Question: using this data, what is the internal rate of returns for both proposals? what is the cash payback period for both proposals? more attractive to

using this data, what is the internal rate of returns for both proposals? what is the cash payback period for both proposals?

using this data, what is the internal rate of returns for both proposals? what is the cash payback period for both proposals?

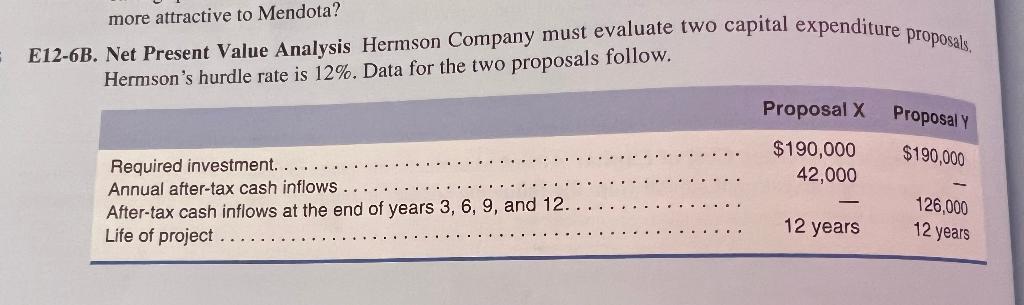

more attractive to Mendota? 12-6B. Net Present Value Analysis Hermson Company must evaluate two capital expenditure proposals, Hermson's hurdle rate is 12%. Data for the two proposals follow

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts