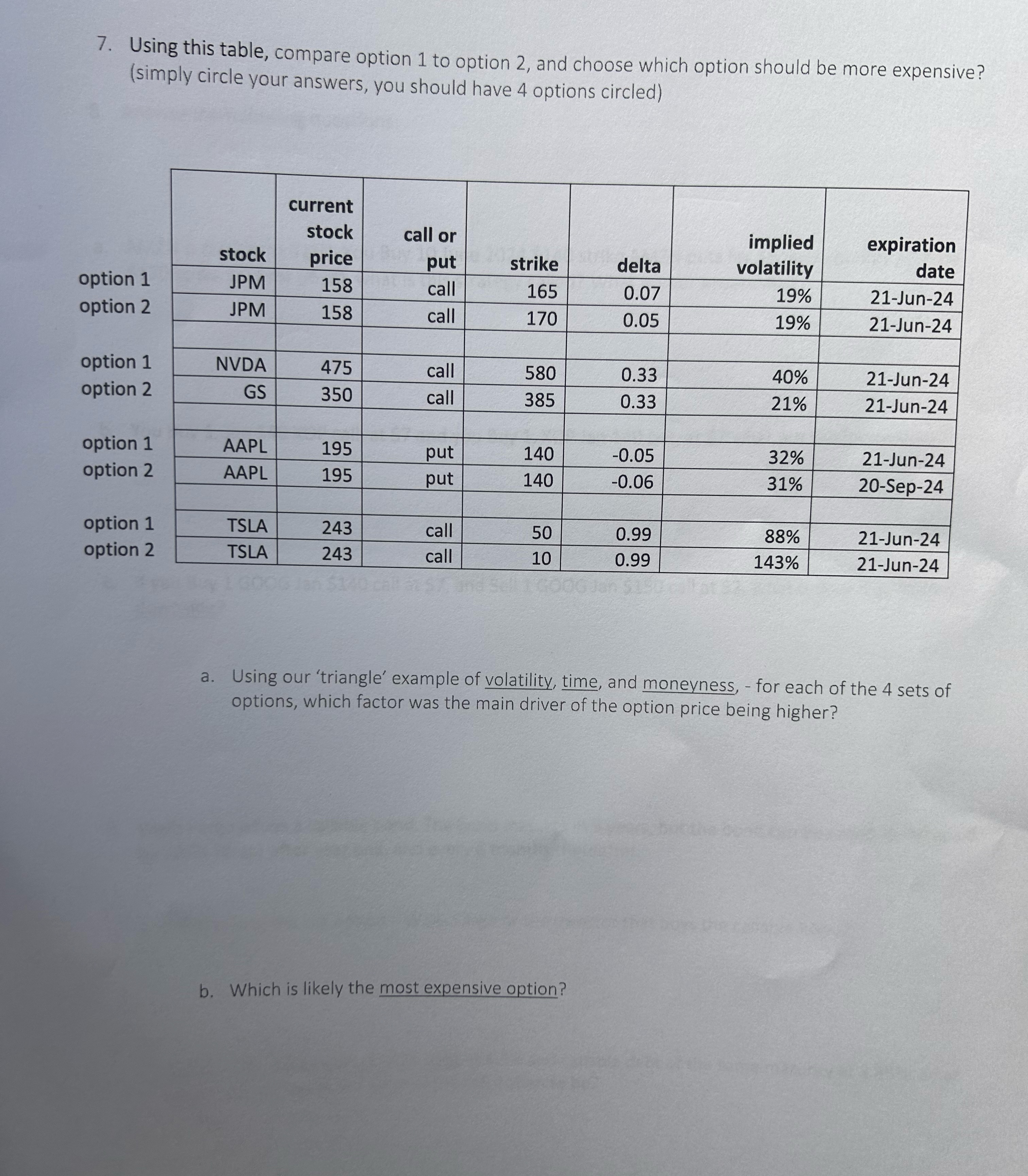

Question: Using this table, compare option 1 to option 2 , and choose which option should be more expensive? ( simply circle your answers, you should

Using this table, compare option to option and choose which option should be more expensive? simply circle your answers, you should have options circled

tablestock,tablecurrentstockpricetablecall orputstrike,delta,tableimpliedvolatilitytableexpirationdatetableoption option JPMcall,JunJPMcall,Juntableoption option NVDA,call,JunGScall,Juntableoption option AAPL,put,JunAAPLput,Septableoption option TSLA,call,JunTSLAcall,Jun

a Using our 'triangle' example of volatility, time, and moneyness, for each of the sets of options, which factor was the main driver of the option price being higher?

b Which is likely the most expensive option?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock