Question: using the table in appendix 14A, Calculate the present value of a 9%, $400,000 bond with a three-year term issued when the market rate of

using the table in appendix 14A, Calculate the present value of a 9%, $400,000 bond with a three-year term issued when the market rate of interest was 8%, interest is paid quarterly.

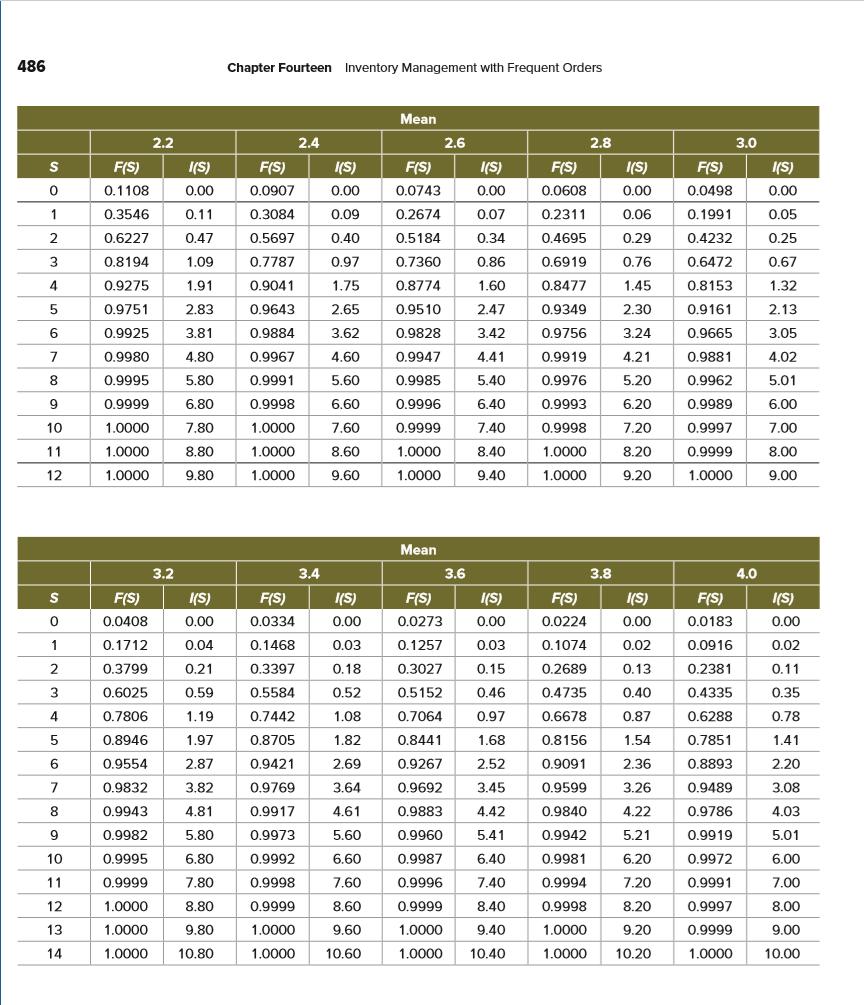

TABLE 14A.2 Poisson Tables F(S) is the distribution function-the probability the outcome of a Poisson is S or lower. I(S) is the expected inventory function-given an initial quantity, S, I(S) is the expected amount of inventory remaining after demand. Mean 0.1 0.2 0.3 0.4 0.5 F(S) I(S) F(S) I(S) F(S) I(S) F(S) I(S) F(S) I(S) 0.9048 0.00 0.8187 0.00 0.7408 0.00 0.6703 0.00 0.6065 0.00 1 0.9953 0.90 0.9825 0.82 0.9631 0.74 0.9384 0.67 0.9098 0.61 2 0.9998 1.90 0.9989 1.80 0.9964 1.70 0.9921 1.61 0.9856 1.52 3 1.0000 2.90 0.9999 2.80 0.9997 2.70 0.9992 2.60 0.9982 2.50 4 1.0000 3.90 1.0000 3.80 1.0000 3.70 0.9999 3.60 0.9998 3.50 5 1.0000 4.90 1.0000 4.80 1.0000 4.70 1.0000 4.60 1.0000 4.50 Mean 0.6 0.7 0.8 0.9 1.0 I(S) F(S) S F(S) I(S) F(S) I(S) F(S) I(S) F(S) (S) 0.5488 0.00 0.4966 0.00 0.4493 0.00 0.4066 0.00 0.3679 0.00 1 0.8781 0.55 0.8442 0.50 0.8088 0.45 0.7725 0.41 0.7358 0.37 2 0.9769 1.43 0.9659 1.34 0.9526 1.26 0.9371 1.18 0.9197 1.10 3 0.9966 2.40 0.9942 2.31 0.9909 2.21 0.9865 2.12 0.9810 2.02 4 0.9996 3.40 0.9992 3.30 0.9986 3.20 0.9977 3.10 0.9963 3.00 5 1.0000 4.40 0.9999 4.30 0.9998 4.20 0.9997 4.10 0,9994 4.00 6 1.0000 5.40 1.0000 5.30 1.0000 5.20 1.0000 5.10 0.9999 5.00 7 1.0000 6.40 1.0000 6.30 1.0000 6.20 1.0000 6.10 1.0000 6.00 Mean 1.2 1.4 1.6 1.8 2.0 F(S) I(S) F(S) I(S) F(S) I(S) F(S) I(S) F(S) I(S) 0.3012 0.00 0.2466 0.00 0.2019 0.00 0.1653 0.00 0.1353 0.00 1 0.6626 0.30 0.5918 0.25 0.5249 0.20 0.4628 0.17 0.4060 0.14 2 0.8795 0.96 0.8335 0.84 0.7834 0.73 0.7306 0.63 0.6767 0.54 3 0.9662 1.84 0.9463 1.67 0.9212 1.51 0.8913 1.36 0.8571 1.22 0.9923 2.81 0.9857 2.62 0.9763 2.43 0.9636 2.25 0.9473 2.08 5 0.9985 3.80 0.9968 3.60 0.9940 3.41 0.9896 3.21 0.9834 3.02 0.9997 4.80 0.9994 4.60 0.9987 4.40 0.9974 4.20 0,9955 4.01 7 1.0000 5.80 0.9999 5.60 0,9997 5.40 0.9994 5.20 0,9989 5.00 8 1.0000 6.80 1.0000 6.60 1.0000 6.40 0.9999 6.20 0.9998 6.00 9. 1.0000 7.80 1.0000 7.60 1.0000 7.40 1.0000 7.20 1.0000 7.00 Continued

Step by Step Solution

3.43 Rating (153 Votes )

There are 3 Steps involved in it

Bond par value 400000 Coupon 9 Coupon 9000 quarter payment market interest 8 Quarterly int... View full answer

Get step-by-step solutions from verified subject matter experts