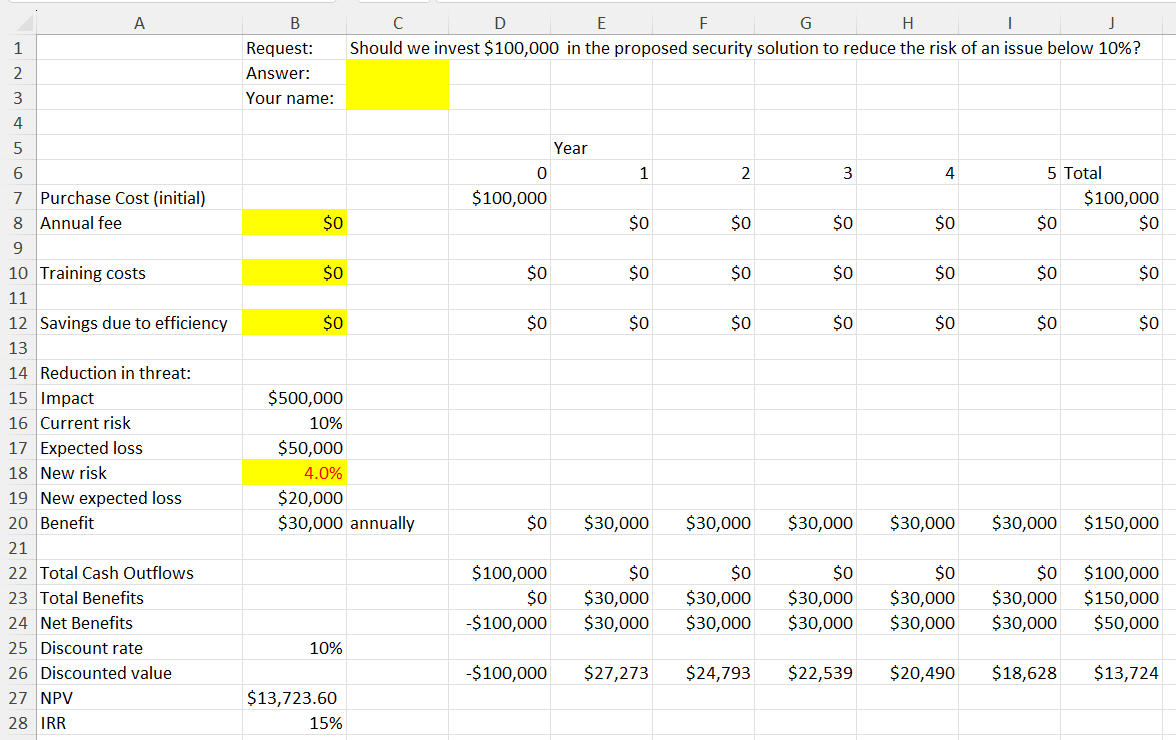

Question: Using the spreadsheet provided, edit the cells to include the following controls: Annual fee cannot exceed 8% of purchase cost. Training costs cannot exceed $12,000

Using the spreadsheet provided, edit the cells to include the following controls:

- Annual fee cannot exceed 8% of purchase cost.

- Training costs cannot exceed $12,000 in year 0 and $3,000 thereafter.

(Enter the annual training costs in cell B10 and enter initial year 0 training costs in cell D10).

- Annual savings due to efficiency cannot exceed $5,000, but must be zero in year 0.

- Cell C2 (highlighted in yellow to the right of the word Answer) must force entry of either YES or NO no other values can be accepted.

(hint: use cells A30 and A31 as the source for a dropdown list).

- Your name must appear in cell C3, and the cell must ensure that any name entered cannot exceed 30 characters total.

- Cell B8 (annual fee) must NOT permit any alphabetic text.

- The reduction in risk due to the security investment (cell B18) must range between 2% and 8%, inclusive.

- Lock the spreadsheet so that data can only be entered in these cells (all highlighted in yellow in the spreadsheet):

- C2

- C3

- B8

- B10

- B12

- B18

- D10

- A30

- A31

\begin{tabular}{|c|c|c|c|c|c|c|c|c|c|c|} \hlineA & A & B & C & D & E & F & G & H & 1 & J \\ \hline 1 & & Request: & \multicolumn{8}{|c|}{ Should we invest $100,000 in the proposed security solution to reduce the risk of an issue below 10% ? } \\ \hline 2 & & Answer: & & & & & & & & \\ \hline 3 & & Your name: & & & & & & & & \\ \hline \multicolumn{11}{|l|}{4} \\ \hline 5 & & & & \multicolumn{2}{|r|}{ Year } & & & & \multirow{2}{*}{\multicolumn{2}{|c|}{5 Total }} \\ \hline 6 & & & & 0 & 1 & 2 & 3 & 4 & & \\ \hline 7 & Purchase Cost (initial) & & & $100,000 & & & & & & $100,000 \\ \hline 8 & Annual fee & $0 & & & $0 & $0 & $0 & $0 & $0 & $0 \\ \hline \multicolumn{11}{|c|}{9} \\ \hline 10 & Training costs & $0 & & $0 & $0 & $0 & $0 & $0 & $0 & $0 \\ \hline \multicolumn{11}{|l|}{11} \\ \hline 12 & Savings due to efficiency & $0 & & $0 & $0 & $0 & $0 & $0 & $0 & $0 \\ \hline \multicolumn{11}{|l|}{13} \\ \hline 14 & Reduction in threat: & & & & & & & & & \\ \hline 15 & Impact & $500,000 & & & & & & & & \\ \hline 16 & Current risk & 10% & & & & & & & & \\ \hline 17 & Expected loss & $50,000 & & & & & & & & \\ \hline 18 & New risk & 4.0% & & & & & & & & \\ \hline 19 & New expected loss & $20,000 & & & & & & & & \\ \hline 20 & Benefit & $30,000 & annually & $0 & $30,000 & $30,000 & $30,000 & $30,000 & $30,000 & $150,000 \\ \hline \multicolumn{11}{|l|}{21} \\ \hline 22 & Total Cash Outflows & & & $100,000 & $0 & $0 & $0 & $0 & $0 & $100,000 \\ \hline 23 & Total Benefits & & & $0 & $30,000 & $30,000 & $30,000 & $30,000 & $30,000 & $150,000 \\ \hline 24 & Net Benefits & & & $100,000 & $30,000 & $30,000 & $30,000 & $30,000 & $30,000 & $50,000 \\ \hline 25 & Discount rate & 10% & & & & & & & & \\ \hline 26 & Discounted value & & & $100,000 & $27,273 & $24,793 & $22,539 & $20,490 & $18,628 & $13,724 \\ \hline 27 & NPV & $13,723.60 & & & & & & & & \\ \hline 28 & IRR & 15% & & & & & & & & \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts