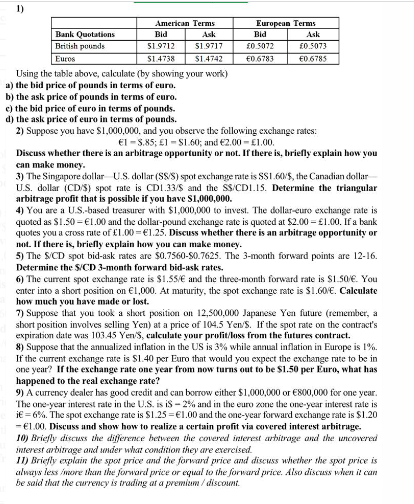

Question: Using the table above, calculate (by showing your work) the bid price of pounds in terms of euro. the ask price of pounds in terms

Using the table above, calculate (by showing your work) the bid price of pounds in terms of euro. the ask price of pounds in terms of euro. the bid price of euro in terms of pounds. the ask price of euro in terns of pounds. 2) Suppose you have $1,000,000. and you observe the following exchange rates: El3.85;1=$1.60;and/2.00=51,00. Discuss whether there is an arbitrage opportunity or not. If there is, hriefly explain how you can make moncy. 3) The Singapore dollar U.S. dollar (SS/S) spot exchange rate is SS1 .60/5, the Canadian dollar U.S. dollar (CD/\$) spot rate is CD1.33/\$ and the S\$/CD1.15. Determine the triangular 4) You are a U.S.-based treasurer with $1,000,000 to invest. The dollar-euro exchange rate is quoted as $1.50=1.00 and the dollar-pound cxchangc rate is quoted at $2.00=1.00. If a bank quotes you a cross rate of 1.00=1.25. Discuss whether there is an arbitrage opportunity or mit. If there is, hriefly explain haw you can make money. 5) The $CD spot bid-ask rates are $0.7560$0.7625. The 3-month forward points are 12-16. Determine the \$iCD 3-month forward bid-ask rutes. 6) The current spot exchange rate is $1.55 and the three-month forward rate is $1.50. You how much you have made or lost. 7) Suppoose that you took a short position on 12,500,000 Japancse Yen future (remember, a short position involves selling Yen) at a price of 104.5 Yens. If the spot rate on the contract's expiration diate was 103.45 Yen /, culculate your prolit/loss from the futures contruct. 8) Suppose that the annualized inflation in the US is 3% while annual inflation in Europe is 1%. If the current exchange rate is $1.40 per Euro that would you expect the exchange rate to be in one year? If the exchange rate one year from now turns out to be $1.50 per Euro, what has happened to the real exchange rate? 9) A currency dealer has good credit and can borrow either $1,000,000 or 6800,000 for one year. The one-year interest rate in the U.S. is iS 2% and in the euro oone the one-year interest rate is iE=6%. The spot exchange rate is $1.25=1.00 and the one-year forward exchange rate is $1.20 - 1.00 . Discuss and show how to realize a certain profit via covered interest arbitruge. 10) Briefly dircuss the difference between the covered inferest ahnituge and the inconered interest ambitage and shder what condition they are exercised. 11) Briefly explain the spot price and the forward price and diccuss whether the spot price is ahays less ineve thun the fovward pvice or equal to the forward price. Also discurs when it can be said that the currency is trading at a premiam / discosit. Using the table above, calculate (by showing your work) the bid price of pounds in terms of euro. the ask price of pounds in terms of euro. the bid price of euro in terms of pounds. the ask price of euro in terns of pounds. 2) Suppose you have $1,000,000. and you observe the following exchange rates: El3.85;1=$1.60;and/2.00=51,00. Discuss whether there is an arbitrage opportunity or not. If there is, hriefly explain how you can make moncy. 3) The Singapore dollar U.S. dollar (SS/S) spot exchange rate is SS1 .60/5, the Canadian dollar U.S. dollar (CD/\$) spot rate is CD1.33/\$ and the S\$/CD1.15. Determine the triangular 4) You are a U.S.-based treasurer with $1,000,000 to invest. The dollar-euro exchange rate is quoted as $1.50=1.00 and the dollar-pound cxchangc rate is quoted at $2.00=1.00. If a bank quotes you a cross rate of 1.00=1.25. Discuss whether there is an arbitrage opportunity or mit. If there is, hriefly explain haw you can make money. 5) The $CD spot bid-ask rates are $0.7560$0.7625. The 3-month forward points are 12-16. Determine the \$iCD 3-month forward bid-ask rutes. 6) The current spot exchange rate is $1.55 and the three-month forward rate is $1.50. You how much you have made or lost. 7) Suppoose that you took a short position on 12,500,000 Japancse Yen future (remember, a short position involves selling Yen) at a price of 104.5 Yens. If the spot rate on the contract's expiration diate was 103.45 Yen /, culculate your prolit/loss from the futures contruct. 8) Suppose that the annualized inflation in the US is 3% while annual inflation in Europe is 1%. If the current exchange rate is $1.40 per Euro that would you expect the exchange rate to be in one year? If the exchange rate one year from now turns out to be $1.50 per Euro, what has happened to the real exchange rate? 9) A currency dealer has good credit and can borrow either $1,000,000 or 6800,000 for one year. The one-year interest rate in the U.S. is iS 2% and in the euro oone the one-year interest rate is iE=6%. The spot exchange rate is $1.25=1.00 and the one-year forward exchange rate is $1.20 - 1.00 . Discuss and show how to realize a certain profit via covered interest arbitruge. 10) Briefly dircuss the difference between the covered inferest ahnituge and the inconered interest ambitage and shder what condition they are exercised. 11) Briefly explain the spot price and the forward price and diccuss whether the spot price is ahays less ineve thun the fovward pvice or equal to the forward price. Also discurs when it can be said that the currency is trading at a premiam / discosit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts