Question: Using the spreadsheet template as a model, you are going to first replicate the risk management strategy of using futures contracts to hedge aluminum prices.

Using the spreadsheet template as a model, you are going to first replicate the risk management strategy of using futures contracts to hedge aluminum prices. Next, create a risk management strategy if you had the opposite natural position in aluminum (in other words, an inflow). What would your natural position look like? What type of futures contract would hedge this risk? Finally, what would the combined payoff look like? Adjust the spreadsheet for this strategy.

Hint:

replicate hedging with a forward contract. So you have your risk ($ outflow of aluminum cost), you hedge with a forward contract (calculate your profit or loss at a given aluminum price) and then just combine those two positions to show that you will always have -2077.5 as your total cost

Then, just create the opposite strategy. That is, now assume you have a inflow risk ($ revenue for aluminum). What forward position would hedge that risk? Then calculate the total cash flows like the first part to show that no matter what happens to aluminum prices you always have a 2077.5 total revenue

[P.S. PLEASE WRITE BOTH THE PARTS IN THE FORM OF THIS TABLE]

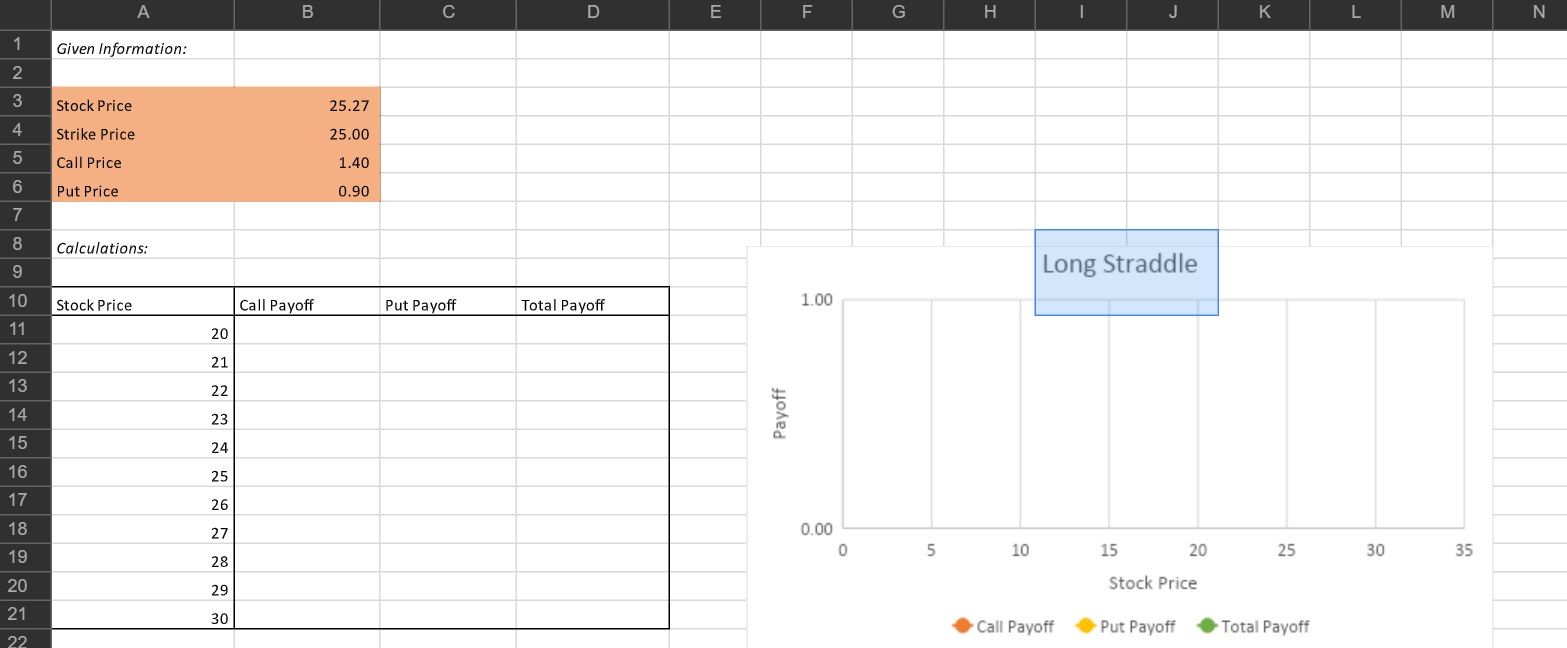

B D E F. G . J K M . N 1 Given Information: 2 3 Stock Price 25.27 4 Strike Price 25.00 5 Call Price 1.40 6 Put Price 0.90 7 8 Calculations: 9 Long Straddle 10 Stock Price Call Payoff Put Payoff Total Payoff 1.00 11 20 21 12 13 22 14 15 23 Payoff 24 25 16 17 18 26 27 0.00 0 5 10 15 20 25 30 35 28 19 20 21 Stock Price 29 30 Call Payoff Put Payoff Total Payoff 22 B D E F. G . J K M . N 1 Given Information: 2 3 Stock Price 25.27 4 Strike Price 25.00 5 Call Price 1.40 6 Put Price 0.90 7 8 Calculations: 9 Long Straddle 10 Stock Price Call Payoff Put Payoff Total Payoff 1.00 11 20 21 12 13 22 14 15 23 Payoff 24 25 16 17 18 26 27 0.00 0 5 10 15 20 25 30 35 28 19 20 21 Stock Price 29 30 Call Payoff Put Payoff Total Payoff 22

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts