Question: using the transactions provided fill in the journal entry 32 32 32 32 Jun 30 Jun 30 Jun 30 Jun 30 5110 Depreciation Expense depreciation

using the transactions provided fill in the journal entry

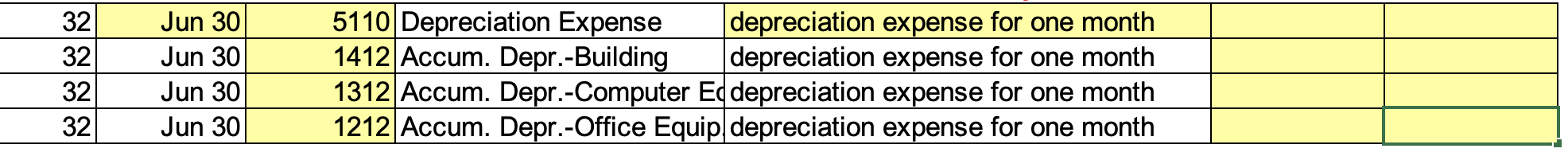

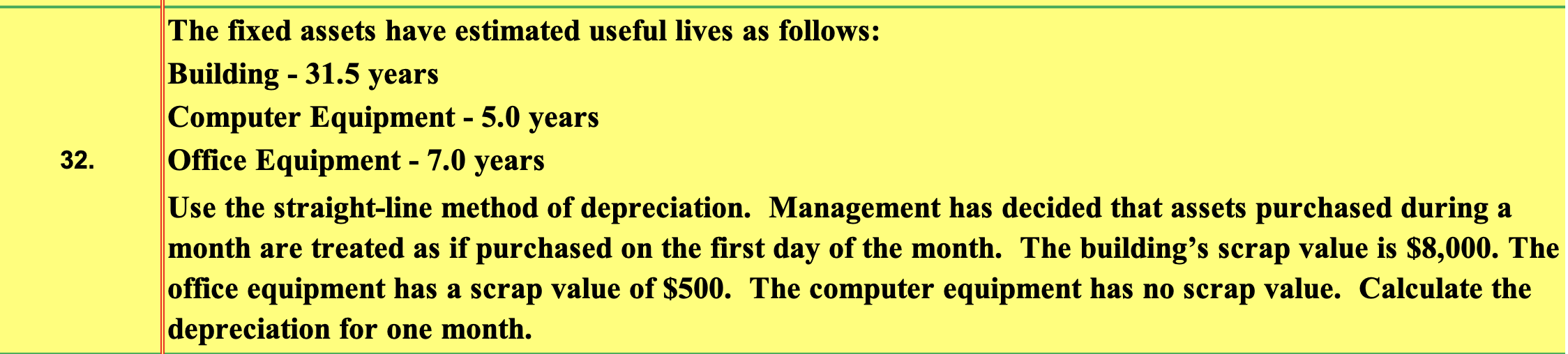

32 32 32 32 Jun 30 Jun 30 Jun 30 Jun 30 5110 Depreciation Expense depreciation expense for one month 1412 Accum. Depr.-Building depreciation expense for one month 1312 Accum. Depr.-Computer Ed depreciation expense for one month 1212 Accum. Depr.-Office Equip depreciation expense for one month 32. The fixed assets have estimated useful lives as follows: Building - 31.5 years Computer Equipment - 5.0 years Office Equipment - 7.0 years Use the straight-line method of depreciation. Management has decided that assets purchased during a month are treated as if purchased on the first day of the month. The building's scrap value is $8,000. The office equipment has a scrap value of $500. The computer equipment has no scrap value. Calculate the depreciation for one month. 32 32 32 32 Jun 30 Jun 30 Jun 30 Jun 30 5110 Depreciation Expense depreciation expense for one month 1412 Accum. Depr.-Building depreciation expense for one month 1312 Accum. Depr.-Computer Ed depreciation expense for one month 1212 Accum. Depr.-Office Equip depreciation expense for one month 32. The fixed assets have estimated useful lives as follows: Building - 31.5 years Computer Equipment - 5.0 years Office Equipment - 7.0 years Use the straight-line method of depreciation. Management has decided that assets purchased during a month are treated as if purchased on the first day of the month. The building's scrap value is $8,000. The office equipment has a scrap value of $500. The computer equipment has no scrap value. Calculate the depreciation for one month

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts