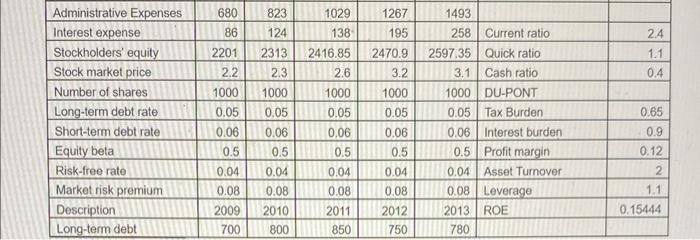

Question: using this info, find the economic value added (EVA) and market value added (MVA) in 2020 that is benchmark. looking for 2020 eva and mva

\begin{tabular}{|l|r|r|r|r|r|l|r|} \hline Administrative Expenses & 680 & 823 & 1029 & 1267 & 1493 & \\ \hline Interest expense & 86 & 124 & 138 & 195 & 258 & Current ratio \\ \hline Stockholders' equity & 2201 & 2313 & 2416.85 & 2470.9 & 2597.35 & Quick ratio & 2.4 \\ \hline Stock market price & 2.2 & 2.3 & 2.6 & 3.2 & 3.1 & Cash ratio & 1.1 \\ \hline Number of shares & 1000 & 1000 & 1000 & 1000 & 1000 & DU-PONT & 0.4 \\ \hline Long-term debt rate & 0.05 & 0.05 & 0.05 & 0.05 & 0.05 & Tax Burden & 0.65 \\ \hline Short-term debt rate & 0.06 & 0.06 & 0.06 & 0.06 & 0.06 & Interest burden & 0.9 \\ \hline Equity beta & 0.5 & 0.5 & 0.5 & 0.5 & 0.5 & Profit margin & 0.12 \\ \hline Risk-free rate & 0.04 & 0.04 & 0.04 & 0.04 & 0.04 & Asset Turnover & \\ \hline Market risk premium & 0.08 & 0.08 & 0.08 & 0.08 & 0.08 & Leverage & 2 \\ \hline Description & 2009 & 2010 & 2011 & 2012 & 2013 & ROE & \\ \hline Long-term debt & 700 & 800 & 850 & 750 & 780 & & 0.15444 \\ \hline \end{tabular} \begin{tabular}{|l|r|r|r|r|r|l|r|} \hline Administrative Expenses & 680 & 823 & 1029 & 1267 & 1493 & \\ \hline Interest expense & 86 & 124 & 138 & 195 & 258 & Current ratio \\ \hline Stockholders' equity & 2201 & 2313 & 2416.85 & 2470.9 & 2597.35 & Quick ratio & 2.4 \\ \hline Stock market price & 2.2 & 2.3 & 2.6 & 3.2 & 3.1 & Cash ratio & 1.1 \\ \hline Number of shares & 1000 & 1000 & 1000 & 1000 & 1000 & DU-PONT & 0.4 \\ \hline Long-term debt rate & 0.05 & 0.05 & 0.05 & 0.05 & 0.05 & Tax Burden & 0.65 \\ \hline Short-term debt rate & 0.06 & 0.06 & 0.06 & 0.06 & 0.06 & Interest burden & 0.9 \\ \hline Equity beta & 0.5 & 0.5 & 0.5 & 0.5 & 0.5 & Profit margin & 0.12 \\ \hline Risk-free rate & 0.04 & 0.04 & 0.04 & 0.04 & 0.04 & Asset Turnover & \\ \hline Market risk premium & 0.08 & 0.08 & 0.08 & 0.08 & 0.08 & Leverage & 2 \\ \hline Description & 2009 & 2010 & 2011 & 2012 & 2013 & ROE & \\ \hline Long-term debt & 700 & 800 & 850 & 750 & 780 & & 0.15444 \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts