Question: Using the spreadsheet provided, simulate a portfolio with delta hedging. Assume you have sold 1 0 0 European call options ( each of which is

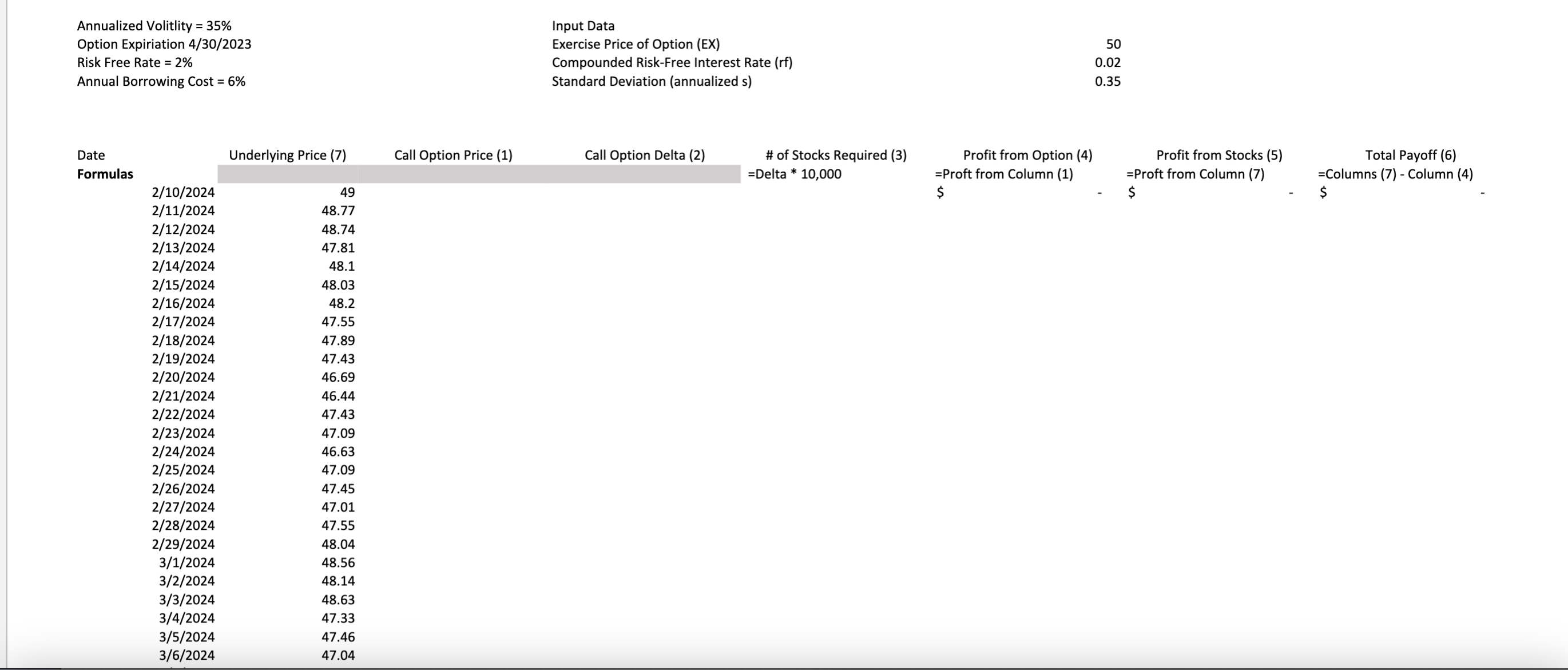

Using the spreadsheet provided, simulate a portfolio with delta hedging. Assume you have sold European call options each of which is worth shares, for a total of shares exposure short on the stock of Lumberjack Farms. Information about option is given below. Annualized Volitlity

Option Expiriation

Risk Free Rate

Annual Borrowing Cost

Strike Price

Number of Shares

No transaction costs and days in a year for interest and purposes

Input Data

Exercise Price of Option EX

Compounded RiskFree Interest Rate rf

Standard Deviation annualized s

Date

Formulas

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock