Question: Using the worksheet tab, run the following simulation and answer the questions below. (Hint: you will need to adjust the cells that are in blue

Using the "worksheet" tab, run the following simulation and answer the questions below. (Hint: you will need to adjust the cells that are in blue font [this is fairly standard for most financial spreadsheet where changeable cells are colored blue])  |

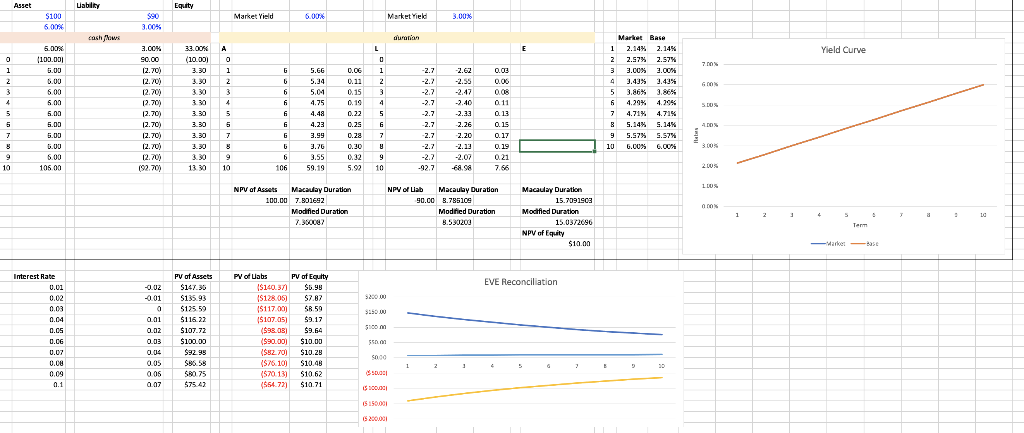

PRO SOS da 8 3 888888888888 R BE 2 HE H? 8 ANNRO a.com e NPV of Lab Pa NOVO EN UBW & 3.00% 88dddoo EVE Reconciliation kambapo ndN Modified Duration Macaulay Duratke 3 * in S AN Has Yield Curve Instructions: Using the "worksheet" tab, run the following simulation and answer the questions below. (Hint: you will need to adjust the cells that are in blue font (this is fairly standard for most financial spreadsheet where changeable cells are colored blue]) Part 1 Assumptions: Asset $100 value 10.00% coupon fixed rate, locked Liability $94 value 5.00% coupon fixed rate, locked Market Yields Currently at 10% for 10 Y assets Currently at 5% for 10Y liabilities Part 1 Questions: 1 What is the ROA in the base case? 2 What is the ROE in the base case? 3 What is the capital ratio in the base case? 4 What is the modified duration gap in the base case? 5 What is the EVE in the base case? 6 Is this balance sheet considered asset or liability sensitive? PRO SOS da 8 3 888888888888 R BE 2 HE H? 8 ANNRO a.com e NPV of Lab Pa NOVO EN UBW & 3.00% 88dddoo EVE Reconciliation kambapo ndN Modified Duration Macaulay Duratke 3 * in S AN Has Yield Curve Instructions: Using the "worksheet" tab, run the following simulation and answer the questions below. (Hint: you will need to adjust the cells that are in blue font (this is fairly standard for most financial spreadsheet where changeable cells are colored blue]) Part 1 Assumptions: Asset $100 value 10.00% coupon fixed rate, locked Liability $94 value 5.00% coupon fixed rate, locked Market Yields Currently at 10% for 10 Y assets Currently at 5% for 10Y liabilities Part 1 Questions: 1 What is the ROA in the base case? 2 What is the ROE in the base case? 3 What is the capital ratio in the base case? 4 What is the modified duration gap in the base case? 5 What is the EVE in the base case? 6 Is this balance sheet considered asset or liability sensitive

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts