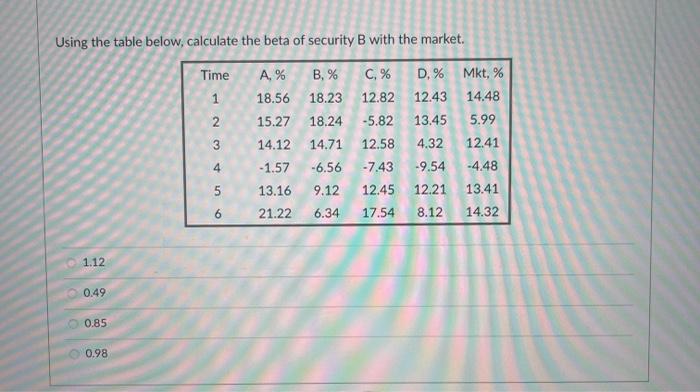

Question: Using the table below, calculate the beta of security B with the market. Time A. % 18.56 B, % 18.23 1 Mkt, % 14.48 5.99

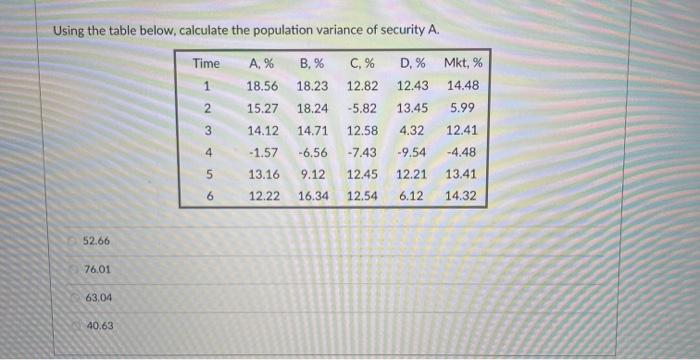

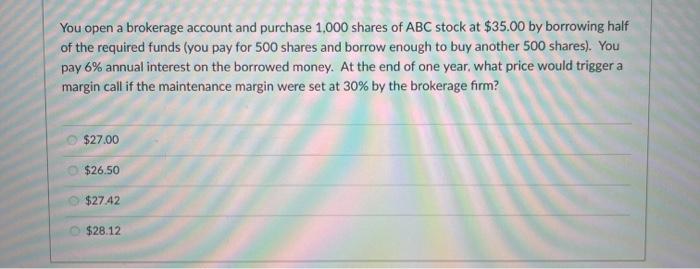

Using the table below, calculate the beta of security B with the market. Time A. % 18.56 B, % 18.23 1 Mkt, % 14.48 5.99 2 18.24 C, % 12.82 -5.82 12.58 -7.43 12.45 D, % 12.43 13.45 4.32 -9.54 12.21 3 15.27 14.12 -1.57 13.16 21.22 12.41 14.71 -6.56 4 -4.48 13.41 5 9.12 6.34 6 17.54 8.12 14.32 1.12 0.49 0.85 0.98 Using the table below.calculate the population variance of security A. Time 1 A. % 18.56 15.27 B. % 18.23 18.24 C, % 12.82 2 -5.82 D.% Mkt, % 12.43 14.48 13.45 5.99 4.32 12.41 -9.54 -4.48 12.21 13.41 3 12.58 4 -7.43 14.12 -1.57 13.16 12.22 14.71 -6,56 9.12 16.34 5 12.45 6 12.54 6.12 14.32 52.66 76,01 63.04 40.63 You open a brokerage account and purchase 1,000 shares of ABC stock at $35.00 by borrowing half of the required funds (you pay for 500 shares and borrow enough to buy another 500 shares). You pay 6% annual interest on the borrowed money. At the end of one year, what price would trigger a margin call if the maintenance margin were set at 30% by the brokerage firm? $27.00 $26.50 $2742 $28.12

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts