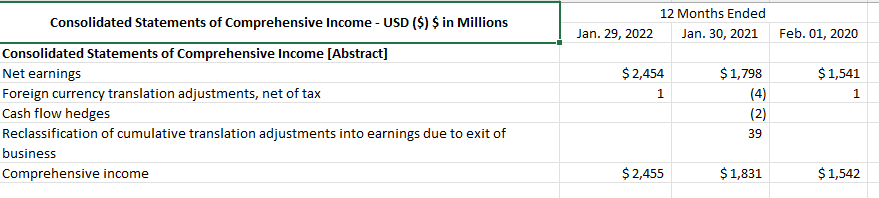

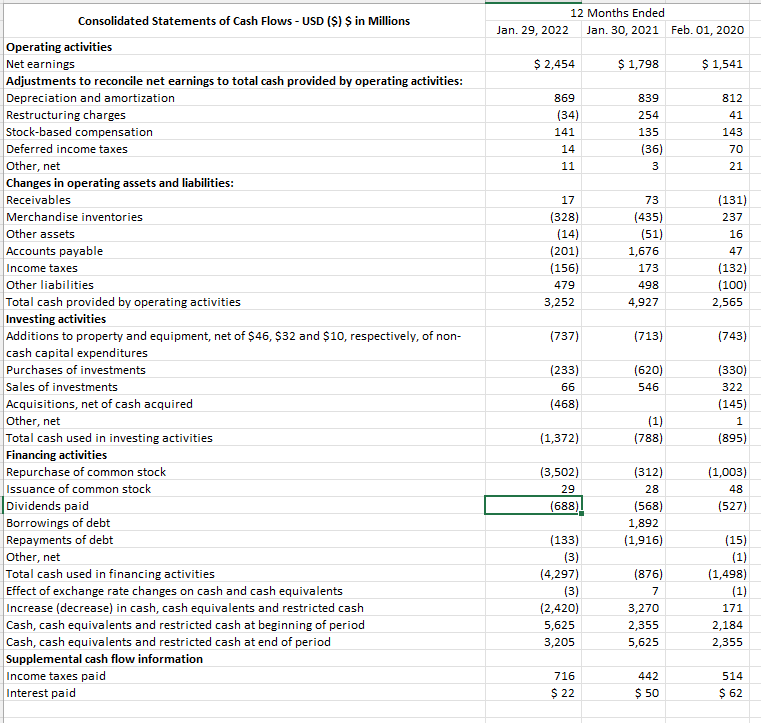

Change Amount Percent Percent Best Buy, Inc. (Ticker: BBY): Horizontal Analysis - Balance Sheet Balance Sheet 2022 2021 (in Millions, Except par value per share amounts) Amount Percent Amount ASSETS Current Asset Cash and Cash Equivalents Merchandise Inventories Other Current Assets Total Current Assets Property, equpitment, net Deferred Taxes Goodwill Other Intagible Assets, net Other assets TOTAL ASSETS LIABILITIES AND SHAREHOLDER'S EQUITY Current Liabilities Accounts Payable Accrued and Other Liabilities Current Portion of Capital Lease Obligations Total Current Liabilities Long-Term Debt Obligations Under Capital Lease Other Liabilities Total Liabilities Shareholder's Equity TOTAL LIABILITIES AND SHAREHOLDER'S EQUITY Percent Best Buy, Inc. (Ticker: BBY): Vertical Analysis - Income Statement Income Statement 2022 2021 (in Millions, Except par value per share amounts) Amount Percent Amount Net Sales $51,761 $47,262 Cost of Sales 40,121 36.689 Selling, General, and Adminstrative expenses 8,635 7.928 Depreciation and Amortization 869 839 Litigation, Impairment, and Other Charges Net Interest Expensel Other Incomel Income Before Income Tax Income Tax Expense 574 579 Net Income $2,454 $1,798 12 Months Ended Jan. 30, 2021 Jan. 29, 2022 Feb. 01, 2020 Consolidated Statements of Changes in Shareholders' Equity (Parenthetical) - $ / shares Consolidated Statements of Changes in Shareholders' Equity [Abstract] Common Stock, Dividends, Per Share, Declared $ 2.80 $ 2.20 $ 2 Jan. 29, 2022 Jan. 30, 2021 $ 2,936 1,042 5,965 596 10,539 $5,494 1,061 5,612 373 12,540 671 2,160 5,419 91 8,341 6,091 2,250 2,654 1,384 677 17,504 658 2,192 6,333 73 9,256 6,996 2,260 2,612 986 669 19,067 6,803 845 946 Consolidated Balance Sheets - USD ($) $ in Millions Current assets Cash and cash equivalents Receivables, net Merchandise inventories Other current assets Total current assets Property and equipment Land and buildings Leasehold improvements Fixtures and equipment Property under finance leases Gross property and equipment Less accumulated depreciation Net property and equipment Operating lease assets Goodwill Other assets Total assets Current liabilities Accounts payable Accrued compensation and related expenses Accrued liabilities Short-term debt Current portion of operating lease liabilities Current portion of long-term debt Total current liabilities Long-term operating lease liabilities Long-term liabilities Long-term debt Contingencies and commitments (Note 13) Equity Preferred stock, $1.00 par value: Authorized - 400,000 shares; Issued and outstanding - none Common stock, $0.10 par value: Authorized - 1.0 billion shares; Issued and outstanding - 227.4 shares and 256.9 shares, respectively Additional paid-in capital Retained earnings Accumulated other comprehensive income Total equity Total liabilities and equity Gift Card (Member] Current liabilities Short-term contract liabilities Deferred Revenue (Member) Current liabilities Short-term contract liabilities 648 13 10,674 2,061 533 1,216 6,979 725 972 110 693 14 10,521 2,012 694 1,253 23 26 2,668 329 3,020 17,504 4,233 328 4,587 19,067 316 317 $ 1,103 $ 711 Jan. 29, 2022 Jan. 30, 2021 $1 Consolidated Balance Sheets (Parenthetical) - $ / shares Consolidated Balance Sheets [Abstract] Preferred stock, par value (in dollars per share) Preferred stock, authorized shares Preferred stock, issued shares Preferred stock, outstanding shares Common stock, par value in dollars per share) Common stock, authorized shares Common stock, issued shares Common stock, outstanding shares $ 1 400,000 400,000 0 0 0 0 $ 0.10 $0.10 1,000,000,000 1,000,000,000 227,400,000 256,900,000 227,400,000 256,900,000 12 Months Ended Jan. 30, 2021 Jan. 29, 2022 Feb. 01, 2020 $ 51,761 40,121 11,640 8,635 (34) 3,039 $ 47,262 36,689 10,573 7,928 254 2,391 $43,638 33,590 10,048 7,998 41 2,009 1 1 Consolidated Statements of Earnings - USD ($) shares in Millions, $ in Millions Consolidated Statements of Earnings [Abstract] Revenue Cost of sales Gross profit Selling, general and administrative expenses Restructuring charges Operating income Other income (expense): Gain on sale of investments Investment income and other Interest expense Earnings before income tax expense and equity in income of affiliates Income tax expense Equity in income of affiliates Net earnings Basic earnings per share Diluted earnings per share Weighted average common shares outstanding Basic Diluted 10 37 (52) 2,377 579 47 (64) 1,993 452 (25) 3,024 574 4 $ 2,454 $9.94 $9.84 $ 1,798 $6.93 $6.84 $ 1,541 $5.82 $5.75 246.8 249.3 259.6 263 264.9 268.1 12 Months Ended Jan. 30, 2021 Jan. 29, 2022 Feb. 01, 2020 Consolidated Statements of Comprehensive Income - USD ($) $ in Millions Consolidated Statements of Comprehensive Income [Abstract] Net earnings Foreign currency translation adjustments, net of tax Cash flow hedges Reclassification of cumulative translation adjustments into earnings due to exit of business Comprehensive income $ 2,454 1 $ 1,541 1 $ 1,798 (4) (2) 39 $ 2,455 $ 1,831 $ 1,542 12 Months Ended Jan. 29, 2022 Jan. 30, 2021 Feb. 01, 2020 $ 2,454 $ 1,798 $ 1,541 869 (34) 141 14 11 839 254 135 (36) 3 812 41 143 70 21 73 (131) 237 16 17 (328) (14) (201) (156) 479 3,252 (435) (51) 1,676 173 498 4,927 47 (132) (100) 2,565 (737) (713) (743) Consolidated Statements of Cash Flows - USD ($) $ in Millions Operating activities Net earnings Adjustments to reconcile net earnings to total cash provided by operating activities: Depreciation and amortization Restructuring charges Stock-based compensation Deferred income taxes Other, net Changes in operating assets and liabilities: Receivables Merchandise inventories Other assets Accounts payable Income taxes Other liabilities Total cash provided by operating activities Investing activities Additions to property and equipment, net of $46, $32 and $10, respectively, of non- cash capital expenditures Purchases of investments Sales of investments Acquisitions, net of cash acquired Other, net Total cash used in investing activities Financing activities Repurchase of common stock Issuance of common stock Dividends paid Borrowings of debt Repayments of debt Other, net Total cash used in financing activities Effect of exchange rate changes on cash and cash equivalents Increase (decrease) in cash, cash equivalents and restricted cash Cash, cash equivalents and restricted cash at beginning of period Cash, cash equivalents and restricted cash at end of period Supplemental cash flow information Income taxes paid Interest paid (233) 66 (468) (620) 546 (330) 322 (145) 1 (895) (1) (788) (1,372) (3,502) 29 (688) (312) 28 (568) 1,892 (1,916) (1,003) 48 (527) (133) (3) (4,297) (3) (2,420) 5,625 3,205 (876) 7 3,270 2,355 5,625 (15) (1) (1,498) (1) 171 2,184 2,355 716 $ 22 442 $ 50 514 $ 62 Change Amount Percent Percent Best Buy, Inc. (Ticker: BBY): Horizontal Analysis - Balance Sheet Balance Sheet 2022 2021 (in Millions, Except par value per share amounts) Amount Percent Amount ASSETS Current Asset Cash and Cash Equivalents Merchandise Inventories Other Current Assets Total Current Assets Property, equpitment, net Deferred Taxes Goodwill Other Intagible Assets, net Other assets TOTAL ASSETS LIABILITIES AND SHAREHOLDER'S EQUITY Current Liabilities Accounts Payable Accrued and Other Liabilities Current Portion of Capital Lease Obligations Total Current Liabilities Long-Term Debt Obligations Under Capital Lease Other Liabilities Total Liabilities Shareholder's Equity TOTAL LIABILITIES AND SHAREHOLDER'S EQUITY Percent Best Buy, Inc. (Ticker: BBY): Vertical Analysis - Income Statement Income Statement 2022 2021 (in Millions, Except par value per share amounts) Amount Percent Amount Net Sales $51,761 $47,262 Cost of Sales 40,121 36.689 Selling, General, and Adminstrative expenses 8,635 7.928 Depreciation and Amortization 869 839 Litigation, Impairment, and Other Charges Net Interest Expensel Other Incomel Income Before Income Tax Income Tax Expense 574 579 Net Income $2,454 $1,798 12 Months Ended Jan. 30, 2021 Jan. 29, 2022 Feb. 01, 2020 Consolidated Statements of Changes in Shareholders' Equity (Parenthetical) - $ / shares Consolidated Statements of Changes in Shareholders' Equity [Abstract] Common Stock, Dividends, Per Share, Declared $ 2.80 $ 2.20 $ 2 Jan. 29, 2022 Jan. 30, 2021 $ 2,936 1,042 5,965 596 10,539 $5,494 1,061 5,612 373 12,540 671 2,160 5,419 91 8,341 6,091 2,250 2,654 1,384 677 17,504 658 2,192 6,333 73 9,256 6,996 2,260 2,612 986 669 19,067 6,803 845 946 Consolidated Balance Sheets - USD ($) $ in Millions Current assets Cash and cash equivalents Receivables, net Merchandise inventories Other current assets Total current assets Property and equipment Land and buildings Leasehold improvements Fixtures and equipment Property under finance leases Gross property and equipment Less accumulated depreciation Net property and equipment Operating lease assets Goodwill Other assets Total assets Current liabilities Accounts payable Accrued compensation and related expenses Accrued liabilities Short-term debt Current portion of operating lease liabilities Current portion of long-term debt Total current liabilities Long-term operating lease liabilities Long-term liabilities Long-term debt Contingencies and commitments (Note 13) Equity Preferred stock, $1.00 par value: Authorized - 400,000 shares; Issued and outstanding - none Common stock, $0.10 par value: Authorized - 1.0 billion shares; Issued and outstanding - 227.4 shares and 256.9 shares, respectively Additional paid-in capital Retained earnings Accumulated other comprehensive income Total equity Total liabilities and equity Gift Card (Member] Current liabilities Short-term contract liabilities Deferred Revenue (Member) Current liabilities Short-term contract liabilities 648 13 10,674 2,061 533 1,216 6,979 725 972 110 693 14 10,521 2,012 694 1,253 23 26 2,668 329 3,020 17,504 4,233 328 4,587 19,067 316 317 $ 1,103 $ 711 Jan. 29, 2022 Jan. 30, 2021 $1 Consolidated Balance Sheets (Parenthetical) - $ / shares Consolidated Balance Sheets [Abstract] Preferred stock, par value (in dollars per share) Preferred stock, authorized shares Preferred stock, issued shares Preferred stock, outstanding shares Common stock, par value in dollars per share) Common stock, authorized shares Common stock, issued shares Common stock, outstanding shares $ 1 400,000 400,000 0 0 0 0 $ 0.10 $0.10 1,000,000,000 1,000,000,000 227,400,000 256,900,000 227,400,000 256,900,000 12 Months Ended Jan. 30, 2021 Jan. 29, 2022 Feb. 01, 2020 $ 51,761 40,121 11,640 8,635 (34) 3,039 $ 47,262 36,689 10,573 7,928 254 2,391 $43,638 33,590 10,048 7,998 41 2,009 1 1 Consolidated Statements of Earnings - USD ($) shares in Millions, $ in Millions Consolidated Statements of Earnings [Abstract] Revenue Cost of sales Gross profit Selling, general and administrative expenses Restructuring charges Operating income Other income (expense): Gain on sale of investments Investment income and other Interest expense Earnings before income tax expense and equity in income of affiliates Income tax expense Equity in income of affiliates Net earnings Basic earnings per share Diluted earnings per share Weighted average common shares outstanding Basic Diluted 10 37 (52) 2,377 579 47 (64) 1,993 452 (25) 3,024 574 4 $ 2,454 $9.94 $9.84 $ 1,798 $6.93 $6.84 $ 1,541 $5.82 $5.75 246.8 249.3 259.6 263 264.9 268.1 12 Months Ended Jan. 30, 2021 Jan. 29, 2022 Feb. 01, 2020 Consolidated Statements of Comprehensive Income - USD ($) $ in Millions Consolidated Statements of Comprehensive Income [Abstract] Net earnings Foreign currency translation adjustments, net of tax Cash flow hedges Reclassification of cumulative translation adjustments into earnings due to exit of business Comprehensive income $ 2,454 1 $ 1,541 1 $ 1,798 (4) (2) 39 $ 2,455 $ 1,831 $ 1,542 12 Months Ended Jan. 29, 2022 Jan. 30, 2021 Feb. 01, 2020 $ 2,454 $ 1,798 $ 1,541 869 (34) 141 14 11 839 254 135 (36) 3 812 41 143 70 21 73 (131) 237 16 17 (328) (14) (201) (156) 479 3,252 (435) (51) 1,676 173 498 4,927 47 (132) (100) 2,565 (737) (713) (743) Consolidated Statements of Cash Flows - USD ($) $ in Millions Operating activities Net earnings Adjustments to reconcile net earnings to total cash provided by operating activities: Depreciation and amortization Restructuring charges Stock-based compensation Deferred income taxes Other, net Changes in operating assets and liabilities: Receivables Merchandise inventories Other assets Accounts payable Income taxes Other liabilities Total cash provided by operating activities Investing activities Additions to property and equipment, net of $46, $32 and $10, respectively, of non- cash capital expenditures Purchases of investments Sales of investments Acquisitions, net of cash acquired Other, net Total cash used in investing activities Financing activities Repurchase of common stock Issuance of common stock Dividends paid Borrowings of debt Repayments of debt Other, net Total cash used in financing activities Effect of exchange rate changes on cash and cash equivalents Increase (decrease) in cash, cash equivalents and restricted cash Cash, cash equivalents and restricted cash at beginning of period Cash, cash equivalents and restricted cash at end of period Supplemental cash flow information Income taxes paid Interest paid (233) 66 (468) (620) 546 (330) 322 (145) 1 (895) (1) (788) (1,372) (3,502) 29 (688) (312) 28 (568) 1,892 (1,916) (1,003) 48 (527) (133) (3) (4,297) (3) (2,420) 5,625 3,205 (876) 7 3,270 2,355 5,625 (15) (1) (1,498) (1) 171 2,184 2,355 716 $ 22 442 $ 50 514 $ 62

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts